- United States

- /

- Medical Equipment

- /

- NasdaqCM:AXGN

Why Axogen (AXGN) Is Up 22.3% After Returning to Profitability and Raising 2025 Guidance

Reviewed by Sasha Jovanovic

- Axogen, Inc. recently reported third quarter 2025 results, highlighting sales of US$60.08 million, net income of US$0.71 million, and raised its full-year 2025 revenue guidance to at least 19% growth (US$222.8 million) with expected gross margins of 73% to 75%.

- This marks a significant turnaround from a net loss in the prior year and underscores management’s confidence in ongoing sales momentum and operational improvements.

- With Axogen returning to profitability and projecting higher annual growth, we’ll examine how these results influence the company’s long-term growth narrative and risk profile.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Axogen Investment Narrative Recap

To be an Axogen shareholder, one needs to believe the company can sustain its current sales momentum and translate recent profitability into long-term earnings growth, especially as the market for nerve repair expands. The solid third-quarter results and raised full-year guidance are positive, but near-term risks, particularly uncertainty around regulatory progress for the Avance Nerve Graft, remain material and could overshadow short-term catalysts if regulatory timelines slip or compliance costs rise.

Among recent news, the October 2025 guidance increase is most relevant: strong revenue growth and consistent gross margins point to business resilience amid ongoing operational investments. This updated outlook provides a clearer backdrop for investors weighing Axogen’s ability to balance growth targets with regulatory and competitive pressures.

Yet, it's just as important for investors to be aware that unexpected regulatory or reimbursement changes could quickly...

Read the full narrative on Axogen (it's free!)

Axogen's narrative projects $323.0 million revenue and $25.7 million earnings by 2028. This requires 16.7% yearly revenue growth and a $30.4 million increase in earnings from today’s $-4.7 million.

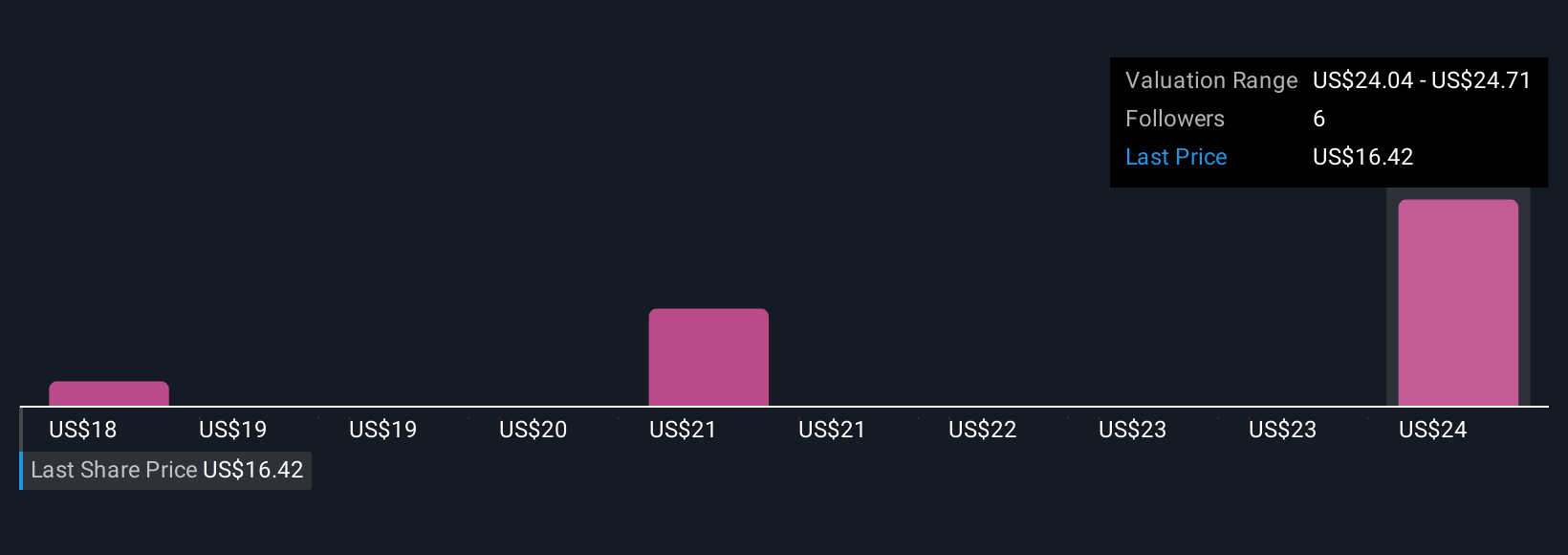

Uncover how Axogen's forecasts yield a $27.38 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community range from US$17.95 to US$29.81 per share, reflecting diverse outlooks. At the same time, ongoing regulatory hurdles for Axogen’s lead product could be a pivotal factor shaping future returns, so consider how these scenarios might affect your own view.

Explore 4 other fair value estimates on Axogen - why the stock might be worth as much as 34% more than the current price!

Build Your Own Axogen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Axogen research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Axogen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Axogen's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AXGN

Axogen

Develops and commercializes technologies for peripheral nerve regeneration and repair worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives