- United States

- /

- Healthcare Services

- /

- NasdaqGS:ACHC

Assessing Acadia Healthcare Value After Share Price Drops 24% on Regulatory Concerns

Reviewed by Bailey Pemberton

- Wondering if Acadia Healthcare Company's recent struggles have opened up a rare value opportunity? You're not alone, and that's exactly what we'll explore here.

- The stock has tumbled, dropping 10.8% in the last week and nearly 24% over the past month. Year-to-date and 1-year losses stand at 49.3% and 51.4%, respectively, which are signals that investors are reassessing their stance.

- Investor sentiment shifted sharply after industry-wide news about increased competition and regulatory changes, both of which have weighed heavily on behavioral healthcare providers. Commentary around potential reimbursement pressures has only added to the volatility seen in Acadia Healthcare’s share price.

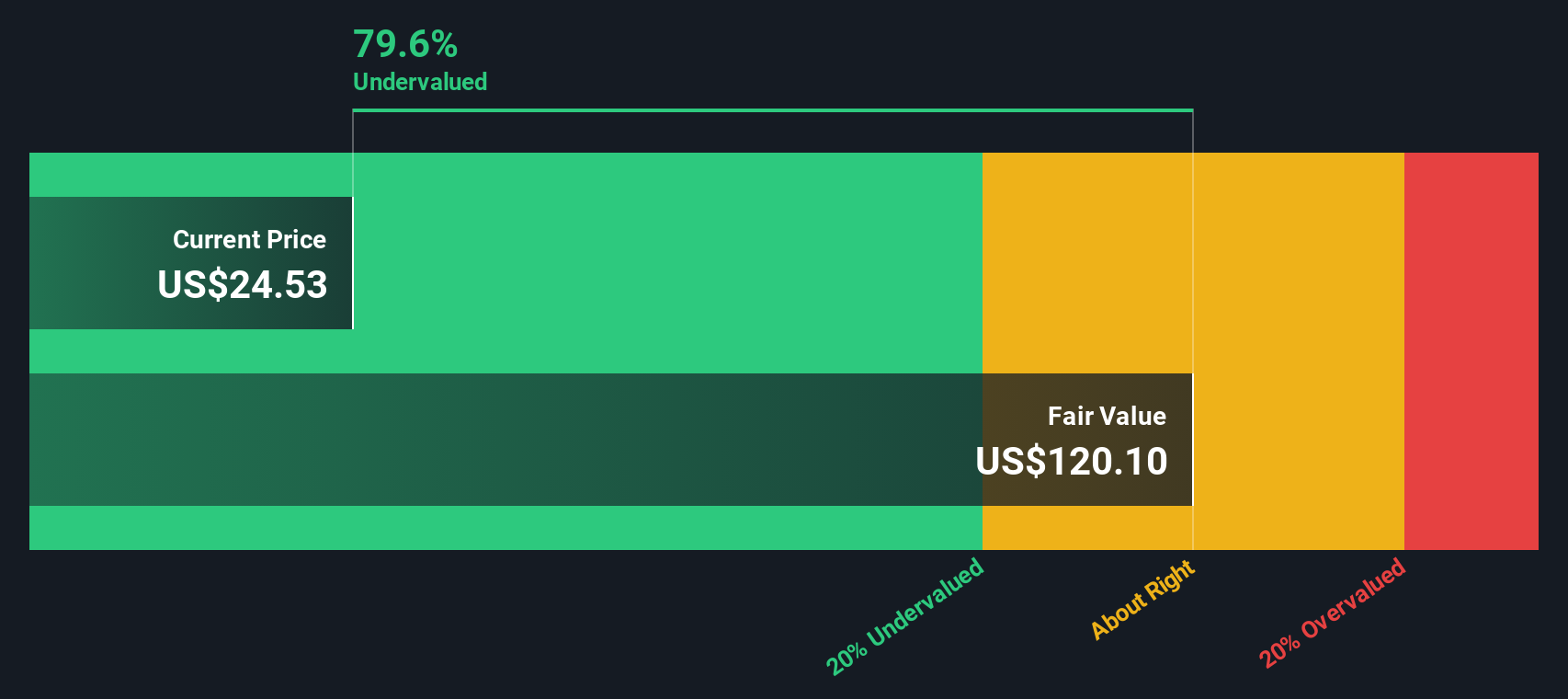

- Despite the noise, Acadia Healthcare Company currently scores a 5 out of 6 on our undervaluation checks. This suggests there may be more to the story than recent headlines reveal. Next, we'll break down how different valuation models approach Acadia, and stick around as there is an even more insightful way to assess value that we'll share at the end of the article.

