- United States

- /

- Healthcare Services

- /

- NasdaqGS:ALHC

How Investors May Respond To Alignment Healthcare (ALHC) After Rate Cut Hopes Spark Market Rally

Reviewed by Sasha Jovanovic

- Earlier this week, Alignment Healthcare received a boost as comments from New York Federal Reserve President John Williams raised expectations of a near-term interest rate cut and set off a broad market rally.

- This shift in investor sentiment highlights how macroeconomic policy can drive short-term movements in healthcare stocks beyond company-specific news.

- We’ll look at how improved market sentiment driven by potential interest rate cuts could influence Alignment Healthcare’s investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Alignment Healthcare Investment Narrative Recap

To be a shareholder in Alignment Healthcare, you need to believe that the company’s technology-driven Medicare Advantage model and scaling efforts can outpace regulatory and competitive pressures. While the recent boost in market sentiment on potential interest rate cuts gave shares a short-term lift, the main catalysts and the biggest risks, such as ongoing regulatory scrutiny and Medicare reimbursement dynamics, are not materially changed by this news event.

Among recent developments, Alignment Healthcare’s upcoming presentation at the Piper Sandler 37th Annual Healthcare Conference stands out. This event will let management highlight their long-term growth ambitions and operational progress to a broad audience, though investors will remain focused on how changes in reimbursement rates and policy could impact future performance.

However, before assuming improving sentiment sweeps away all challenges, investors should also consider the risk of...

Read the full narrative on Alignment Healthcare (it's free!)

Alignment Healthcare's narrative projects $6.8 billion in revenue and $118.7 million in earnings by 2028. This requires a 26.7% yearly revenue growth and a $169.7 million increase in earnings from -$51.0 million currently.

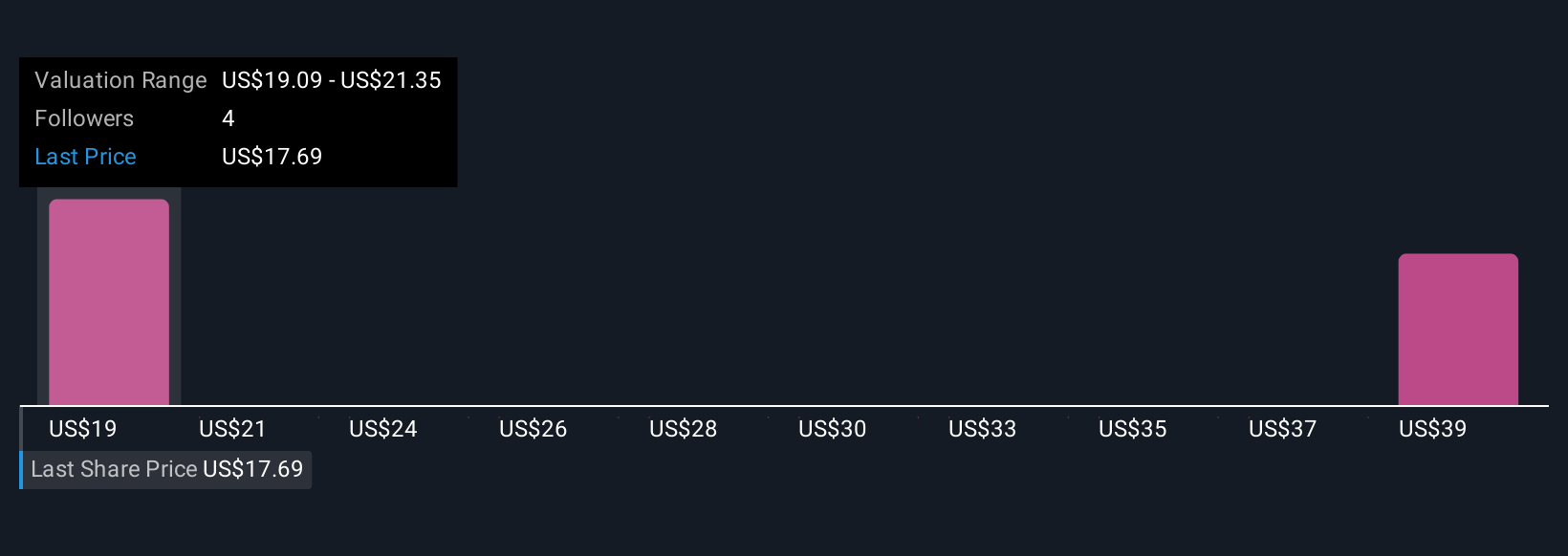

Uncover how Alignment Healthcare's forecasts yield a $20.88 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Two different fair value estimates from the Simply Wall St Community put Alignment’s worth between US$20.88 and US$24.24 per share. While investors weigh these diverse perspectives, many are also watching how policy and reimbursement changes may shape the company’s outlook going forward.

Explore 2 other fair value estimates on Alignment Healthcare - why the stock might be worth as much as 45% more than the current price!

Build Your Own Alignment Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alignment Healthcare research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alignment Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alignment Healthcare's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALHC

Alignment Healthcare

Operates a consumer-centric healthcare platform for seniors in the United States.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives