- United States

- /

- Tobacco

- /

- NYSE:PM

Philip Morris International (NYSE:PM) Valuation Spotlight Following $1.7 Billion Debt Redemption Initiative

Reviewed by Simply Wall St

Philip Morris International (PM) is taking an active step in debt management by announcing plans to redeem $1.7 billion of its 4.875% notes ahead of schedule. This decision highlights deliberate capital allocation and signals financial confidence to investors.

See our latest analysis for Philip Morris International.

This proactive debt move comes after a rollercoaster year for Philip Morris International’s share price, with recent turbulence following mixed earnings. A solid revenue beat but an EBITDA miss sent the stock down 3.4%. Still, building on long-term momentum, the company posts a 24.8% total shareholder return over the last year and an impressive 155.8% over five years, reflecting lasting value creation and renewed growth confidence.

If this financial reshuffling sparks your curiosity, consider broadening your search and discover fast growing stocks with high insider ownership

Given Philip Morris International’s robust shareholder returns and deliberate balance sheet moves, the real question for investors is this: does the current stock price offer hidden upside, or is future growth already baked in?

Most Popular Narrative: 15% Undervalued

The most followed analyst narrative currently sees Philip Morris International as trading below its estimated fair value of $183.25, with the last close at $155.85. This significant discount sets the stage for further scrutiny of the company's forecasted transformation and market positioning in the years ahead.

The accelerating global adoption of smoke-free alternatives, driven by increasing health awareness and regulatory moves away from combustibles, is fueling strong double-digit volume and margin growth in PMI's IQOS, ZYN, and VEEV platforms. This secular shift enables the company to capture new consumer segments, expand its addressable market, and structurally boost net revenues and operating margins over time.

Want to know the real fuel behind this valuation? The narrative hinges on bold growth forecasts, steady margin expansion, and a major shift in what drives future profit. Are you curious which financial assumptions pack the most punch in the calculation? Unlock the full story by reading the detailed forecast breakdown.

Result: Fair Value of $183.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory changes and the threat of slower smoke-free growth could quickly challenge the current bullish outlook for Philip Morris International.

Find out about the key risks to this Philip Morris International narrative.

Another View: What Do the Multiples Say?

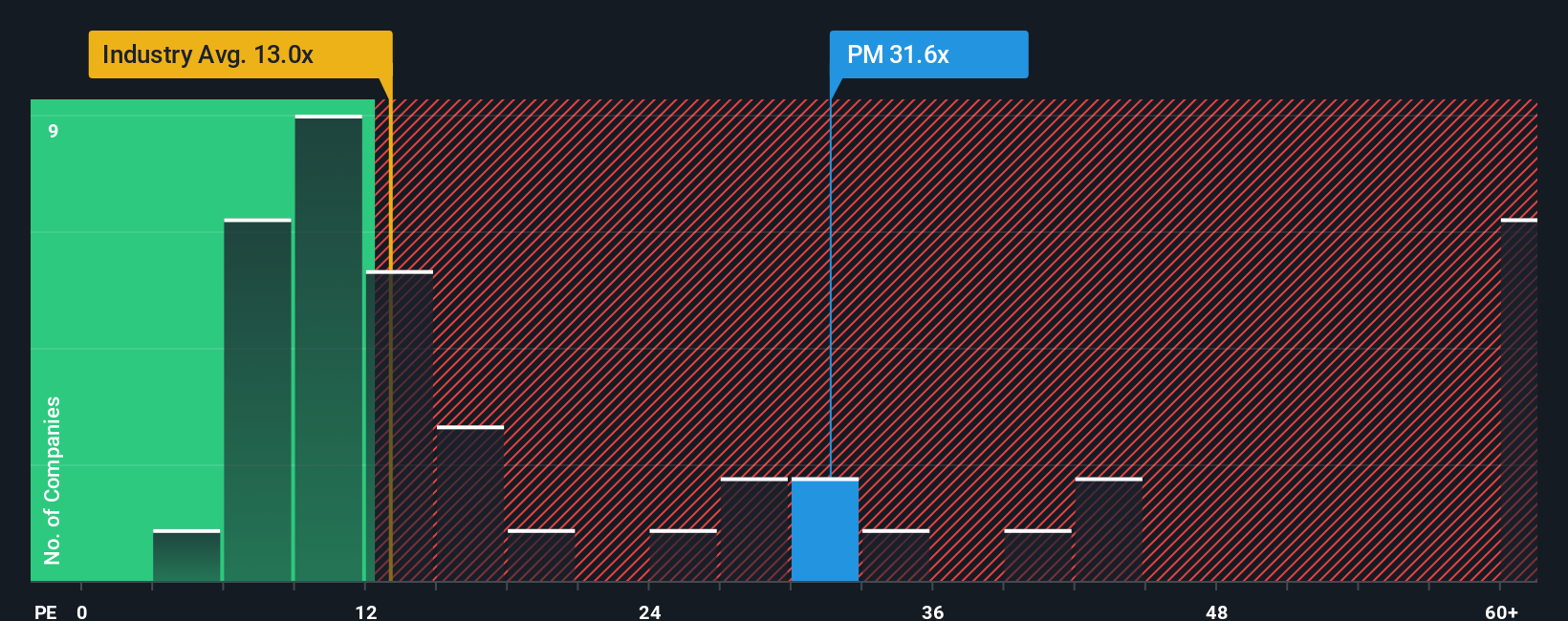

Looking at valuation through the lens of the price-to-earnings ratio, Philip Morris International is trading at 28.2x, which is noticeably higher than both its peer average of 23.8x and the global industry average of 14.7x. Compared to the fair ratio of 26.8x, the current price carries a premium, potentially signaling caution for investors who focus on traditional multiples. Does this suggest a vulnerability if market sentiment changes, or is the premium justified by growth prospects?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Philip Morris International Narrative

If these perspectives do not fit your take or you prefer digging into the numbers yourself, you can craft your own in just minutes. Do it your way

A great starting point for your Philip Morris International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why settle for the usual picks when tomorrow's winners are already making headlines? Let Simply Wall Street's Screeners reveal what's moving and help you stay ahead of the curve.

- Spot overlooked values by starting with these 907 undervalued stocks based on cash flows, which highlights stocks trading below their true worth based on future cash flows.

- Unlock income potential by exploring these 18 dividend stocks with yields > 3%, featuring stocks with yields that outshine market standards.

- Catch the next wave in medicine and innovation by using these 31 healthcare AI stocks, focused on companies harnessing AI to disrupt healthcare.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PM

Second-rate dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives