- United States

- /

- Healthcare Services

- /

- NasdaqCM:AHCO

AdaptHealth (AHCO) Profitability Marks Turnaround, Challenging Bearish Valuation Narratives

Reviewed by Simply Wall St

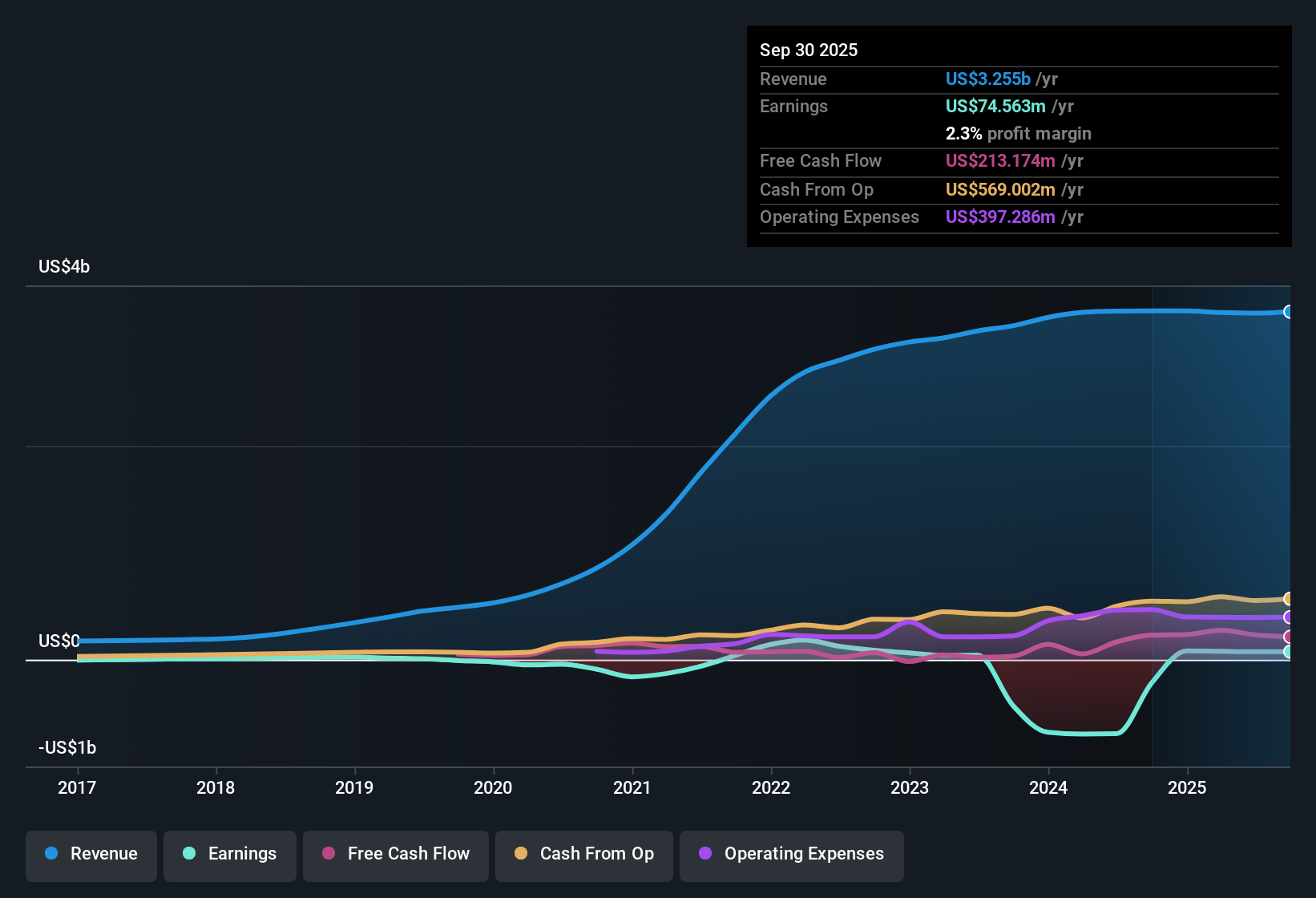

AdaptHealth (AHCO) recently turned profitable, with its net profit margin shifting notably over the past year. Despite a -16.2% average annual earnings growth over the last five years, forecasts now call for earnings to grow at 23.1% per year, outpacing the broader US market’s 16%. While revenue is expected to rise 7.3% per year in the coming period, which trails the US average, high earnings quality and significant near-term profit growth are clear upside drivers for investors who see value at current levels.

See our full analysis for AdaptHealth.Up next, we’ll see how these results stack up against the most widely followed narratives on Simply Wall St, highlighting where reality supports the stories and where they may differ.

See what the community is saying about AdaptHealth

Recurring Revenue Locked In by $1+ Billion 5-Year Contract

- The newly signed five-year, $1+ billion national health system contract sets AdaptHealth up for predictable, recurring revenue growth, supporting topline expansion beginning in 2026.

- Analysts' consensus view heavily supports the durability of AdaptHealth's revenue and margin base, emphasizing that exclusive and long-term payer arrangements like this mitigate cyclicality and reduce future earnings risk.

- Consensus narrative notes this major contract will accelerate the company's shift to a higher proportion of non-cyclical revenue, which provides a buffer against industry reimbursement swings.

- They also point out that with demographic tailwinds, such as aging populations and rising chronic disease rates, demand for home-based care is set to climb steadily, underpinning sustained growth in Sleep Health and Respiratory segments.

- Building on the contract win, consensus analysts see this as a turning point for earnings reliability, with digital automation and scale advantages fueling further gains. 📊 Read the full AdaptHealth Consensus Narrative.

PE Ratio Discount Widens Against Peers and Industry

- AdaptHealth trades at a price-to-earnings ratio of 18.9x, below both the US healthcare industry average of 20.7x and the peer group average of 33.9x, while also trading below its DCF fair value of $24.26 per share.

- Analysts' consensus view highlights that strong free cash flow and rapid debt reduction are helping AdaptHealth improve financial flexibility. This, combined with a discount to intrinsic value and peer multiples, supports the case for attractive relative value.

- What’s surprising is the current share price of $10.67 still sits well below the analyst price target of $13.00, implying over 20% potential upside even with cautious DCF and industry assumptions.

- This valuation gap holds even as analysts expect sector consolidation to increase competition, suggesting investors are already pricing in some execution risk and regulatory uncertainty.

Net Margins Projected to Climb as Automation Scales

- Analysts forecast that net profit margins will expand from 2.3% today to 3.9% within three years, primarily driven by digital automation initiatives and improved operating efficiency.

- Consensus narrative argues that investments in AI-driven order intake, scheduling, and patient engagement apps will meaningfully boost margins and EBITDA by lowering costs, even as new contracts require heavy upfront spending.

- They underscore this margin resilience as crucial, especially with new capital-intensive projects on deck and looming reimbursement headwinds from CMS rules.

- Consensus further notes that consistent profit growth and a rising margin base could alleviate concerns over debt load, smoothing the path for stable long-term returns.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for AdaptHealth on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an opportunity or risk others might have missed? Share your unique outlook and shape your own narrative in just a few minutes with Do it your way.

A great starting point for your AdaptHealth research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While AdaptHealth is positioned for margin growth, its heavy debt load and exposure to industry reimbursement changes create uncertainty around long-term financial health.

If you prefer companies with robust balance sheets and less risk from debt or policy shifts, discover solid balance sheet and fundamentals stocks screener (1980 results) designed to showcase those built for stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AHCO

AdaptHealth

Distributes home medical equipment (HME), medical supplies, and home and related services in the United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives