- United States

- /

- Tobacco

- /

- NYSE:PM

Philip Morris International (NYSE:PM): Assessing Valuation as New Corporate Structure Targets Smoke-Free Future

Reviewed by Simply Wall St

Philip Morris International (PM) is set to overhaul its corporate structure starting January 2026 by introducing separate U.S. and International business units and reorganizing its reporting into three new segments. This marks a pivotal move in its ongoing smoke-free transformation.

See our latest analysis for Philip Morris International.

After a strong run earlier in the year, Philip Morris International shares cooled in the third quarter, but the company’s momentum remains impressive. Aided by its push into smoke-free products and recent executive changes, the stock’s latest 1-year total shareholder return stands at a robust 22.85% and the 5-year total return is a staggering 152.99%. This is clear evidence that long-term investors have been rewarded as strategic shifts gather pace.

If you're interested in uncovering what else is out there, now could be a prime opportunity to broaden your search and discover fast growing stocks with high insider ownership

With shares currently trading at a notable discount to analyst targets but following an extended rally, the central question now is whether Philip Morris is undervalued at these levels or if future growth is already reflected in the price.

Most Popular Narrative: 20% Undervalued

The most widely followed narrative places Philip Morris International's fair value significantly higher than the recent closing price, highlighting a notable discount that is catching investors' attention. Here is an inside view of the argument driving this perspective.

The accelerating global adoption of smoke-free alternatives, driven by increasing health awareness and regulatory moves away from combustibles, is fueling strong double-digit volume and margin growth in PMI's IQOS, ZYN, and VEEV platforms. This secular shift enables the company to capture new consumer segments, expand its addressable market, and structurally boost net revenues and operating margins over time.

Curious what’s fueling this optimism? The most popular narrative counts on outsized growth from new product lines, margin expansion, and a future profit multiple that rivals market leaders. Want to discover the bold assumptions and unspoken risks supporting that lofty fair value? The full narrative reveals every blockbuster projection feeding into the target price.

Result: Fair Value of $185.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing declines in cigarette volumes and risks from illicit trade could quickly shift market sentiment and challenge the current bullish outlook.

Find out about the key risks to this Philip Morris International narrative.

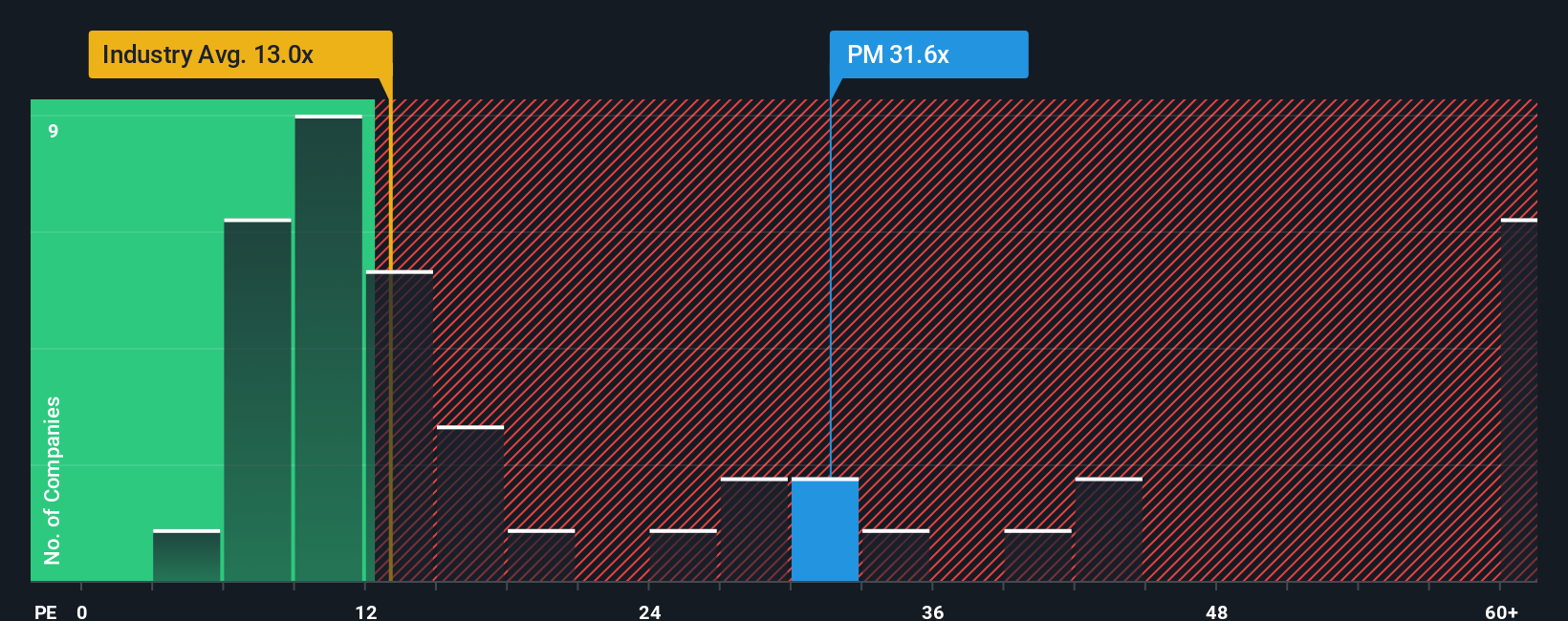

Another View: Multiples Suggest a Higher Valuation Risk

While the analyst consensus points to Philip Morris International being undervalued, our peer and industry price-to-earnings comparisons tell a more cautious story. The company's ratio stands at 26.9x, notably higher than both the global tobacco industry average of 14.6x and its direct peers. Even the fair ratio, which the market could move towards, is slightly below at 26.7x. In practical terms, this leaves less margin for error if earnings do not live up to optimistic forecasts. Will the market reward further growth, or is today's price reflecting too much optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Philip Morris International Narrative

If you have a different perspective or want to dive into the numbers on your own, it's quick and easy to build a personal view using your own inputs. Do it your way.

A great starting point for your Philip Morris International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. Power up your watchlist with unique stocks and megatrends you might otherwise miss, using these top picks:

- Amplify your returns with these 836 undervalued stocks based on cash flows that offer strong fundamentals but are still trading below fair value.

- Target passive income by seeking out these 20 dividend stocks with yields > 3% designed to pay yields over 3%.

- Accelerate your strategy in a booming sector by tapping into these 26 AI penny stocks leading the artificial intelligence revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PM

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives