- United States

- /

- Medical Equipment

- /

- NasdaqGS:ALGN

Does Align Technology’s Recent Rebound Signal Opportunity After 30% Decline in 2025?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Align Technology is an overlooked bargain or justifiably unloved, you are not alone. Let’s put the numbers under the microscope together.

- The stock recently climbed 2.1% over the past week and is up 4.8% over the last month. Despite these gains, Align Technology is still down more than 30% year to date, raising some big questions about future potential and risk perception.

- Investors have been reacting to industry developments and announcements around digital orthodontics and evolving market competition, which have influenced sentiment and stock movements. These news stories provide the real-world context for the price swings and can offer clues about where the business might be heading next.

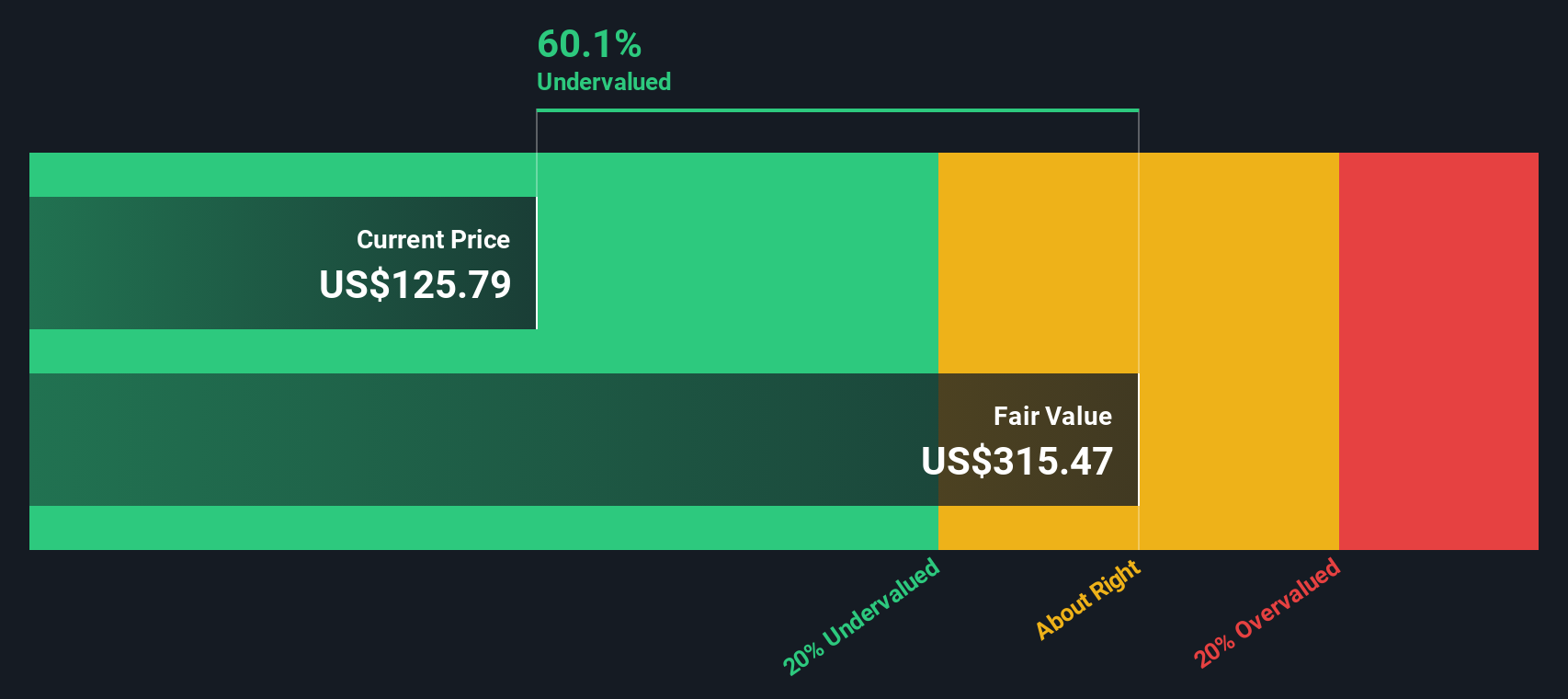

- On our valuation checks, Align Technology scores a 6 out of 6 for being undervalued. This makes it a compelling case to dig into different approaches for figuring out whether it is truly a bargain. By the end, there is one perspective that could help you see past the usual numbers entirely.

Find out why Align Technology's -34.3% return over the last year is lagging behind its peers.

Approach 1: Align Technology Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting those numbers back to today’s dollars. Essentially, this approach aims to answer the question, "What is the present value of all the cash the business is expected to generate in the future?"

For Align Technology, the current Free Cash Flow is $507.3 million. Analysts provide cash flow projections for the next five years, and Simply Wall St extrapolates these numbers out to a ten-year time frame. By 2029, projected Free Cash Flow is expected to reach $903.7 million, with estimates for 2035 reaching $1.16 billion. These projections suggest robust cash flow growth in the coming years, reflecting both analyst expectations and modeled continuing performance.