Approach 1: Acadia Healthcare Company Discounted Cash Flow (DCF) Analysis

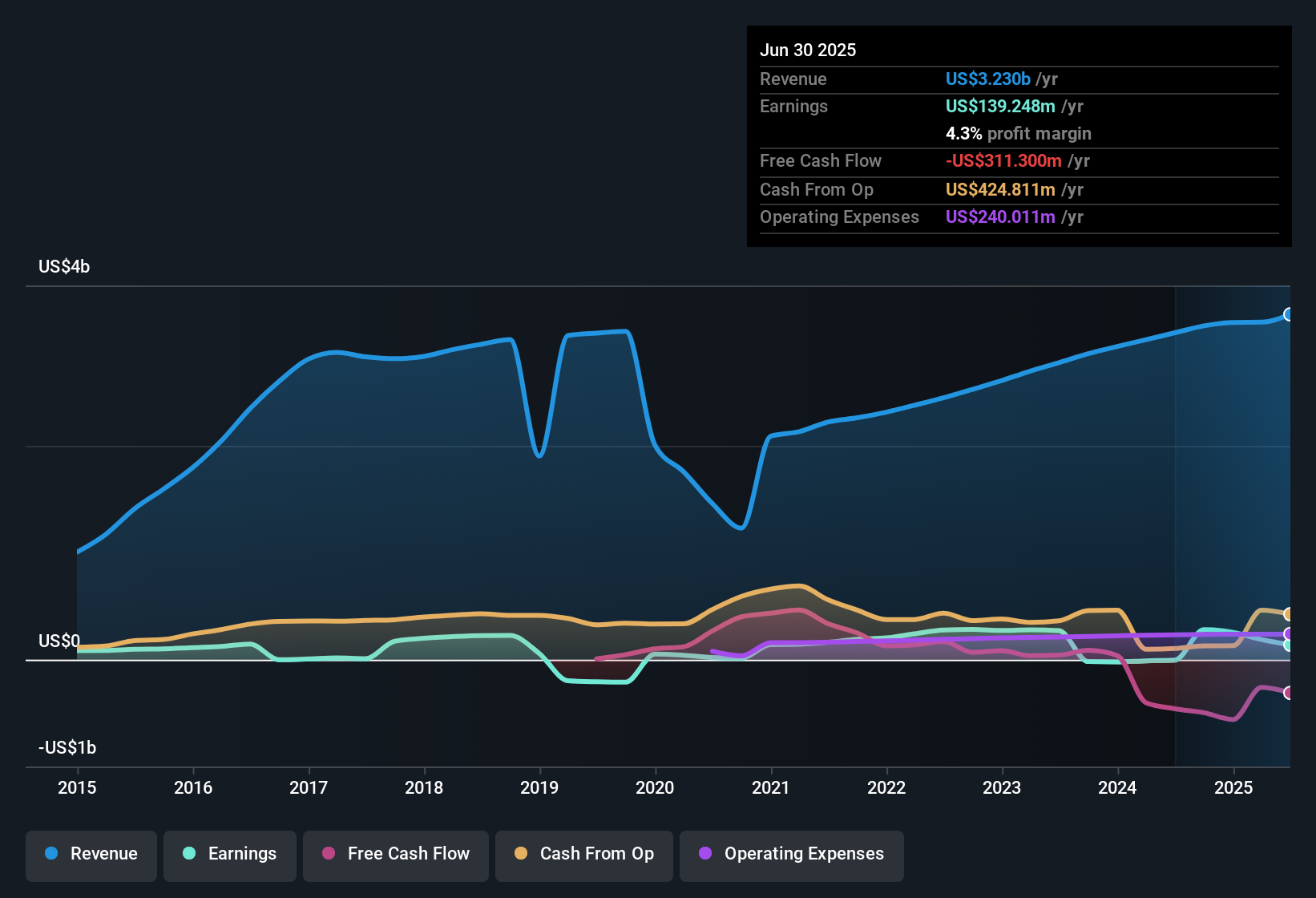

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting future free cash flows and discounting them back to today’s value. This approach helps investors gauge what a business is truly worth, based on its actual ability to generate cash in the years ahead.

For Acadia Healthcare Company, the DCF model uses current and projected Free Cash Flow (FCF) figures, all reported in USD. The company’s latest twelve-month FCF stands at a negative $152.6 Million, reflecting recent challenges. However, analysts expect significant improvement, with estimates jumping to $300 Million by 2027. Longer-term projections, based on extrapolations, show FCF potentially rising above $2 Billion by 2035.

Based on these cash flow projections and the 2 Stage Free Cash Flow to Equity model, Acadia Healthcare Company’s estimated intrinsic value is $342.69 per share. This figure suggests a 94.0% discount relative to the current share price. This may indicate substantial undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Acadia Healthcare Company is undervalued by 94.0%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Acadia Healthcare Company Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used to value profitable companies like Acadia Healthcare Company, as it relates a company’s current share price to its per-share earnings. This metric is especially useful for firms generating consistent profits, since it reflects how much investors are willing to pay for each dollar of earnings today.

What constitutes a “normal” or “fair” PE ratio is shaped by growth expectations and risk. Companies expected to grow earnings quickly, or those perceived as safer investments, typically trade at higher PE multiples. Lower-growth or riskier stocks tend to see more modest ratios.

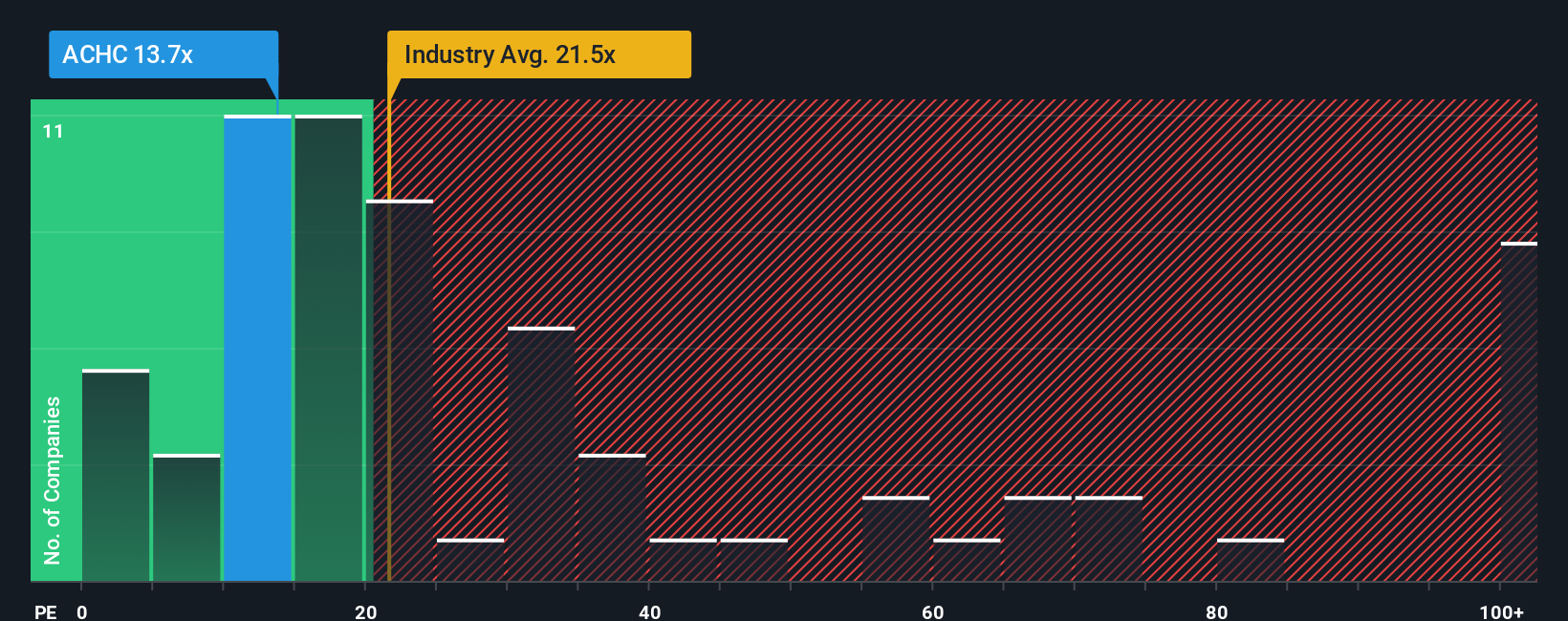

Acadia Healthcare Company is currently valued at 13.7x earnings. This is notably lower than the Healthcare industry average of 21.5x and also undercuts its peer group average of 21.4x. At first glance, this suggests the market is discounting Acadia’s earnings more heavily than its competitors.

Simply Wall St’s proprietary Fair Ratio for Acadia is 24.5x. Unlike a basic comparison with industry peers, the Fair Ratio takes into account specific factors like Acadia’s expected earnings growth, profit margins, industry type, company size, and overall risk profile. This makes it a more tailored and meaningful benchmark when evaluating value.

Since Acadia’s actual PE ratio (13.7x) is well below the Fair Ratio (24.5x), this points to an undervalued stock based on current earnings fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Acadia Healthcare Company Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. In simple terms, a Narrative is the story investors build around a company. It is your unique perspective on what drives Acadia Healthcare Company’s future, combining your assumptions for revenue, profit margins and risks, to shape a personalized forecast and fair value.

Narratives go beyond the numbers by connecting Acadia’s business context and your outlook, then instantly modeling the results so you can see at a glance whether your perspective implies the stock is undervalued or overvalued. Used by millions on Simply Wall St’s Community page, Narratives make it easy to compare your view with others and are automatically updated as new information, like news or earnings, emerges. This empowers you to refine your thinking in real time.

For example, some investors see Acadia’s growth potential from new facilities and innovation and set their Fair Value as high as $55, while others focus on operational struggles or regulatory risks, believing a Fair Value as low as $20 is justified. Narratives help you rationally decide if and when Acadia Healthcare is a buy or sell, giving you a smarter, more dynamic way to invest.

Do you think there's more to the story for Acadia Healthcare Company? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACHC

Acadia Healthcare Company

Provides behavioral healthcare services in the United States and Puerto Rico.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives