- United States

- /

- Beverage

- /

- NYSE:STZ

How the Canada Boycott Impacts Constellation Brands’ Share Price in 2025

Reviewed by Bailey Pemberton

If you’re looking at Constellation Brands and wondering whether now is the right moment to buy or hold, you are not alone. The stock has given investors plenty to discuss recently, leaving some optimistic about growth and others puzzled by recent declines. In the past week, shares have risen 5.9%, showing some recovery. However, taking a longer view, the picture is more challenging: down 7.1% over 30 days, and a significant 36.9% drop year-to-date. The stock is still well below its level from a year ago, with a loss of 41.1% over the past 12 months. Five-year holders have also experienced declines, down 17.9% from their starting point.

Recent headlines have influenced the narrative. With U.S. alcohol brands facing a boycott in Canada and Americans drinking less overall, Constellation Brands has encountered notable industry challenges. Meanwhile, there are signs of potential, as the company explores shifts into the cannabis beverage market and some investors anticipate improvement if trends reverse or new markets emerge.

What does all this indicate for the stock’s underlying value? By traditional measures, the outlook is mixed. Constellation scores a 2 out of 6 on our undervaluation checks, suggesting it may be undervalued in two areas but not broadly across the board. However, numbers alone do not capture the entire story. Next, we will examine those classic valuation checks and consider whether there is a broader way to assess what this company is truly worth.

Constellation Brands scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Constellation Brands Discounted Cash Flow (DCF) Analysis

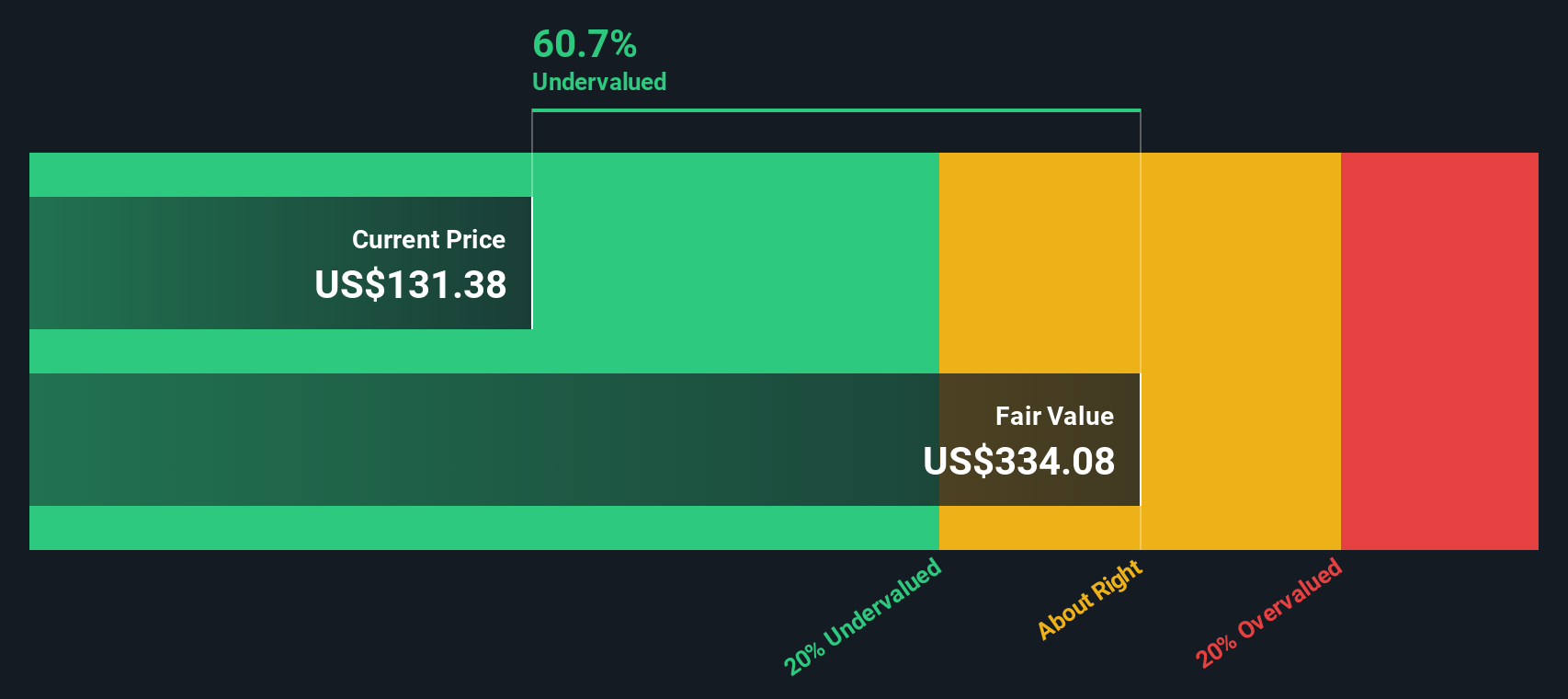

The Discounted Cash Flow (DCF) model estimates a company’s current value by projecting its future free cash flows and discounting them back to the present. For Constellation Brands, the DCF approach uses a two-stage Free Cash Flow to Equity model. This model calculates expected cash flows over the next five years based on analyst estimates, then extrapolates additional years using broader industry trends.

Currently, Constellation Brands generated $1.91 Billion in free cash flow (FCF) over the last twelve months. Analyst consensus projects this figure will grow in the years ahead, reaching around $2.57 Billion by 2030, with further modest growth in subsequent years extrapolated by Simply Wall St.

Based on these projections, the model calculates an intrinsic value per share of $337.50. Compared to the current market price, this DCF implies the stock is trading at a 58.4% discount to its fair value.

In simple terms, this analysis suggests Constellation Brands is significantly undervalued according to the cash flow method, and that the market may be underappreciating its future earning power.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Constellation Brands is undervalued by 58.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

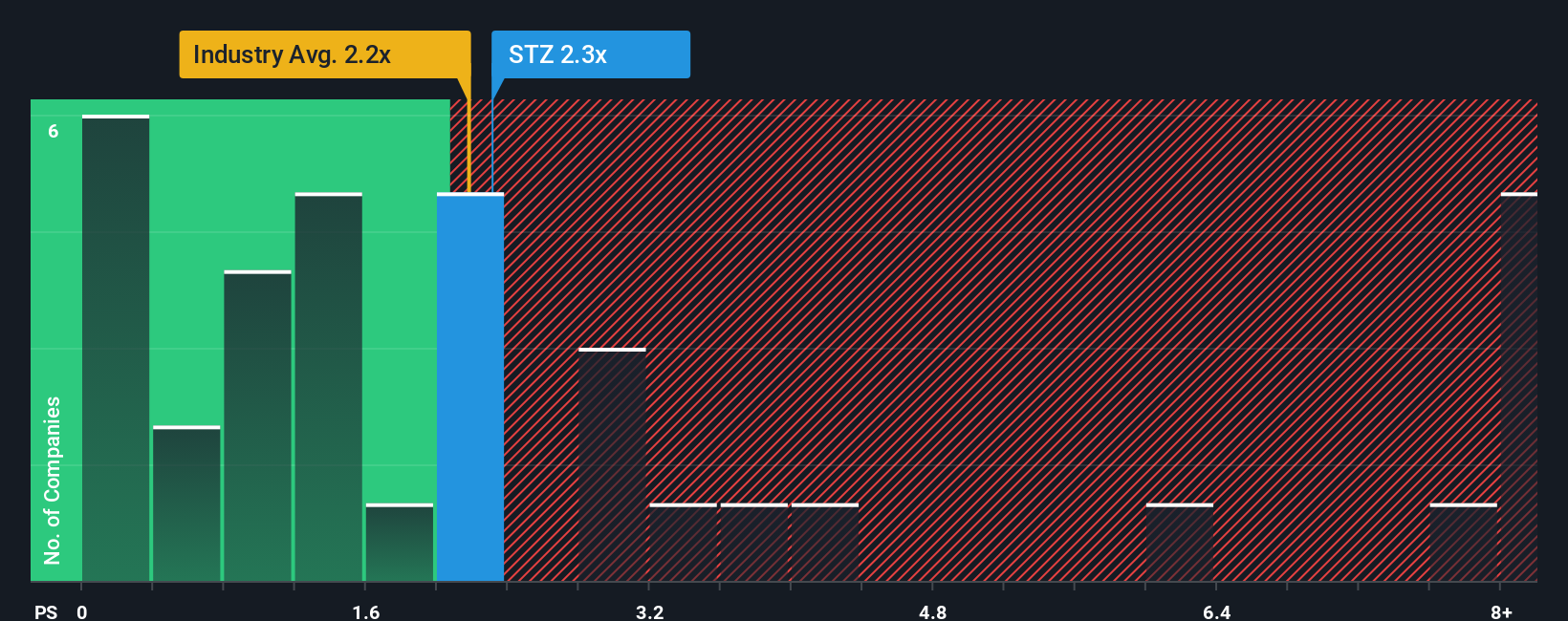

Approach 2: Constellation Brands Price vs Sales

The Price-to-Sales (P/S) ratio is the preferred multiple for valuing Constellation Brands because it is especially useful for profitable companies experiencing industry headwinds or fluctuating margins. The P/S ratio allows investors to compare the market’s valuation of a company to its actual sales, offering perspective when earnings are volatile or affected by one-time charges.

Growth expectations and risk levels significantly influence what qualifies as a “fair” or “normal” P/S multiple. Higher growth companies, or those with stable and predictable revenues, usually warrant higher multiples, while firms facing risks or slowdowns typically see their ratios compress.

Constellation Brands currently trades at a P/S ratio of 2.46x. By comparison, the average for its Beverage industry peers is 1.87x, while the broader industry average stands at 2.17x. This implies the company is being valued at a modest premium over its direct competitors, yet only slightly above the overall industry norm.

Simply Wall St’s proprietary “Fair Ratio” for Constellation Brands is calculated at 2.29x. Unlike a basic peer or industry average, the Fair Ratio incorporates key factors like earnings growth, profit margins, risk profile, market cap, and specific industry trends. This leads to a more nuanced read on true value, going beyond simple averages.

With Constellation’s actual P/S ratio sitting just 0.17x above its Fair Ratio, the evidence suggests the stock is only slightly more expensive than it “should” be, but not excessively so.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Constellation Brands Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story about a company, where you tie together your outlook on its business, your financial forecasts, and your resulting sense of fair value. This gives context to the numbers that drive investment decisions. Narratives bridge the gap between what a company does and what those actions mean for its financials and share price, allowing you to directly link a company’s strategy, expected sales, and profit trends to a real-world fair value estimate.

With Simply Wall St’s Narratives, used by millions of investors and available right in the Community page, you can easily outline your perspective (optimistic or cautious) alongside your forecasts and see at a glance how your fair value stacks up to the current share price. The best part is that whenever news, earnings, or major events occur, Narratives are automatically updated, so your investment thesis is always relevant. For example, some investors currently forecast Constellation Brands' future value as high as $247.00 per share, while the most skeptical see it at just $123.00. This demonstrates how Narratives make it easy to compare the full range of market perspectives and refine your own decision about when to buy or sell.

Do you think there's more to the story for Constellation Brands? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STZ

Constellation Brands

Produces, imports, markets, and sells beer, wine, and spirits in the United States, Canada, Mexico, New Zealand, and Italy.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives