- United States

- /

- Beverage

- /

- NYSE:TAP

Molson Coors (TAP): Loss Reductions and Earnings Growth Forecast Challenge Bearish Narratives

Reviewed by Simply Wall St

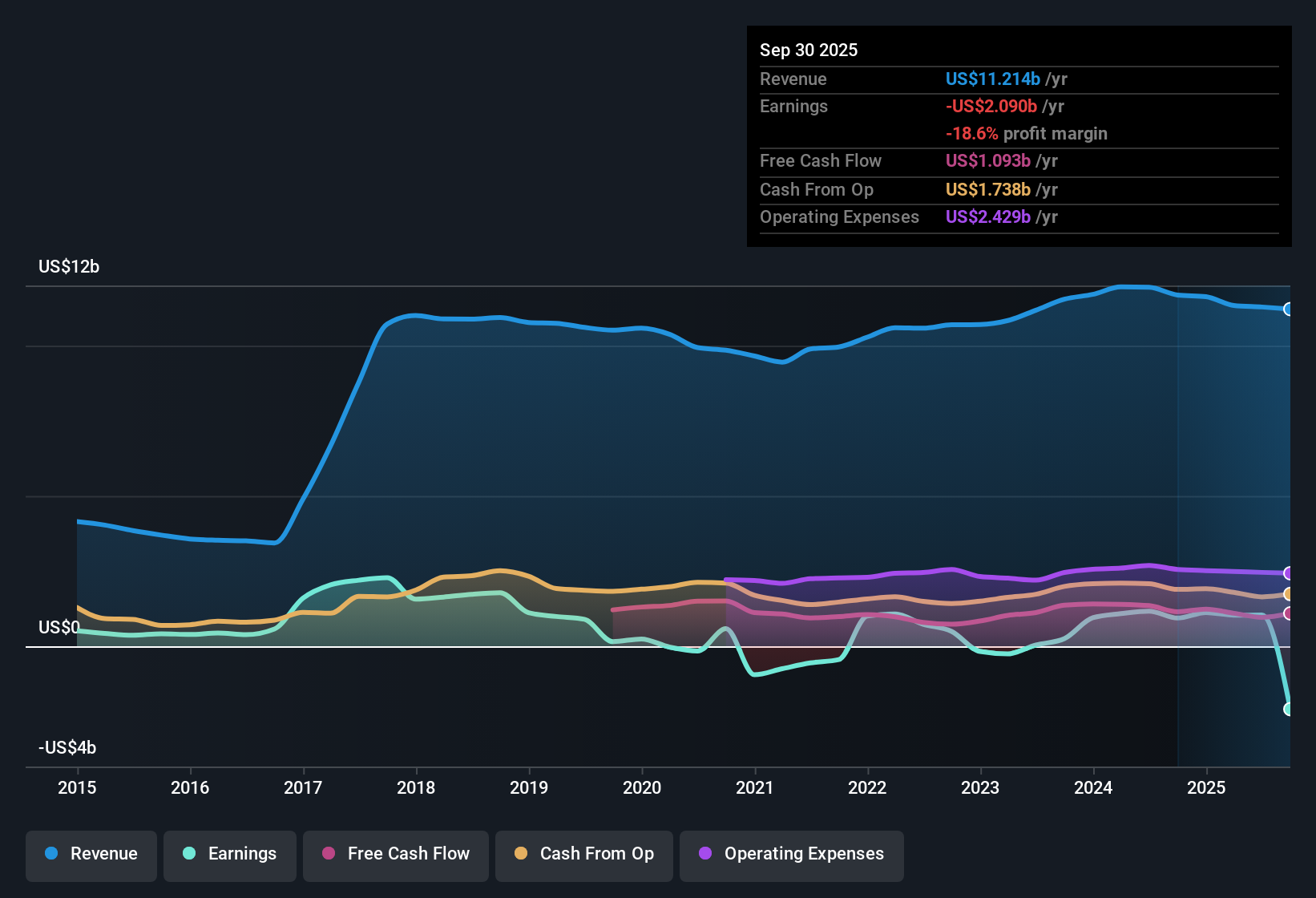

Molson Coors Beverage (TAP) is forecast to turn profitable within the next three years, with projected earnings growth of 65.59% annually. Revenue, however, is expected to rise just 0.6% per year, well below the US market average of 10.5%. While the company remains unprofitable in the latest results, losses have declined at an annual rate of 17.4% over the past five years. At $43.67 per share, TAP trades at a price-to-sales multiple of 0.8x, below both peer and sector averages, and notably beneath its estimated fair value of $158.09. Investors may see rewards in the earnings growth outlook and the valuation discount, but concerns remain around TAP’s financial position and dividend sustainability.

See our full analysis for Molson Coors Beverage.The next section sets these results in the context of the dominant investment narratives. It compares the hard numbers with stories that have shaped sentiment around TAP.

See what the community is saying about Molson Coors Beverage

Margins Edge Up as Profitability Nears

- Profit margins are projected to rise from 9.2% to 9.3% within three years, matching analyst expectations of a modest improvement despite sluggish sales.

- Analysts' consensus view notes that diversification into premium, non-beer, and international products is expected to support higher margins and growth resilience.

- Margin expansion is tied to new segments like above-premium drinks and to cost mitigation efforts that offset input price spikes.

- Supply chain enhancements and free cash flow are highlighted as key levers for defending and gradually improving margins, even as core markets remain challenged.

- Consensus sees a slow but steady margin improvement as critical for the turnaround story, hinging on execution in higher-margin categories and disciplined spending.

- If Molson Coors can convert premiumization and operational savings into even modest margin gains, it could alter the long-term outlook more than headline revenue numbers imply. 📊 Read the full Molson Coors Beverage Consensus Narrative.

Share Buybacks Boost EPS Potential

- The number of shares outstanding is forecast to fall by 4.02% per year over the next three years, pointing directly to higher future earnings per share even in a weak sales environment.

- Consensus narrative details that aggressive share repurchases and prudent capital investments, enabled by strong free cash flow, will help boost EPS growth and offer financial flexibility.

- This supports improved valuation multiples if the company delivers on cost controls and sustains cash generation.

- Ongoing buybacks help counterbalance tepid top-line progress, allowing per-share metrics to outperform sluggish revenue trends.

Valuation Remains Attractive Despite Risks

- At a price-to-sales ratio of 0.8x and a share price of $43.67, TAP trades well below both DCF fair value ($158.09) and the analyst price target ($52.10), suggesting a potential value opportunity relative to sector peers at 1.8x and industry at 2.2x.

- Consensus narrative highlights that while the valuation discount is a major draw for investors, persistent high input costs and weak core category performance temper the case for a quick rebound.

- DCF fair value sits far above the current share price, but challenges in core US and Canadian markets and volatility in aluminum prices could justify the lingering discount.

- Analysts agree share price upside requires belief in steady execution and margin recovery, not just financial engineering or stock buybacks alone.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Molson Coors Beverage on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a different take on the numbers? Share your perspective and craft your own narrative in just a few minutes by clicking Do it your way.

A great starting point for your Molson Coors Beverage research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While Molson Coors Beverage boasts improving margins and a valuation discount, lingering concerns about its financial stability and dividend sustainability remain.

If you want greater confidence in financial strength, use our solid balance sheet and fundamentals stocks screener (1979 results) to discover companies built on sturdier balance sheets and robust fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TAP

Molson Coors Beverage

Manufactures, markets, and sells beer and other malt beverage products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives