- United States

- /

- Medical Equipment

- /

- NasdaqGS:BVS

Bioventus (BVS): $17.3M One-Time Loss Raises Questions About Quality of New Profitability

Reviewed by Simply Wall St

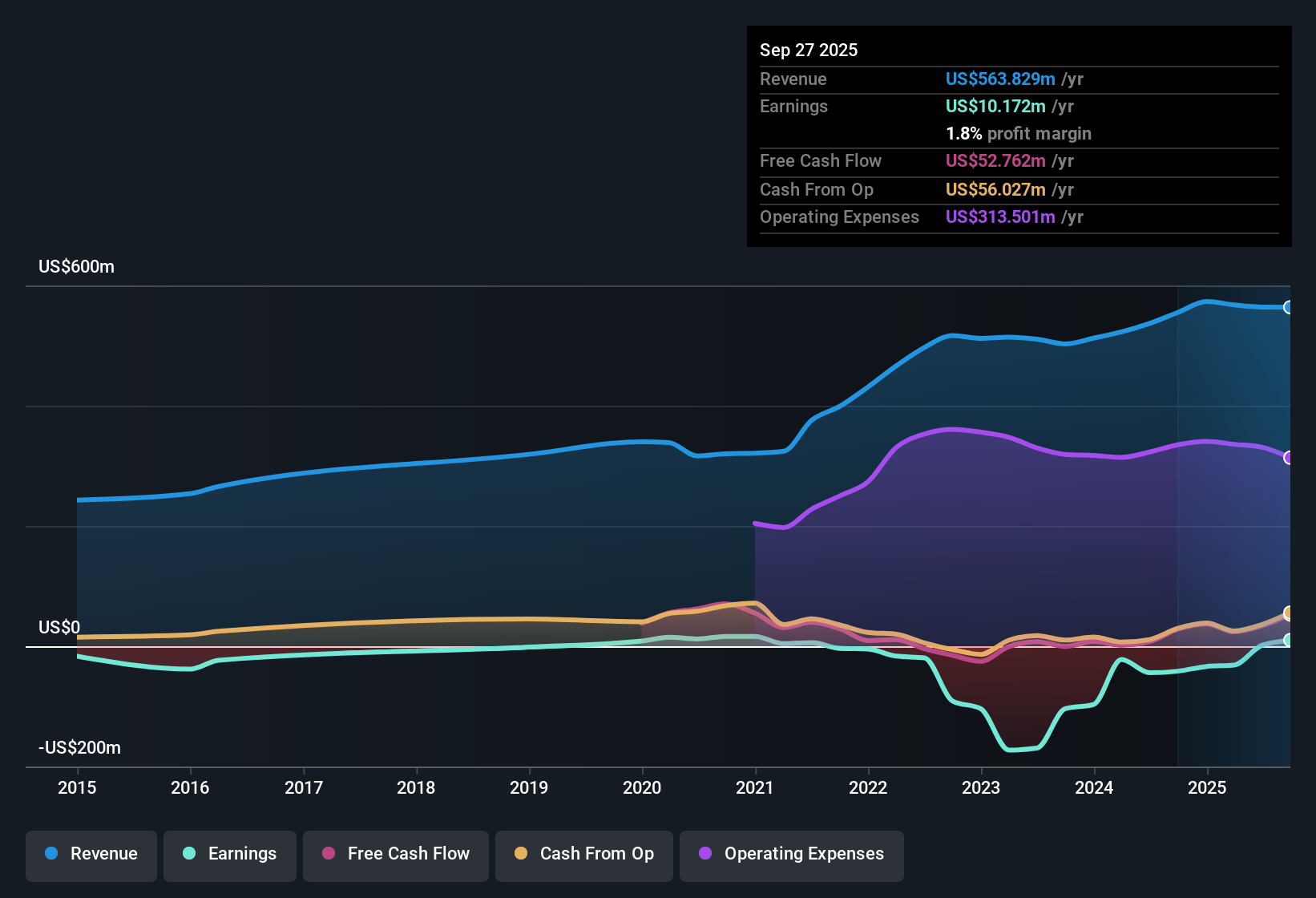

Bioventus (BVS) recently swung to profitability in the past year, despite an average earnings decline of 16.6% per year over the last five years. The bottom line was affected by a non-recurring loss of $17.3 million for the twelve months ending September 27, 2025. Although revenue is forecast to grow at 6.1% annually, this pace trails the broader US market's 10.5% average. Trading at $7.55, the stock sits well below its estimated fair value of $17.96 and also below analyst targets. Its high P/E ratio of 49.6x stands out as a premium to both industry and peer averages. While the transition to profitability may lift sentiment, the quality of those earnings remains under scrutiny as investors weigh risks against the potential for undervaluation.

See our full analysis for Bioventus.The next section puts these headline numbers in context by examining how they compare with the dominant narratives shaping investor views on Bioventus. Let us see where the story aligns and where it gets challenged.

See what the community is saying about Bioventus

Non-Recurring Loss Clouds Profit Improvement

- Bioventus posted a $17.3 million non-recurring loss over the last twelve months ending September 27, 2025, which is a material hit to the company's bottom line despite newly achieved profitability.

- Analysts' consensus view points to a company striving for margin expansion and long-term earnings growth. However, such a substantial one-time expense highlights the risk that future headline profits may not fully reflect the underlying business trajectory.

- Analysts expect margins to rise from 0.3% today to 11.3% in three years, indicating confidence that losses like this will not repeat, but it raises the bar for execution.

- This loss complicates interpretation of recent earnings momentum, especially when assessing if operational efficiencies alone can compensate for these unpredictable setbacks.

- See how analysts reckon with these surprises and track the evolving consensus on Bioventus in the full narrative. 📊 Read the full Bioventus Consensus Narrative.

Debt Burden Looms Over Cash Flow Potential

- With $341 million in debt outstanding, Bioventus remains heavily leveraged relative to its current profit level, and ongoing deleveraging is an explicit company target.

- Consensus narrative notes that while recent refinancing has reduced interest costs, high debt continues to threaten both future R&D spending and the flexibility needed to respond to market pressures.

- Pricing and currency headwinds amounting to a combined $5 million this year chip away at already slim early profit margins, underlining the importance of disciplined OpEx and supply chain improvements.

- Long-term optimism around new product launches and margin growth hinges on Bioventus successfully managing these liabilities, making balance sheet repair a crucial theme to watch.

Discount to DCF and Analyst Fair Values

- At the current share price of $7.55, Bioventus trades at a steep discount to both its DCF fair value of $17.96 and the consensus analyst price target of $14.67, creating a wide valuation gap.

- Analysts' consensus narrative frames this discount as a sign of undervaluation, but the stock's high P/E ratio of 49.6x versus an industry average of 27.6x and a peer group average of -3.9x sparks debate about whether headline multiples accurately reflect future growth or simply magnify perceived quality risks.

- The analyst target sits 44.8% above the current share price, reinforcing the potential for re-rating if Bioventus can translate margin and revenue forecasts into sustainable bottom-line strength.

- Persistent questions around earnings quality and risk-adjusted returns continue to drive caution, offsetting optimism from projected sales and profit expansion.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bioventus on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Take just a few minutes to develop and share your unique perspective. Do it your way

A great starting point for your Bioventus research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Bioventus’s significant debt load and unpredictable one-off losses continue to weigh on financial resilience, which overshadows its recent return to profitability.

If you want stocks with stronger safety nets and fewer debt headaches, start your search with solid balance sheet and fundamentals stocks screener (1981 results) that prioritize robust balance sheets and financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bioventus might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BVS

Bioventus

A medical device company, focuses on relieving pain and addressing musculoskeletal therapies in the United States and internationally.

Fair value with questionable track record.

Similar Companies

Market Insights

Community Narratives