- United States

- /

- Food

- /

- NYSEAM:SEB

Seaboard (SEB): Breaking Down the Valuation After a Standout 74% Annual Return

Reviewed by Simply Wall St

Seaboard (SEB) shares have been on the move recently, sparking curiosity about what might be driving investor interest. With the stock up nearly 9% year to date and returning 74% over the past year, the company is definitely getting attention in the market.

See our latest analysis for Seaboard.

Seaboard’s share price has been on a tear lately, surging over 38% in the past month alone and delivering a standout 89% gain year to date. Recent momentum points to increased optimism around the company’s growth prospects, and its 74% total shareholder return over the last year highlights how strong the performance has been.

If the pace at Seaboard grabbed your attention, this could be a good time to broaden your scope and discover fast growing stocks with high insider ownership

With Seaboard’s stock posting breakneck gains, the key question now is whether the shares remain undervalued with room to run, or if recent momentum means the market has already factored in all future growth potential.

Price-to-Earnings of 11.1x: Is it justified?

Seaboard's shares currently trade at a price-to-earnings (P/E) ratio of 11.1x, noticeably below both its industry peers and the wider US market. With the last close at $4,581.82 per share, this valuation suggests the market is pricing Seaboard more conservatively than many of its competitors.

The price-to-earnings ratio reflects how much investors are willing to pay for each dollar of the company's earnings. In the food industry, this figure can signal market expectations regarding growth, stability, or potential risks. For Seaboard, a lower P/E often indicates either undervaluation or skepticism about future earnings sustainability.

When compared to the US Food industry average of 19x and a peer average of 19.2x, Seaboard stands out for its relatively modest earnings multiple. This could mean the market is underestimating the company’s recent earnings rebound or is cautious about its earnings consistency going forward.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 11.1x (UNDERVALUED)

However, investors should keep in mind that Seaboard’s earnings can be volatile. In addition, a lack of analyst coverage may limit visibility into future performance.

Find out about the key risks to this Seaboard narrative.

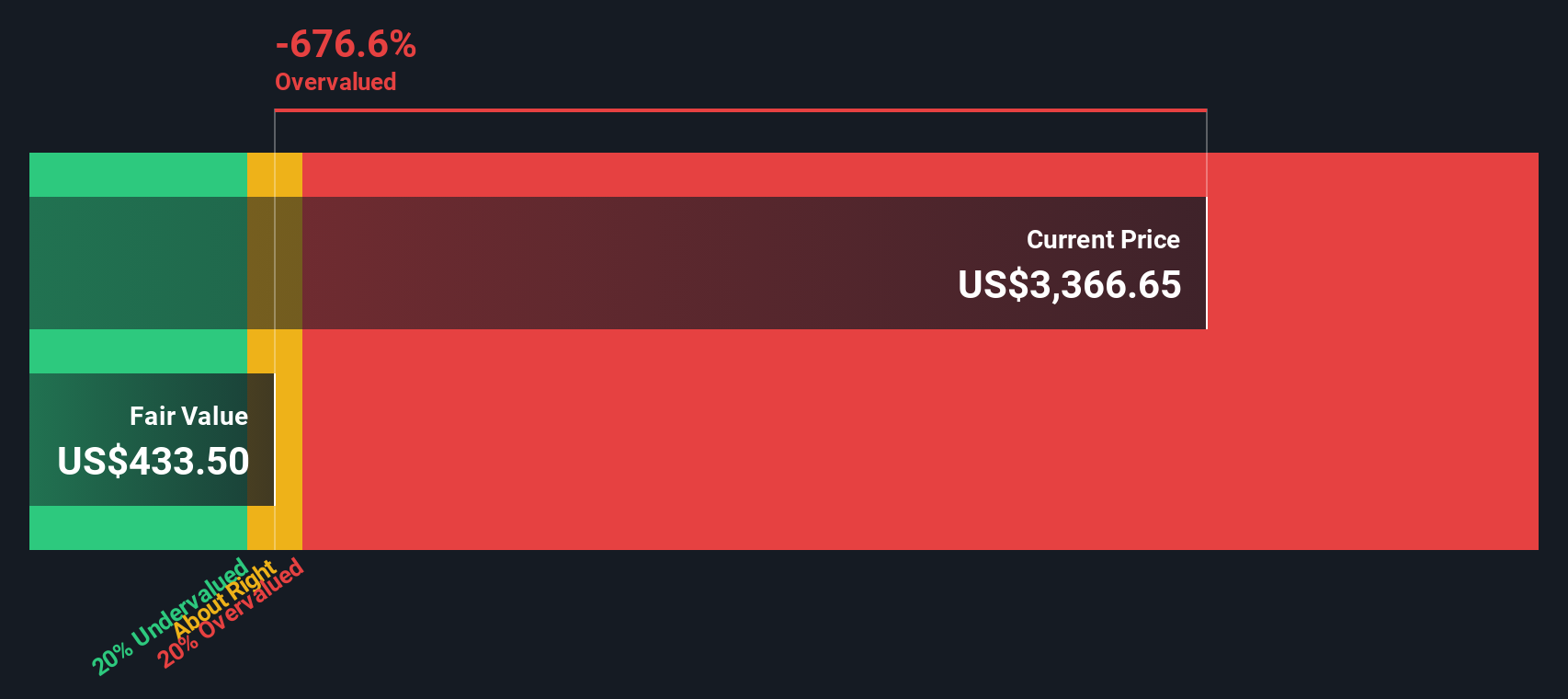

Another View: Discounted Cash Flow Suggests Overvaluation

While the price-to-earnings multiple points to Seaboard being undervalued, our SWS DCF model presents a different picture. According to this method, Seaboard's shares are actually trading above our estimate of fair value. This suggests that the current price might reflect a more optimistic outlook than the fundamentals justify. Could this signal that the market’s recent enthusiasm is outpacing the company’s intrinsic potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Seaboard for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Seaboard Narrative

If you think there’s another angle to Seaboard’s story, or you want to dig into the numbers yourself, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your Seaboard research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take your investing journey further by checking out hand-picked stock lists built around performance, innovation, and future trends. Don’t miss opportunities that others overlook.

- Unlock hidden value by checking out these 924 undervalued stocks based on cash flows for stocks trading below their true worth and presenting opportunities for potential gains.

- Capitalize on tomorrow’s technology by screening these 26 AI penny stocks focused on artificial intelligence and industry disruption.

- Boost your income potential and portfolio stability as you browse these 14 dividend stocks with yields > 3% with standout companies rewarding shareholders with healthy yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:SEB

Seaboard

Operates in agricultural, energy, and ocean transportation business worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success