According to the DCF analysis, the model estimates Align Technology’s intrinsic value at $272.56 per share. This represents a 49.2% discount to the company’s current market value, indicating that the stock is significantly undervalued by this metric.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Align Technology is undervalued by 49.2%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

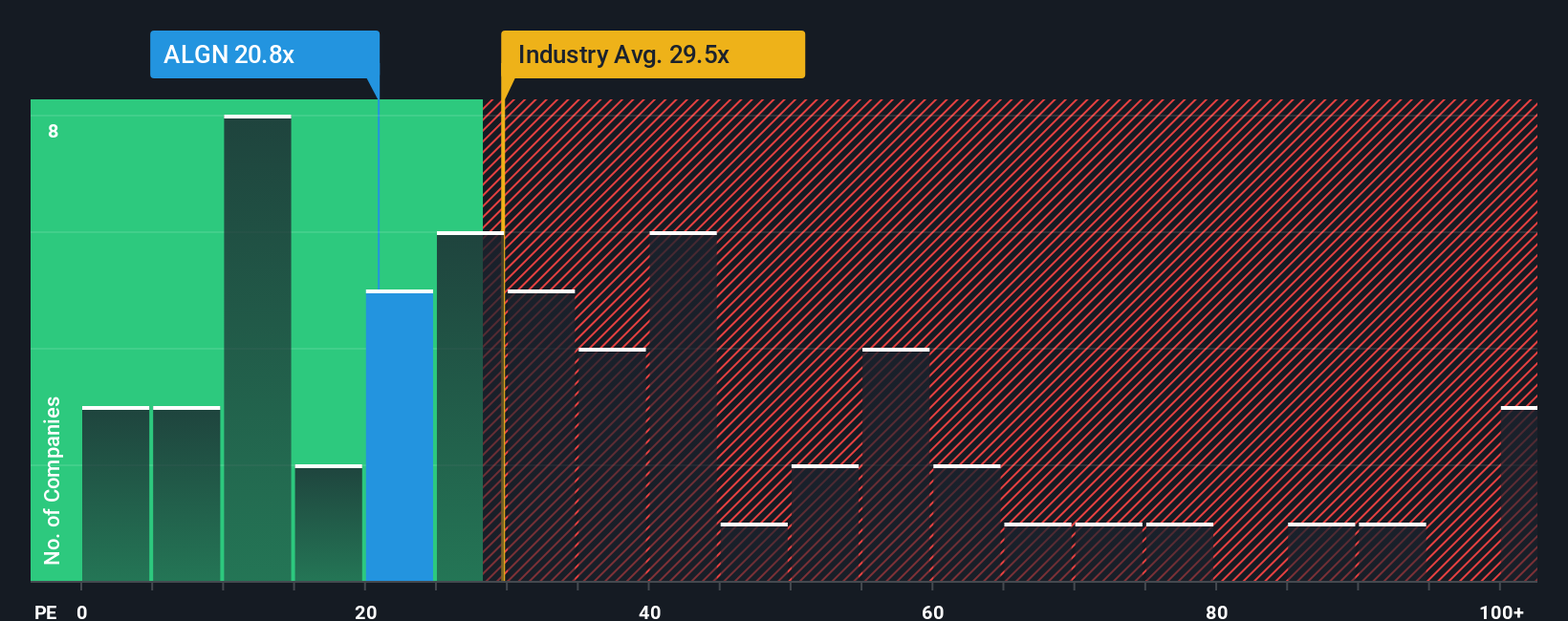

Approach 2: Align Technology Price vs Earnings

The Price-to-Earnings (PE) ratio is often used to value profitable companies like Align Technology because it directly reflects how much investors are willing to pay for each dollar of current earnings. This makes it a practical, widely recognized tool for comparing similar businesses, especially in sectors like Medical Equipment where profits are stable and growth expectations matter.

In general, faster-growing, lower-risk companies tend to justify higher PE ratios, while companies facing more uncertainty or slower growth command a lower ratio. Therefore, a “normal” or “fair” PE is influenced by how quickly a business is expected to grow its earnings and how confident the market is in those forecasts.

Align Technology currently trades on a PE ratio of 26.54x. For context, the Medical Equipment industry average PE is 27.59x, and its peer group sits higher at 30.83x. These benchmarks suggest that Align is trading at a modest discount relative to peers. However, Simply Wall St’s proprietary Fair Ratio goes a step further, estimating what an appropriate multiple should be based on unique factors such as Align’s earnings outlook, margins, size, and sector trends, rather than just relying on broad group averages.

The Fair Ratio for Align Technology is 29.99x, only slightly above its current multiple. Since the difference is less than 0.10, this suggests the stock is priced about right from this valuation perspective, reflecting both its strengths and market risks.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Align Technology Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives—a simple, yet powerful approach that goes beyond traditional analysis by connecting a company’s story to a projected financial outcome and a fair value.

A Narrative lets you express your view on Align Technology’s future by bringing together your own expectations, such as growth in markets, evolving technologies, or new risks, with the concrete numbers you think are reasonable for revenue, profit margins, and fair value. This story-driven approach is easy to use and accessible directly within the Community page on Simply Wall St, where millions of investors build and share their assumptions.

Narratives empower you to compare your personal fair value estimate against Align Technology’s market price, giving you a clear sense of when the stock looks like a buy, hold, or sell for your scenario. Because Narratives update automatically when new news or earnings data arrives, you are always equipped with a forward-looking perspective that stays relevant as circumstances change.

For example, some investors believe Align Technology could reach $220 based on international growth and new products, while others see more downside, predicting as low as $140 if competition and margins worsen. Your Narrative puts you in control of what story, and value, makes sense to you.

Do you think there's more to the story for Align Technology? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALGN

Align Technology

Provides Invisalign clear aligners, Vivera retainers, and iTero intraoral scanners and services in the United States, Switzerland, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives