- United States

- /

- Healthcare Services

- /

- NasdaqGM:AIRS

AirSculpt Technologies, Inc.'s (NASDAQ:AIRS) Shares Climb 32% But Its Business Is Yet to Catch Up

Despite an already strong run, AirSculpt Technologies, Inc. (NASDAQ:AIRS) shares have been powering on, with a gain of 32% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 56% in the last year.

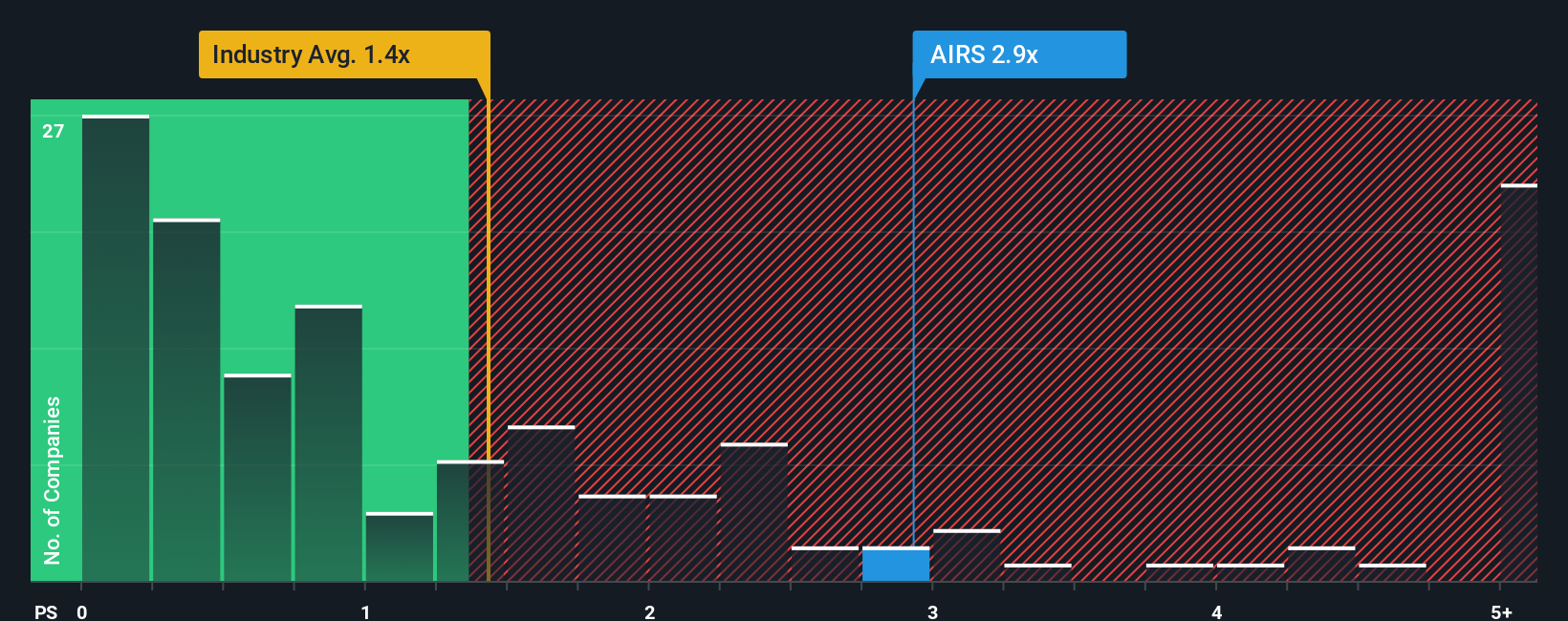

After such a large jump in price, given close to half the companies operating in the United States' Healthcare industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider AirSculpt Technologies as a stock to potentially avoid with its 2.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for AirSculpt Technologies

How Has AirSculpt Technologies Performed Recently?

AirSculpt Technologies could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on AirSculpt Technologies will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, AirSculpt Technologies would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 14%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 1.3% as estimated by the three analysts watching the company. That's shaping up to be materially lower than the 8.7% growth forecast for the broader industry.

With this information, we find it concerning that AirSculpt Technologies is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does AirSculpt Technologies' P/S Mean For Investors?

The large bounce in AirSculpt Technologies' shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for AirSculpt Technologies, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

We don't want to rain on the parade too much, but we did also find 2 warning signs for AirSculpt Technologies that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:AIRS

AirSculpt Technologies

Focuses on operating as a holding company for EBS Intermediate Parent LLC that provides body contouring procedure services in the United States, Canada, and the United Kingdom.

Very low risk with worrying balance sheet.

Market Insights

Community Narratives