- United States

- /

- Tobacco

- /

- NYSE:MO

Does the Recent 10% Pullback Offer a Better Entry Point for Altria Group in 2025?

Reviewed by Bailey Pemberton

- Wondering if Altria Group is trading at a bargain or if you should wait for a better entry point? You are not alone, as many investors are reevaluating its value potential right now.

- The stock’s latest close was $58.19. While it is up a solid 10.8% year-to-date and 10.0% over one year, the past month saw a notable 10.0% pullback.

- Recently, headlines have focused on shifting regulatory landscapes and ongoing litigation in the tobacco sector, both of which play a role in how investors see Altria’s risk and future returns. News coverage has highlighted Altria’s efforts to diversify its product lineup and adapt to changing consumer trends, which may be shaping market sentiment and price swings.

- If you are curious about valuation scores, Altria earns a strong 5 out of 6 on our checks for undervaluation. This suggests the stock offers compelling value on several metrics. We will dig into the different approaches to valuing the company as well as a smarter way to put these numbers in context by the end of this article.

Find out why Altria Group's 10.0% return over the last year is lagging behind its peers.

Approach 1: Altria Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is used to estimate a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This approach helps investors determine if a stock is trading below its true worth based on its long-term earning power.

Altria Group’s most recent Free Cash Flow stands at $9.19 billion. Analysts forecast this figure will remain steady over the next few years, with a 2027 projection of $9.09 billion. From 2026 onward, further cash flow projections are extrapolated, showing gradual increases and reaching more than $10.8 billion by 2035, according to Simply Wall St’s model assumptions.

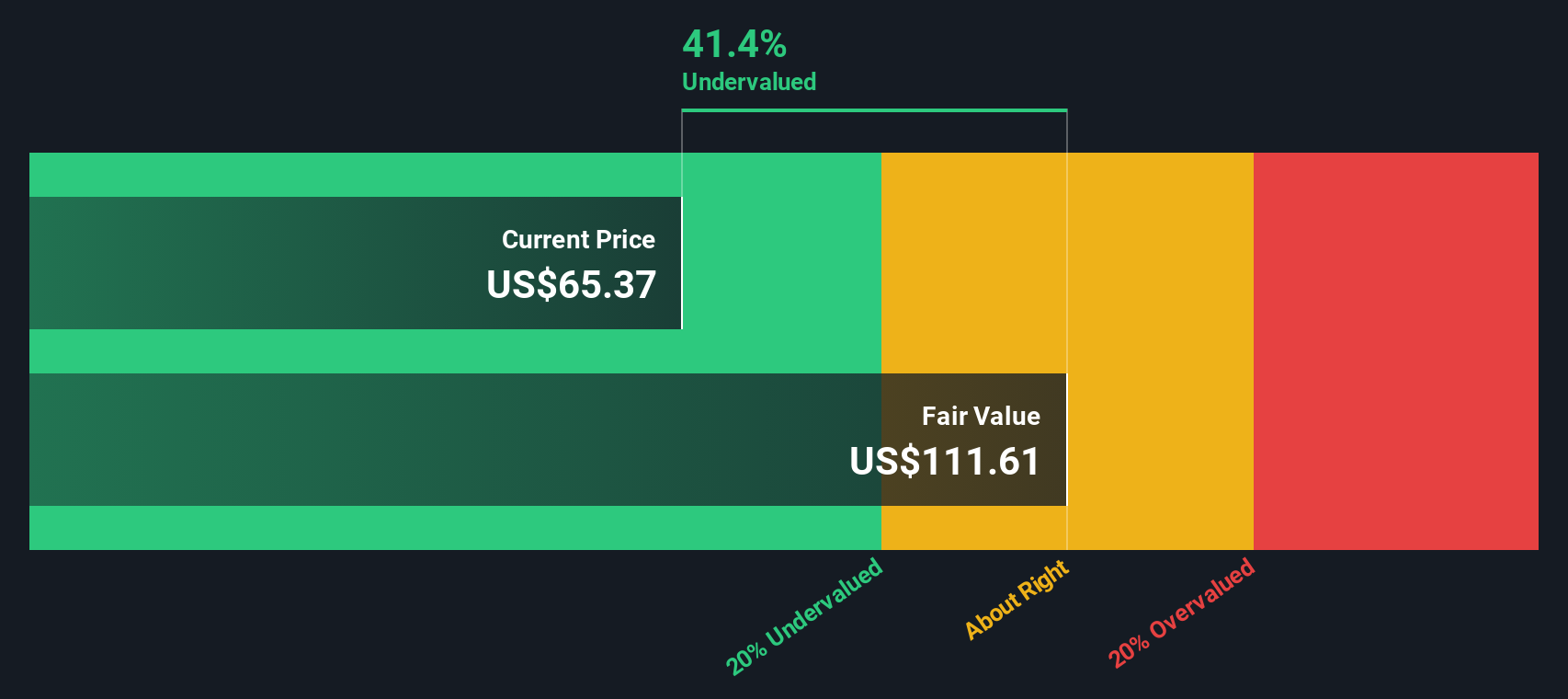

The DCF analysis results in an intrinsic value of $103.67 per share. Comparing this to Altria’s recent share price of $58.19, the model suggests the stock is trading at a 43.9% discount to its estimated fair value. This indicates substantial undervaluation and may present a potential opportunity for value-focused investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Altria Group is undervalued by 43.9%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: Altria Group Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used valuation methods for profitable companies like Altria Group, because it compares the company's share price to its per-share earnings. This makes it especially effective for assessing firms with stable profits, allowing investors to gauge whether a stock is reasonably priced given its ability to generate earnings.

Growth expectations and risk directly influence what constitutes a "normal" PE ratio. Companies with strong growth potential or lower risk profiles tend to trade at higher PE multiples, reflecting investor optimism and the premium paid for future expansion. Conversely, slower growth or higher perceived risks typically result in lower PE ratios as investors demand a discount.

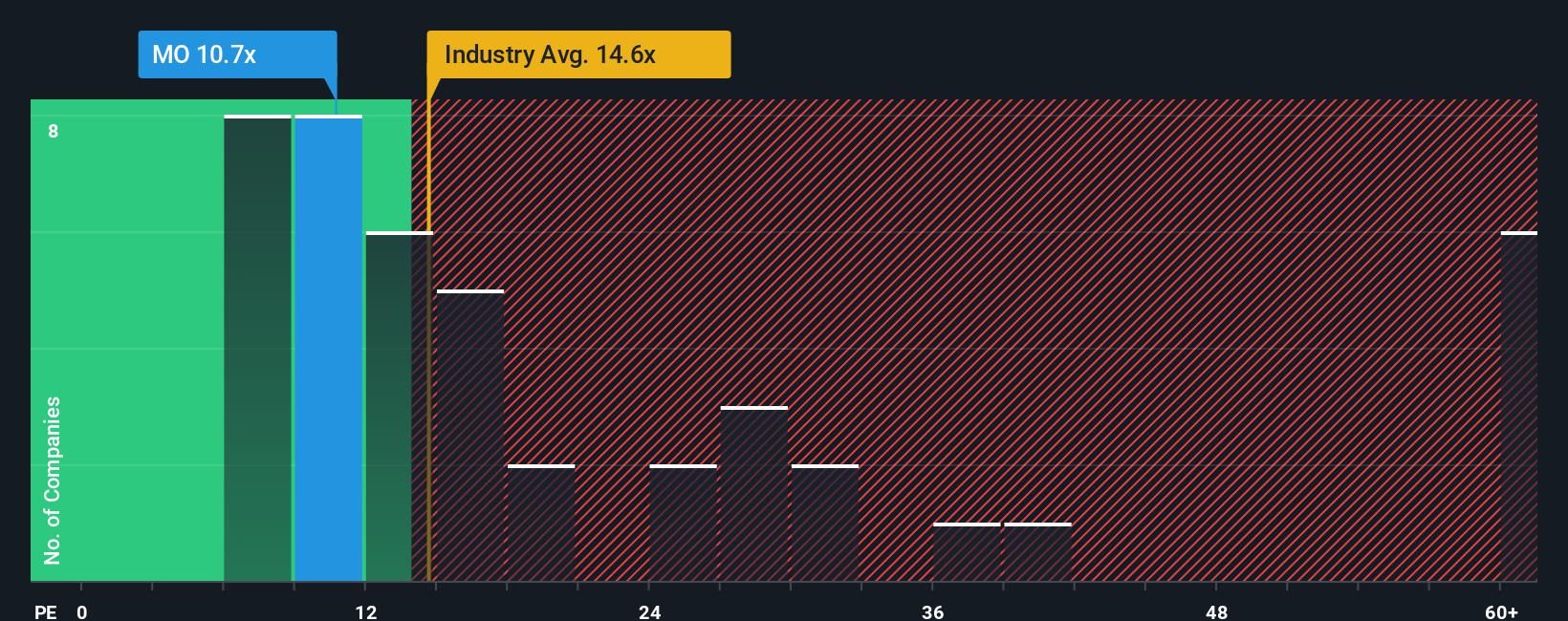

Currently, Altria Group trades at an 11.0x PE ratio, noticeably lower than both the tobacco industry average of 14.3x and the average of its listed peers at 20.8x. Simply Wall St’s “Fair Ratio,” which adjusts for factors such as earnings growth, risk levels, profit margins, industry dynamics, and the company’s market capitalization, stands at 18.5x for Altria. Unlike traditional benchmarks, the Fair Ratio is designed to provide a more accurate picture of what the company's valuation should be, given its unique fundamentals and outlook, rather than just matching market averages.

