- United States

- /

- Medical Equipment

- /

- NasdaqGM:ATRC

AtriCure (ATRC) Is Down 8.0% After Raising 2025 Guidance and Reporting Narrower Losses - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In recent days, AtriCure, Inc. raised its full-year 2025 revenue guidance to approximately US$532 million to US$534 million and reported third-quarter results showing sales of US$134.27 million, a significant increase from the same period last year, along with a much narrower net loss.

- Alongside financial improvements, AtriCure also commenced patient enrollment in the BoxX-NoAF clinical trial, which could potentially expand the clinical use of its devices in cardiac surgery.

- We'll explore how AtriCure’s raised earnings outlook and financial progress may influence its long-term investment narrative and growth prospects.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

AtriCure Investment Narrative Recap

To be an AtriCure shareholder, an investor needs to believe the company's progress in cardiac surgical innovation, product adoption, and global expansion will ultimately drive long-term profitability, despite ongoing losses and competitive pressures. The recently raised 2025 revenue guidance and improved quarterly results strengthen the short-term catalyst of sustained revenue growth, but do not materially lessen the key risk from adoption of alternate minimally invasive ablation technologies, which continues to threaten market share.

Among the latest announcements, the start of patient enrollment in the BoxX-NoAF clinical trial stands out, as outcomes from this study could expand indications for AtriCure’s devices and unlock new patient segments. This process supports the company’s ambition to build a robust clinical evidence base, which remains core to unlocking future catalysts like expanded labeling and stronger payer acceptance.

However, investors should be aware that despite improved guidance, heightened competitive threats from new catheter-based ablation technologies may still weigh on AtriCure’s...

Read the full narrative on AtriCure (it's free!)

AtriCure's narrative projects $717.8 million revenue and $13.2 million earnings by 2028. This requires 12.8% yearly revenue growth and a $49.6 million earnings increase from current earnings of -$36.4 million.

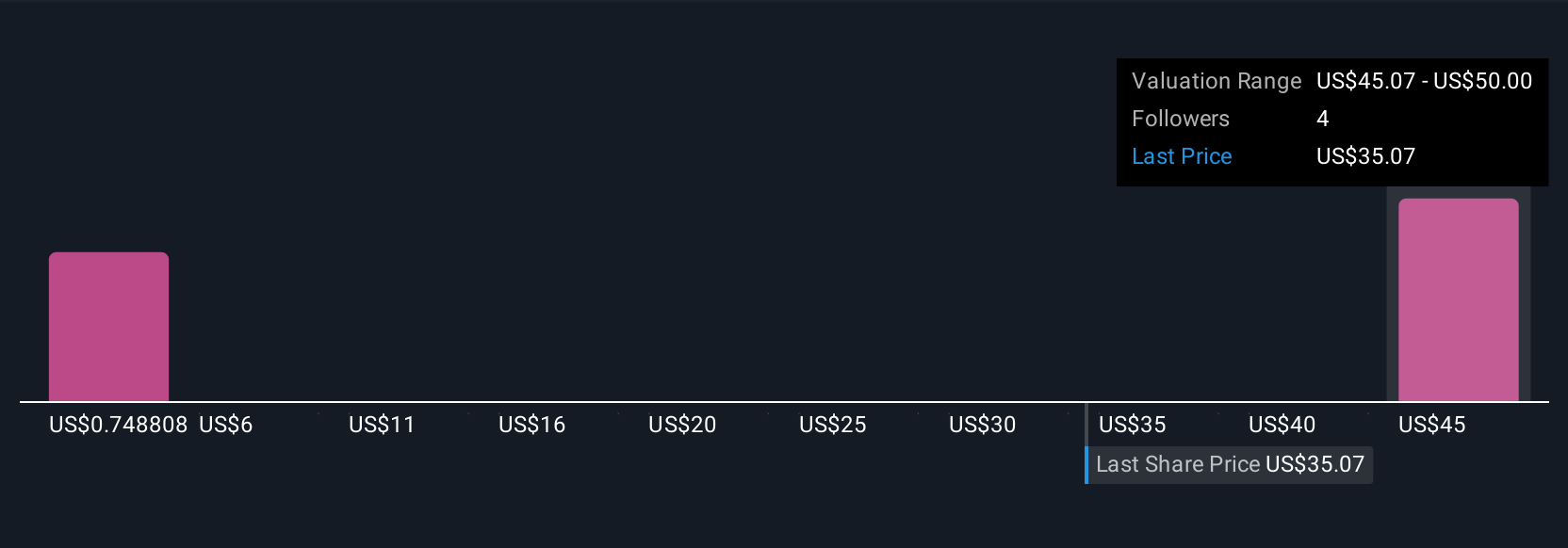

Uncover how AtriCure's forecasts yield a $50.00 fair value, a 45% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span from US$0.79 to US$50, with two individual views submitted. While earnings guidance has been raised, accelerating competition in the minimally invasive ablation segment remains a key factor shaping the outlook for future returns.

Explore 2 other fair value estimates on AtriCure - why the stock might be worth less than half the current price!

Build Your Own AtriCure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AtriCure research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free AtriCure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AtriCure's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ATRC

AtriCure

Develops, manufactures, and sells devices for surgical ablation of cardiac tissue, exclusion of the left atrial appendage, and temporarily blocking pain by ablating peripheral nerves to medical centers in the United States, the Asia-Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives