- United States

- /

- Healthcare Services

- /

- NasdaqGS:ALHC

Further Upside For Alignment Healthcare, Inc. (NASDAQ:ALHC) Shares Could Introduce Price Risks After 34% Bounce

The Alignment Healthcare, Inc. (NASDAQ:ALHC) share price has done very well over the last month, posting an excellent gain of 34%. Looking back a bit further, it's encouraging to see the stock is up 95% in the last year.

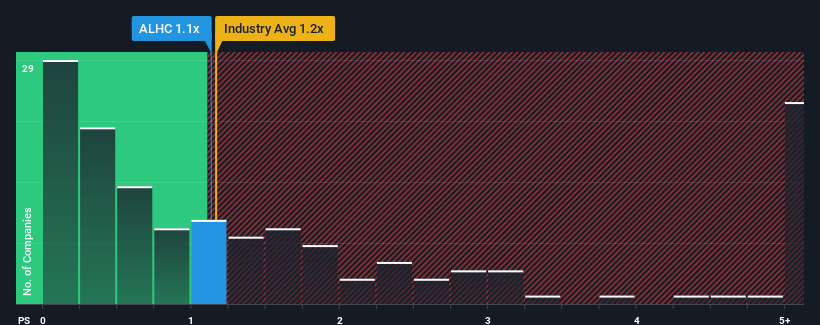

Even after such a large jump in price, there still wouldn't be many who think Alignment Healthcare's price-to-sales (or "P/S") ratio of 1.1x is worth a mention when the median P/S in the United States' Healthcare industry is similar at about 1.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Alignment Healthcare

How Alignment Healthcare Has Been Performing

Recent times have been advantageous for Alignment Healthcare as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Alignment Healthcare will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Alignment Healthcare's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 43% last year. The latest three year period has also seen an excellent 122% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 26% per annum over the next three years. That's shaping up to be materially higher than the 8.4% per year growth forecast for the broader industry.

In light of this, it's curious that Alignment Healthcare's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Alignment Healthcare's P/S

Alignment Healthcare's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, Alignment Healthcare's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Alignment Healthcare you should know about.

If these risks are making you reconsider your opinion on Alignment Healthcare, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ALHC

Alignment Healthcare

Operates a consumer-centric healthcare platform for seniors in the United States.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives