- United States

- /

- Medical Equipment

- /

- NasdaqGS:ARAY

Accuray (ARAY) Losses Increase 28.3% Annually, Challenging Turnaround Narrative Despite Profitability Forecast

Reviewed by Simply Wall St

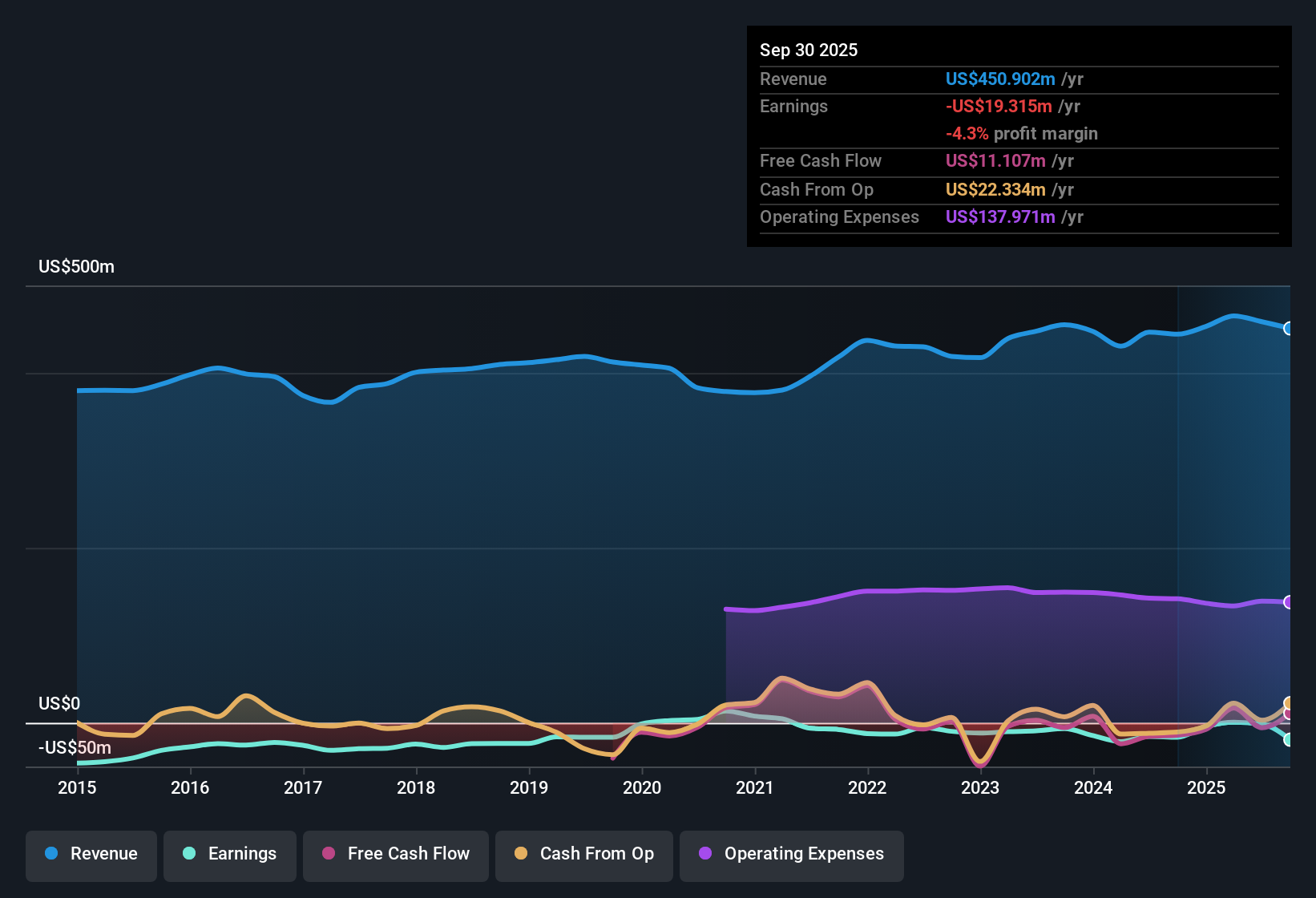

Accuray (ARAY) has remained unprofitable, with losses deepening at an annual rate of 28.3% over the past five years. While revenue is projected to grow at 4.4% per year, which is slower than the broader US market’s 10.4% average, earnings are expected to rise sharply at 116.63% per year. This sets the company on course to become profitable within three years. With a Price-To-Sales Ratio of 0.3x and the current share price trading below the estimated fair value of $5.17, investors are keeping a close eye on Accuray’s ability to turn the tide on profitability and capitalize on forecasted growth.

See our full analysis for Accuray.Next up, we’ll set these figures against the market’s leading narratives to see which stories get reinforced and which could be up for debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Deepen Amid 28.3% Annual Decline

- Accuray's net losses have grown by an average of 28.3% every year for the past five years, highlighting a pattern of worsening unprofitability even as the company eyes a turnaround.

- Forecasts point to an ambitious path to profitability within three years, and recent product launches and strategic partnerships are expected to help spark this transition.

- While annual losses have climbed, management and optimistic analysts argue this is a "setup phase" for long-term margin improvement based on technological innovation.

- Persistent losses could test that view if they remain disconnected from the projected, rapid 116.63% annual earnings uptick.

Sales Growth Lags Far Behind Industry Average

- Revenue is projected to increase at just 4.4% per year, well below the US medical equipment industry’s much stronger 10.4% growth rate.

- This slower growth backdrop means investors must weigh whether product innovation and new market launches can overcome sector headwinds.

- Although positive headlines may build excitement around pipeline and market expansion, a modest revenue trajectory could challenge bulls who count on sector "catch-up" gains.

- Bears highlight that structural headwinds such as competition from larger players and dependency on capital equipment spending could keep Accuray from closing the gap.

Valuation Deep Discount: 0.3x Sales Ratio

- Shares are trading at just 0.3x sales, a steep discount compared to the 3x industry average and 15.5x for peer companies, while the current share price of $1.22 sits well below the DCF fair value of $5.17.

- This substantial valuation gap invites speculation about a turnaround, with some investors seeing Accuray as a deeply undervalued turnaround play if earnings gains materialize.

- Despite no major risks being flagged in company statements, a history of prolonged losses urges caution for those drawn purely by the valuation gap.

- Traders may watch closely for signs of positive earnings inflection as a signal the market’s skepticism is misplaced.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Accuray's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Accuray faces persistent annual losses, lagging sales growth, and remains far behind peers on overall financial health, despite optimism about future profitability.

If you want stocks with stronger finances and less risk of prolonged losses, look for sturdier picks with solid balance sheet and fundamentals stocks screener (1976 results) as your next move.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARAY

Accuray

Engages in the design, development, manufacture, and sale of radiosurgery and radiation therapy systems for the treatment of tumors in the United States, Canada, Latin America, Asia, Australia, New Zealand, Europe, the Middle East, India, Africa, Japan, and China.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives