- United States

- /

- Food

- /

- NYSE:TSN

The Bull Case for Tyson Foods (TSN) Could Change Following DOJ Price Fixing Probe Reopening

Reviewed by Sasha Jovanovic

- Earlier this month, Tyson Foods came under investigation for alleged price fixing in the meatpacking industry after calls for a Department of Justice probe from President Trump.

- This has intensified regulatory scrutiny on Tyson Foods and sparked widespread attention around its business conduct and operational transparency.

- We’ll explore how the reopening of price fixing allegations could impact Tyson Foods’ risk profile and the company's investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Tyson Foods Investment Narrative Recap

To be a shareholder in Tyson Foods, you generally need to believe in the company's ability to leverage global consumer demand for protein and execute on efficiency gains and innovation in its product lines. The reopening of price fixing allegations has increased regulatory scrutiny but does not, by itself, materially alter the most important short-term catalyst, which remains the company's upcoming earnings performance, although it does elevate the perception of risk around legal outcomes and brand reputation. Among the recent announcements, Tyson Foods’ settlement of an $85 million class action lawsuit related to pork price-fixing is particularly relevant. Coming just weeks before the latest Department of Justice investigation, this highlights the persistent legal and regulatory headwinds Tyson faces even as it seeks to drive growth through new product launches and operational improvements. In contrast to the company's efforts to expand its branded product range, the potential impact of ongoing regulatory investigations on future profitability and investor confidence should not be overlooked...

Read the full narrative on Tyson Foods (it's free!)

Tyson Foods' outlook anticipates $57.7 billion in revenue and $2.3 billion in earnings by 2028. This is based on a 2.1% annual revenue growth rate and an increase in earnings of $1.5 billion from the current $784.0 million level.

Uncover how Tyson Foods' forecasts yield a $61.75 fair value, a 17% upside to its current price.

Exploring Other Perspectives

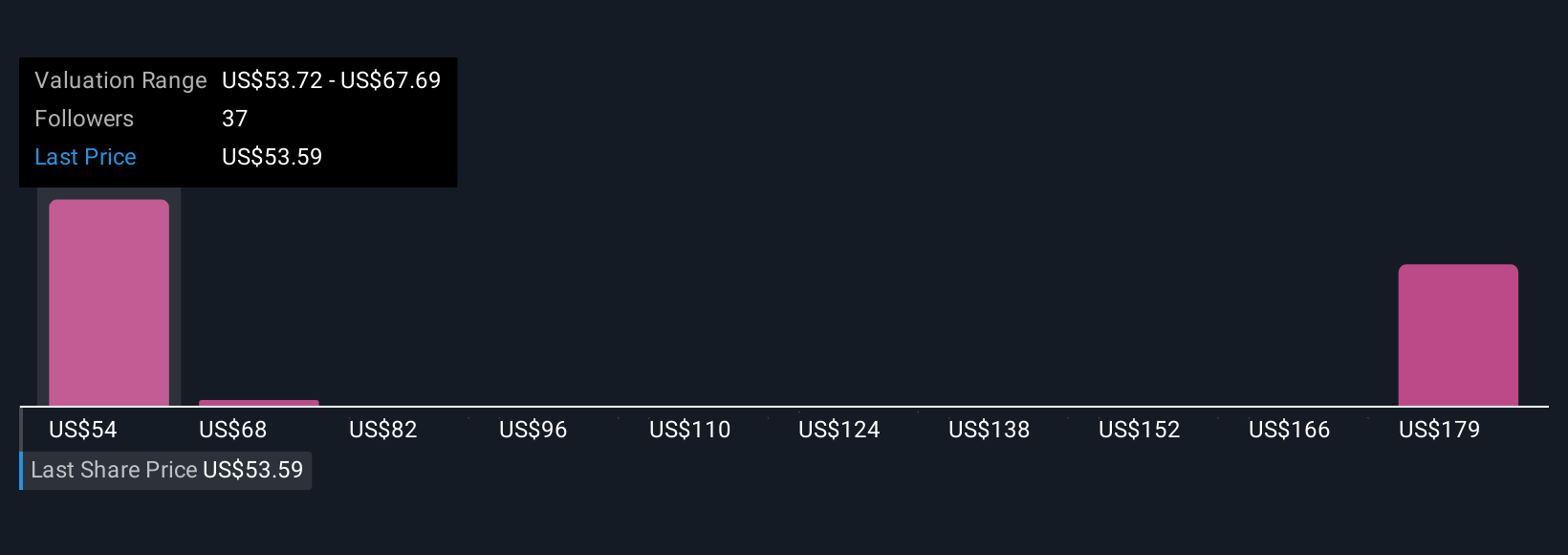

Seven members of the Simply Wall St Community estimate Tyson Foods' fair value between US$45 and US$129.27. While opinions differ significantly, ongoing regulatory risks continue to challenge the company's longer-term prospects and earnings stability.

Explore 7 other fair value estimates on Tyson Foods - why the stock might be worth 15% less than the current price!

Build Your Own Tyson Foods Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tyson Foods research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Tyson Foods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tyson Foods' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyson Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TSN

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives