- United States

- /

- Beverage

- /

- NYSE:SAM

Boston Beer Company (SAM): Taking Stock of Valuation After New Samuel Adams Winter White Ale Launch

Reviewed by Simply Wall St

Boston Beer Company (NYSE:SAM) just shook up its seasonal lineup with the nationwide release of Samuel Adams Winter White Ale, its first new winter beer in 30 years. The company also unveiled a Winter Break Variety Pack featuring both new and classic brews. This signals a broader push to capture holiday demand.

See our latest analysis for Boston Beer Company.

This fresh approach isn't going unnoticed by investors, as Boston Beer Company's share price has struggled lately despite new launches and leadership updates. The company has delivered a 1-year total shareholder return of -35.1% and a five-year total return of -79.1%. While the headline share price has been pressured, these changes could help reverse fading momentum if consumer excitement translates into sales growth.

If you're looking for your next investing idea, now is a great time to expand your search and discover fast growing stocks with high insider ownership

But with shares trading well below analyst targets and a string of disappointing returns, the question remains: is the market offering a real bargain in Boston Beer Company or is future growth already fully accounted for in the price?

Most Popular Narrative: 16.7% Undervalued

Boston Beer Company’s last close at $199.45 sits well below what the most-followed narrative considers fair value, setting the stage for its future prospects to drive fresh debate around this stock.

Ongoing productivity initiatives (brewery efficiency, procurement and waste reduction) are structurally raising gross margins. This should continue to benefit earnings as volume normalizes and new, margin-accretive products (for example, Sun Cruiser) scale.

Want to know why analysts believe gross margin breakthroughs, big brand moves and tight cost controls might redefine Boston Beer’s profit potential? Curious how a few strategic growth levers could be driving a fair value calculation much higher than today’s price? Dive into the narrative for the surprising details behind these bold assumptions.

Result: Fair Value of $239.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition and declining category sales could undermine Boston Beer’s growth outlook if new products do not capture consumer interest as hoped.

Find out about the key risks to this Boston Beer Company narrative.

Another View: What Do Peer Comparisons Say?

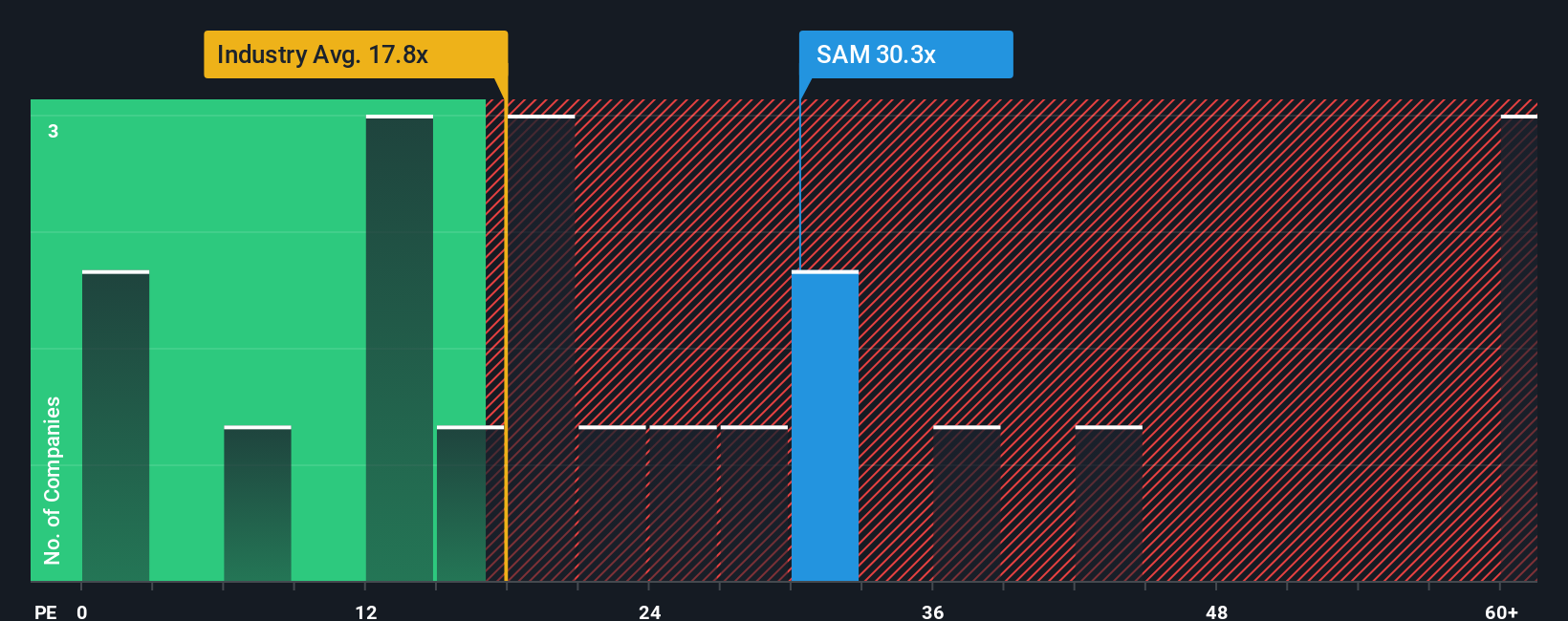

Looking at earnings multiples, Boston Beer Company appears pricey. Its price-to-earnings ratio of 22.6x sits above both the global beverage industry’s 17.6x average and the peer group’s 21x. The fair ratio, based on our analysis, would be 15.8x. This gap means investors are paying a premium. Is the growth story strong enough to justify it, or could this valuation signal future disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Boston Beer Company Narrative

If you think there’s more to this story or want to dig into the numbers yourself, you can easily build your own take in just a few minutes. Do it your way

A great starting point for your Boston Beer Company research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Instead of waiting on the sidelines, power up your portfolio by jumping into curated stock shortlists designed to help you seize unique opportunities others miss.

- Boost your returns by targeting regular income from these 17 dividend stocks with yields > 3% with yields above 3%, making them suitable for steady cash flow and financial resilience.

- Capitalize on the explosive potential of digital assets by stepping into the world of these 82 cryptocurrency and blockchain stocks, which is reshaping global finance and technology.

- Accelerate your strategy by focusing on these 861 undervalued stocks based on cash flows, where overlooked opportunities could translate into gains based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boston Beer Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SAM

Boston Beer Company

Produces and sells alcohol beverages primarily in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives