- United States

- /

- Healthcare Services

- /

- NasdaqCM:AHCO

Should Analyst Downgrades and Weak Sales Prompt a Strategy Rethink for AdaptHealth (AHCO) Investors?

Reviewed by Sasha Jovanovic

- In late October 2025, analysts and financial media flagged AdaptHealth as a stock to sell, citing declining sales, contracting earnings per share, and diminishing returns on capital, which has contributed to a recent shift in investor sentiment.

- This wave of negative analyst coverage reflects growing concerns about AdaptHealth's near-term financial outlook, leading to renewed scrutiny of the company's long-term growth prospects and operational execution.

- We'll now explore how this downturn in sales and analyst sentiment may reshape AdaptHealth's investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

AdaptHealth Investment Narrative Recap

To own AdaptHealth shares, investors need to believe that the company can counteract recent earnings declines by stabilizing core operations and successfully executing on large, recurring contracts, despite weaker sentiment following the latest analyst downgrades. While the October “stock to sell” flag may amplify near-term volatility and caution, its effect on the company’s multi-year catalyst, the major exclusive five-year agreement for home medical equipment, appears limited unless operational setbacks materialize. The primary immediate risk remains execution on cost efficiencies and delivery under its new large-scale contracts.

One of the most relevant recent developments was AdaptHealth’s announcement of a five-year nationwide exclusive contract covering over 10 million members. This announcement ties directly to the company’s central growth catalyst, supporting a foundation of recurring revenue that may help offset short-term sales softness and bolster confidence in longer-term earnings predictability. The ultimate impact depends on the company’s ability to ramp and integrate these new operations efficiently.

By contrast, investors should pay close attention to whether anticipated operational efficiencies and volume gains are realized on schedule, as delays could...

Read the full narrative on AdaptHealth (it's free!)

AdaptHealth's narrative projects $4.0 billion revenue and $157.7 million earnings by 2028. This requires 7.6% yearly revenue growth and an $83.9 million earnings increase from $73.8 million today.

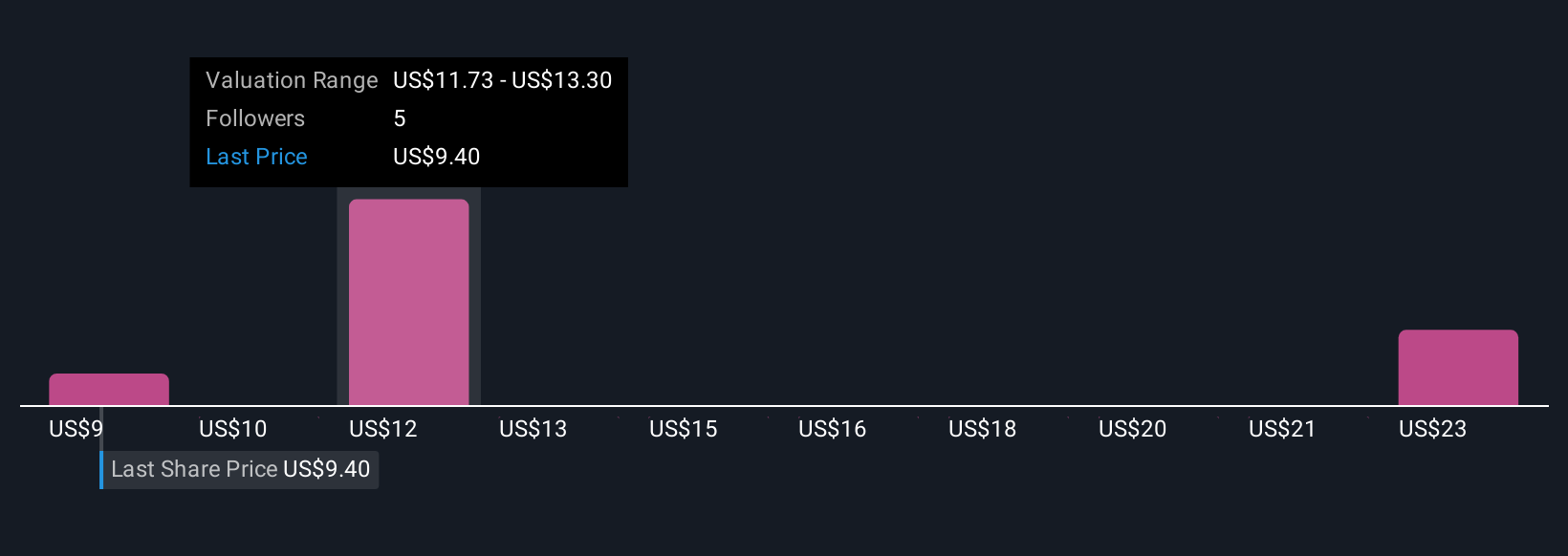

Uncover how AdaptHealth's forecasts yield a $13.12 fair value, a 47% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community estimate fair value for AdaptHealth between US$8.57 and US$26.55 per share. This wide range reflects ongoing uncertainty around AdaptHealth’s contract execution and earnings stability, so consider all viewpoints to get a fuller picture of possible outcomes.

Explore 3 other fair value estimates on AdaptHealth - why the stock might be worth just $8.57!

Build Your Own AdaptHealth Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AdaptHealth research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free AdaptHealth research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AdaptHealth's overall financial health at a glance.

No Opportunity In AdaptHealth?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AHCO

AdaptHealth

Distributes home medical equipment (HME), medical supplies, and home and related services in the United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives