- United States

- /

- Tobacco

- /

- NYSE:TPB

Turning Point Brands (TPB): Assessing Whether Shares Remain Undervalued After a Strong Run

Reviewed by Simply Wall St

See our latest analysis for Turning Point Brands.

Turning Point Brands’ share price has climbed 50.3% since the start of the year and recently closed at $91.16. This reflects investor optimism that is also visible in its robust 100.5% total return over the past 12 months. With positive momentum and a three-year total shareholder return approaching 300%, the company’s renewed growth story has caught the market’s attention.

If this kind of turnaround inspires you to keep searching, now’s the perfect moment to discover fast growing stocks with high insider ownership

After such a strong run, is Turning Point Brands still trading below its true value, or have investors already factored in all the upside? The real question is whether there is still a buying opportunity here, or if future growth has been fully priced in.

Most Popular Narrative: 15.4% Undervalued

Turning Point Brands closed at $91.16, while the most popular narrative indicates a fair value of $107.75. This suggests the stock could still have significant upside. This valuation frames the optimism in analyst expectations and sets the stage for bold financial projections.

Strong growth in the Modern Oral nicotine pouch segment, with sales growing nearly 8x year-over-year and now accounting for 26% of total revenue, positions TPB to capture significant market share in a category projected to reach $10 billion by decade's end. This will drive long-term revenue and margin expansion as the modern oral segment scales and premiumizes.

Want to know how Modern Oral and premium categories are reshaping the company’s earnings base? The most intriguing levers behind this valuation are razor-sharp profit margins and eye-popping future earnings assumptions. Curious which aggressive targets analysts are betting on? Dive in for the full story.

Result: Fair Value of $107.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, aggressive competition in Modern Oral and potential regulatory shifts could quickly upend forecasts. This reminds investors that growth stories always come with real risks.

Find out about the key risks to this Turning Point Brands narrative.

Another View: What Do the Valuation Ratios Say?

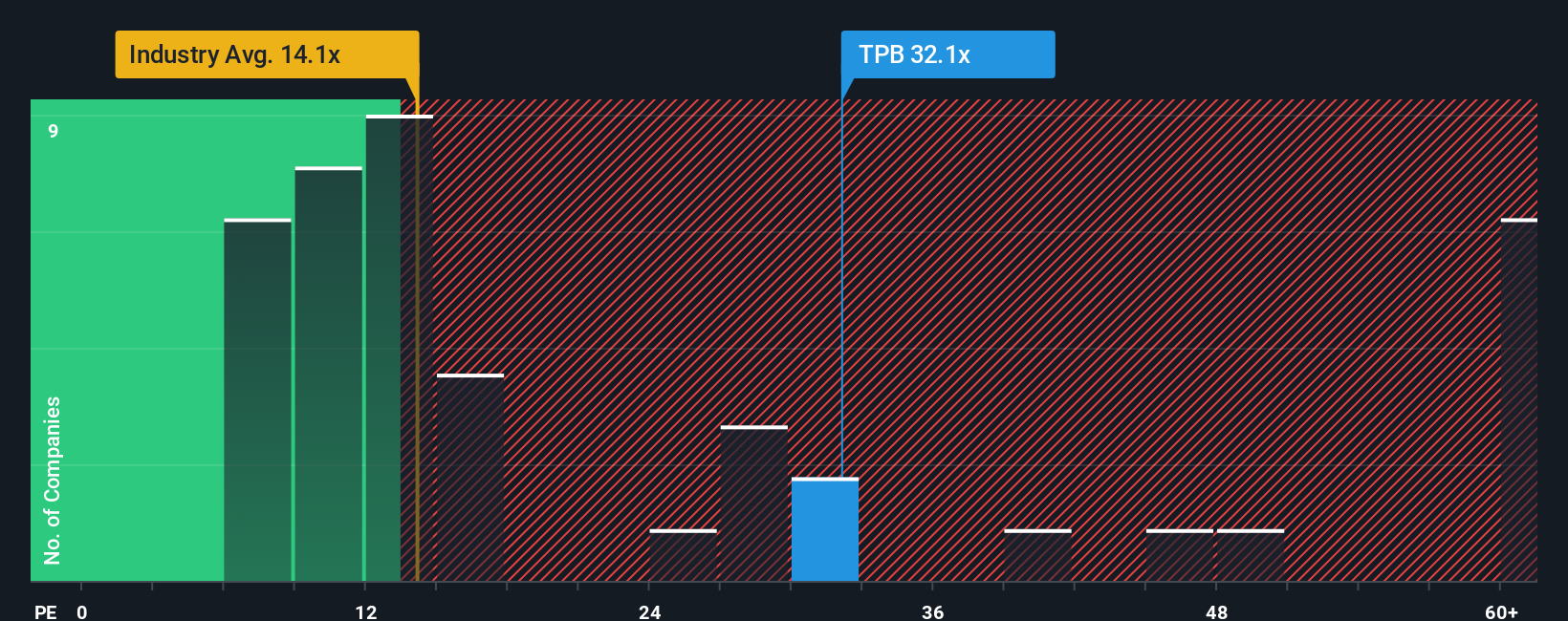

Looking at valuation ratios, Turning Point Brands trades at 32.1 times earnings. That is higher than both the global tobacco industry average (14.9x) and the fair ratio of 27.8x our analysis suggests the market could revert to. This points to a potential valuation risk if investor expectations cool. Does this premium signal quality, or raise a red flag for buyers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Turning Point Brands Narrative

You might have a different perspective or want to run your own numbers. Building your custom narrative takes less than three minutes. Do it your way

A great starting point for your Turning Point Brands research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors don't wait on the sidelines. Use the Simply Wall Street Screener to spot fresh opportunities in high-potential sectors and fast-changing markets before others catch on.

- Unlock the upside in tomorrow’s technology by backing these 27 AI penny stocks, which are driving real-world breakthroughs in automation, robotics, and data intelligence.

- Grab a potential bargain with these 876 undervalued stocks based on cash flows, which may be poised for a turnaround based on solid cash flow fundamentals.

- Supercharge your passive income stream with these 17 dividend stocks with yields > 3%, featuring generous yields and resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Turning Point Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPB

Turning Point Brands

Manufactures, markets, and distributes branded consumer products in the United States and Canada.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives