- United States

- /

- Healthcare Services

- /

- NasdaqGS:BTSG

How BrightSpring Health Services' Upbeat Guidance and Profitable Quarter (BTSG) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- BrightSpring Health Services recently raised its full-year 2025 revenue guidance, projecting consolidated revenues between US$12.40 billion and US$12.70 billion and strong growth in both its pharmacy and provider segments, while announcing significantly improved earnings results for the third quarter and nine months ended September 30, 2025.

- The combination of increased forward guidance and the return to profitability on both a quarterly and year-to-date basis highlights a marked turnaround in operational performance compared to the prior year.

- We'll explore how BrightSpring's upward revision of guidance and robust quarterly results reinforce its investment narrative, especially for its pharmacy segment.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

BrightSpring Health Services Investment Narrative Recap

To be a shareholder in BrightSpring Health Services, you need to believe in the company’s ability to deliver sustained growth, particularly through its strong pharmacy business and a growing provider segment. The recent guidance raise and return to profitability enhance confidence in near-term growth catalysts, notably ongoing specialty pharmacy expansion; however, the most significant risk, exposure to government reimbursement changes, remains largely unchanged by these updates.

Among recent announcements, the company’s raised 2025 revenue guidance stands out as most relevant, with expectations of US$12.40 billion to US$12.70 billion in revenue and pharmacy segment growth of up to 27.9%. This reflects management’s confidence but also sharpens the focus on BrightSpring’s execution as it navigates sector-specific challenges threatening margins and stability.

However, investors should not overlook the persistent policy risk to reimbursement models, especially as...

Read the full narrative on BrightSpring Health Services (it's free!)

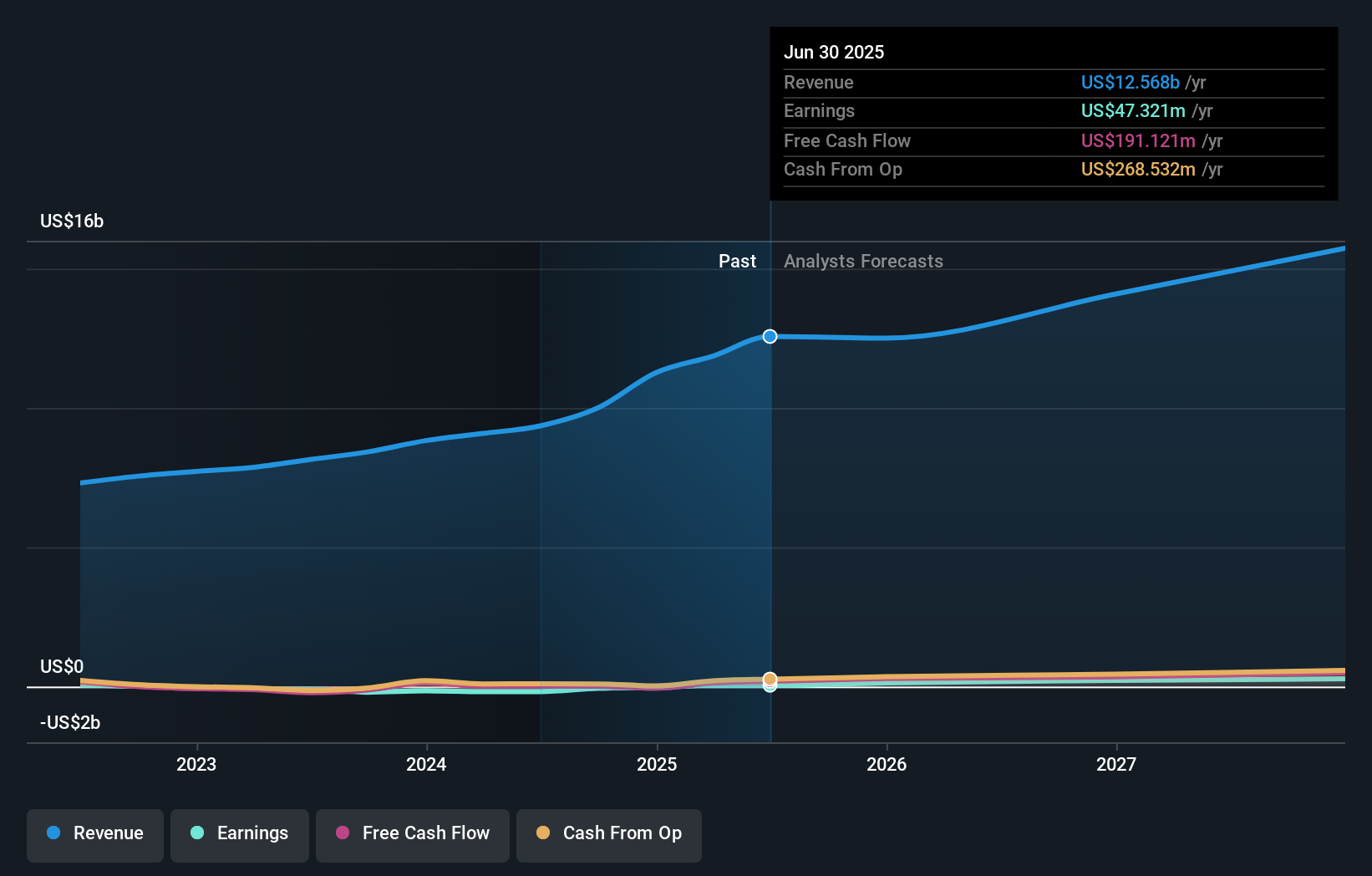

BrightSpring Health Services is projected to reach $16.8 billion in revenue and $361.8 million in earnings by 2028. This outlook is based on an anticipated 10.1% annual revenue growth rate and a $314.5 million increase in earnings from the current level of $47.3 million.

Uncover how BrightSpring Health Services' forecasts yield a $32.96 fair value, in line with its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range widely from US$32.96 to US$129.59, across two viewpoints. With reimbursement risk a major factor, you can see how opinions about BrightSpring's future diverge, consider a variety of perspectives before making your own assessment.

Explore 2 other fair value estimates on BrightSpring Health Services - why the stock might be worth over 3x more than the current price!

Build Your Own BrightSpring Health Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BrightSpring Health Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free BrightSpring Health Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BrightSpring Health Services' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BrightSpring Health Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BTSG

BrightSpring Health Services

Operates as a home and community-based healthcare services platform in the United States.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives