- United States

- /

- Healthcare Services

- /

- NasdaqGS:CCRN

Optimism around Cross Country Healthcare (NASDAQ:CCRN) delivering new earnings growth may be shrinking as stock declines 10% this past week

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in Cross Country Healthcare, Inc. (NASDAQ:CCRN) have tasted that bitter downside in the last year, as the share price dropped 42%. That falls noticeably short of the market return of around 24%. We note that it has not been easy for shareholders over three years, either; the share price is down 35% in that time. And the share price decline continued over the last week, dropping some 10%.

After losing 10% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Cross Country Healthcare

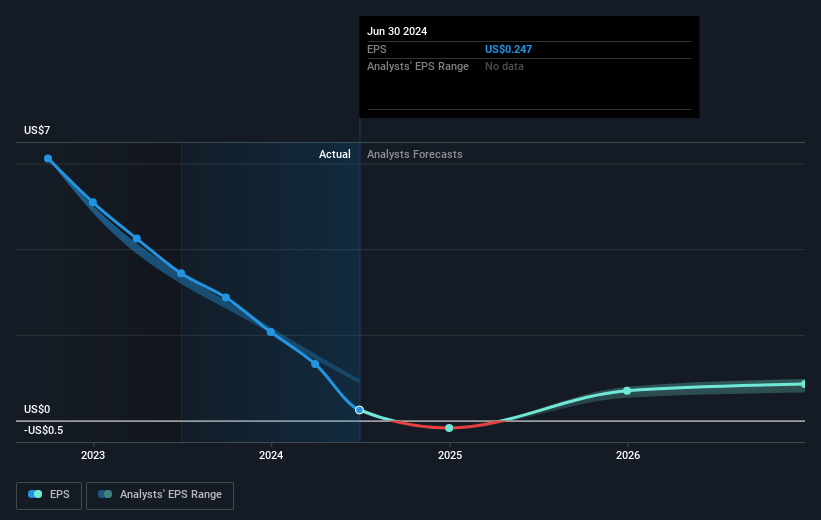

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately Cross Country Healthcare reported an EPS drop of 93% for the last year. This fall in the EPS is significantly worse than the 42% the share price fall. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult. With a P/E ratio of 53.63, it's fair to say the market sees an EPS rebound on the cards.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into Cross Country Healthcare's key metrics by checking this interactive graph of Cross Country Healthcare's earnings, revenue and cash flow.

A Different Perspective

Cross Country Healthcare shareholders are down 42% for the year, but the market itself is up 24%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 5% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Cross Country Healthcare that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CCRN

Cross Country Healthcare

Provides talent management and other consultative services for healthcare clients in the United States.

Flawless balance sheet and fair value.