With Altria’s actual PE ratio of 11.0x well below the calculated Fair Ratio of 18.5x, the analysis points to the stock being significantly undervalued on this basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Altria Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal investment story for a company, combining your perspective on where Altria Group is heading with your own fair value, revenue, profit, and margin expectations. Narratives help you make smarter decisions by linking the company’s story to a set of financial forecasts and then turning these into an estimate of fair value.

On Simply Wall St, Narratives are available within the Community page, used by millions of investors to create, share, and refine their outlook. This makes it simple for anyone to translate their insights into actionable investment decisions. By comparing your Narrative’s Fair Value to the current share price, you can see whether you believe Altria is a buy, hold, or sell, all based on your own view of the business. Whenever new information emerges, such as company results or major news, Narratives automatically update so your forecast and value always reflect the latest context.

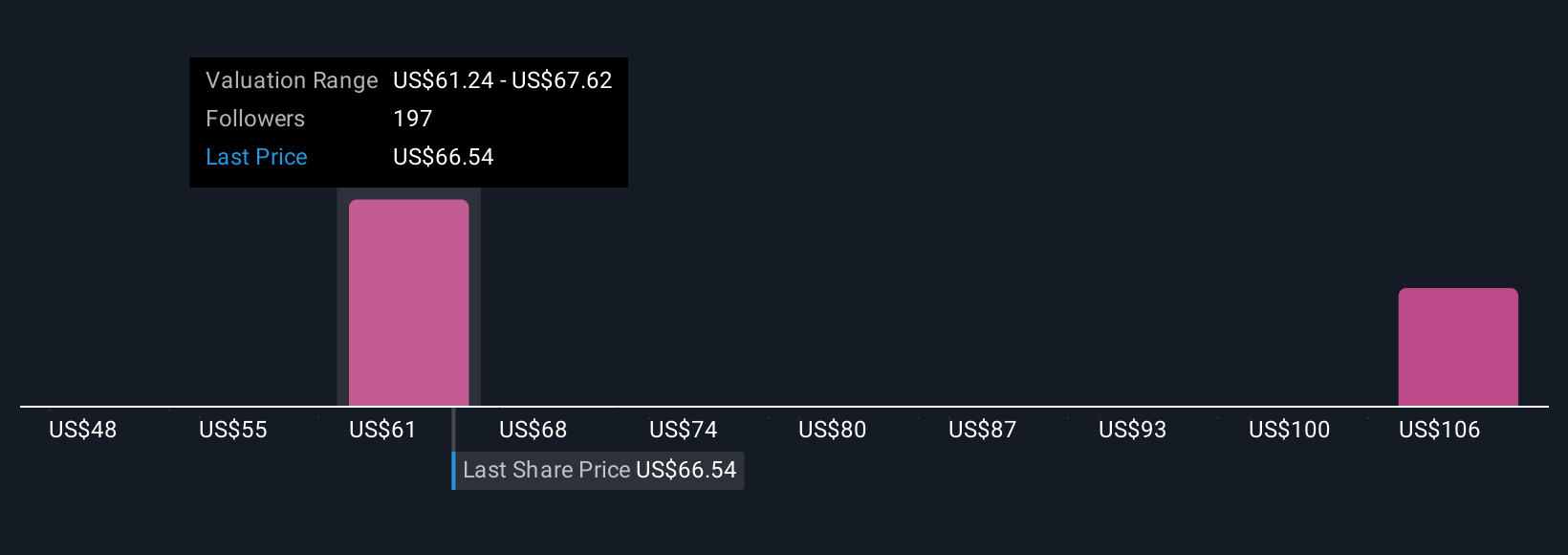

For example, some investors are optimistic and see Altria’s fair value as high as $73 if strong dividend growth and operational improvements continue, while others, wary of regulatory and market headwinds, peg its fair value closer to $49. This demonstrates how Narratives turn facts and forecasts into your personal investment thesis.

Do you think there's more to the story for Altria Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MO

Altria Group

Through its subsidiaries, manufactures and sells smokeable and oral tobacco products in the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives