Stock Analysis

- United States

- /

- Medical Equipment

- /

- NasdaqGM:ATRC

Time To Worry? Analysts Just Downgraded Their AtriCure, Inc. (NASDAQ:ATRC) Outlook

Market forces rained on the parade of AtriCure, Inc. (NASDAQ:ATRC) shareholders today, when the analysts downgraded their forecasts for this year. Revenue estimates were cut sharply as analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

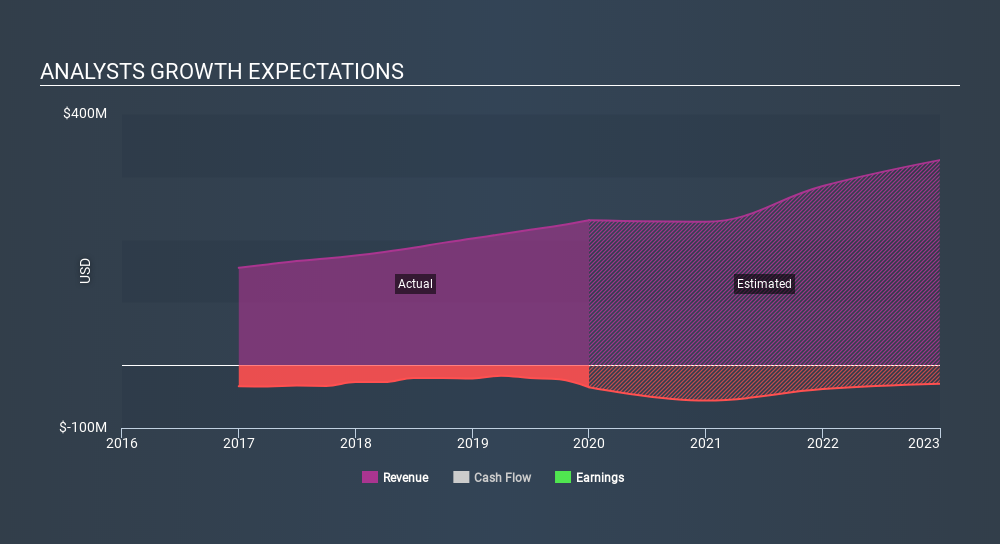

Following this downgrade, AtriCure's seven analysts are forecasting 2020 revenues to be US$229m, approximately in line with the last 12 months. Losses are supposed to balloon 55% to US$1.45 per share. Yet before this consensus update, the analysts had been forecasting revenues of US$259m and losses of US$1.41 per share in 2020. Ergo, there's been a clear change in sentiment, with the analysts administering a notable cut to this year's revenue estimates, while at the same time increasing their loss per share forecasts.

View our latest analysis for AtriCure

The consensus price target fell 6.1% to US$46.43, with the analysts clearly concerned about the company following the weaker revenue and earnings outlook. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values AtriCure at US$50.00 per share, while the most bearish prices it at US$41.00. This is a very narrow spread of estimates, implying either that AtriCure is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. These estimates imply that sales are expected to slow, with a forecast revenue decline of 1.0%, a significant reduction from annual growth of 15% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 7.4% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - AtriCure is expected to lag the wider industry.

The Bottom Line

The most important thing to take away is that analysts increased their loss per share estimates for this year. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that AtriCure's revenues are expected to grow slower than the wider market. The consensus price target fell measurably, with analysts seemingly not reassured by recent business developments, leading to a lower estimate of AtriCure's future valuation. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on AtriCure after today.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple AtriCure analysts - going out to 2022, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGM:ATRC

AtriCure

Develops, manufactures, and sells devices for surgical ablation of cardiac tissue, exclusion of the left atrial appendage, and temporarily blocking pain by ablating peripheral nerves to medical centers in the United States, Europe, the Asia-Pacific, and internationally.

Undervalued with excellent balance sheet.