- United States

- /

- Medical Equipment

- /

- NasdaqCM:AXGN

A Look at Axogen (AXGN) Valuation After Profit Surprise and Raised 2025 Revenue Guidance

Reviewed by Simply Wall St

Axogen (AXGN) came into focus after releasing its quarterly earnings, showing a shift from last year’s loss to a profit. The company also announced it has raised revenue guidance for 2025.

See our latest analysis for Axogen.

Investors have clearly taken notice of Axogen’s turnaround story, with the share price jumping more than 36% in the last month and climbing 66% over the past quarter as the company swung to profitability and lifted its full-year outlook. This momentum follows a year of strong performance, as reflected by a 52.5% total shareholder return. This suggests that investor confidence is building for the long term.

If Axogen’s surge has you watching for what else is gathering pace in healthcare, don’t miss the chance to discover See the full list for free..

With the stock’s major rally and management now guiding for even stronger growth ahead, the key question is whether Axogen is still trading at an attractive valuation, or if markets have already factored in its future gains.

Most Popular Narrative: 14.6% Undervalued

Axogen’s current fair value narrative puts its price target noticeably above the last close, setting up a compelling valuation debate for investors looking at where the stock could go from here.

Broad-based adoption of Axogen's nerve care algorithm across multiple markets (extremities, oral maxillofacial, breast) and exceptional momentum in activating high-potential accounts signal that the addressable market for nerve repair is still substantially underpenetrated. This suggests a long runway for sustained double-digit revenue growth as awareness and adoption rise.

How are analysts backing up this bold projection? The real story goes deep, blending future revenue surges, profit margin leaps, and a growth runway not typically seen in this space. Want a peek at the core assumptions fueling this ambitious fair value? You’ll find the jaw-dropping details in the full narrative.

Result: Fair Value of $27.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Axogen's heavy reliance on a single biologic product and ongoing regulatory hurdles could quickly challenge its promising growth narrative if conditions change.

Find out about the key risks to this Axogen narrative.

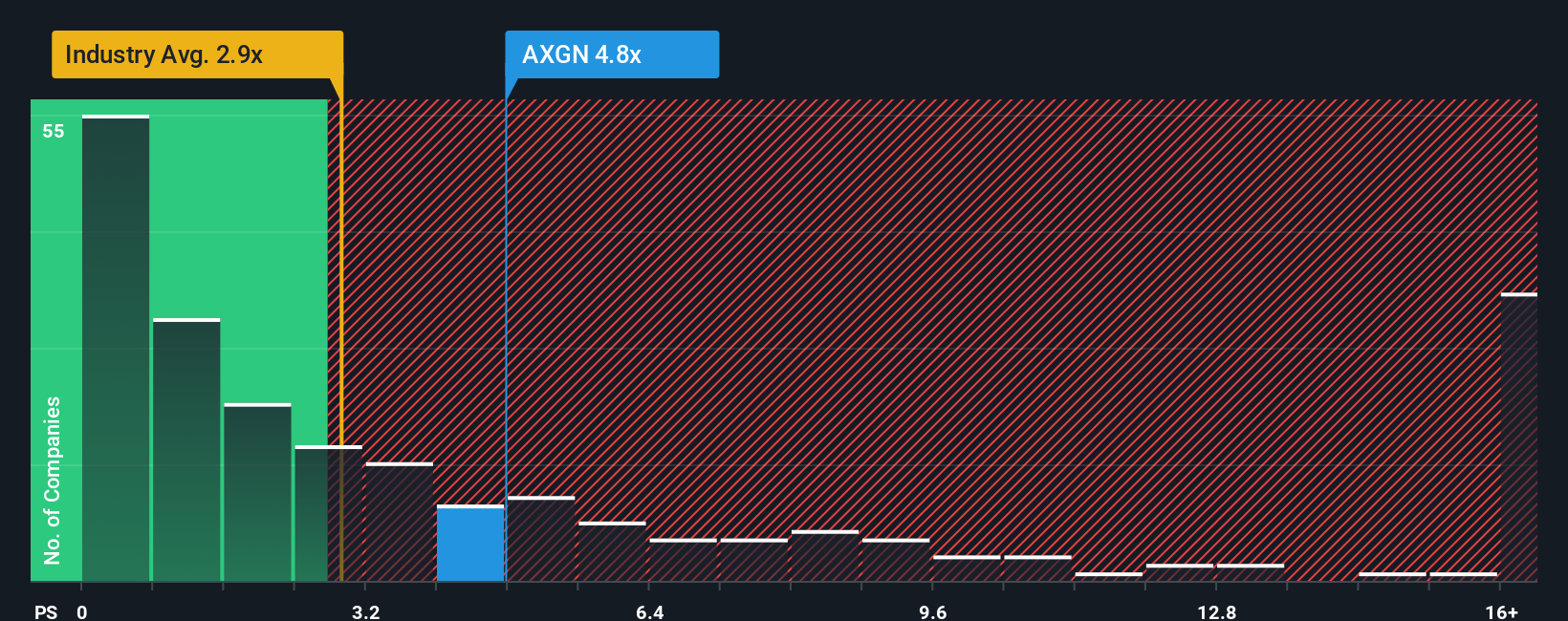

Another View: Multiples Tell a Different Story

While the fair value narrative suggests Axogen may be undervalued, looking at its price-to-sales ratio paints a less optimistic picture. At 5x sales, Axogen trades well above the US Medical Equipment industry average of 2.9x and its peer average of 4x, as well as a fair ratio of 3.7x. This premium suggests the market could already be pricing in much of the company's future growth, raising the risk if Axogen does not deliver. Could this steep premium hold up as new results come in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Axogen Narrative

If you see things differently or want to dig into the numbers for yourself, you can shape your own take on Axogen in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Axogen.

Looking for more investment ideas?

Don't let opportunity pass you by when there are standout stocks waiting in the wings. Uncover new ways to boost your returns and get ahead of market trends with smart ideas tailored for different interests.

- Capture the excitement around artificial intelligence breakthroughs by checking out these 26 AI penny stocks, which are reshaping industries through innovation and rapid adoption.

- Maximize income potential in your portfolio and see which companies are delivering reliable yields with these 20 dividend stocks with yields > 3%, offering over 3% returns.

- Capitalize on undervalued opportunities by searching for these 849 undervalued stocks based on cash flows, set to benefit from strong cash flows and favorable market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AXGN

Axogen

Develops and commercializes technologies for peripheral nerve regeneration and repair worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives