- United States

- /

- Tobacco

- /

- NYSE:MO

Are We Seeing the Limits of Altria's (MO) Pricing Power Amid Ongoing Volume Declines?

Reviewed by Sasha Jovanovic

- Altria Group recently reported its fiscal 2025 Q3 results, with adjusted earnings per share slightly exceeding expectations but revenues falling 3% year over year due to weaker smokeable product sales.

- An ongoing shift away from traditional cigarettes and increased competition in the tobacco industry continue to weigh on the company's long-term growth prospects.

- We'll assess how ongoing volume declines in Altria's core business shape the outlook for its earnings and market position.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Altria Group Investment Narrative Recap

To own Altria Group stock today, you need to believe in the company’s ability to offset declining cigarette volumes with strong pricing, growth in reduced-risk products, and continued shareholder returns. The latest Q3 earnings results did little to shift this view: while adjusted EPS came in slightly higher than expected, persistent revenue declines from weaker smokeable sales kept the focus firmly on the biggest risk, the pace of core volume declines. For now, the main short-term catalyst remains the company’s capacity to sustain earnings, but this risk remains material for shareholders. Altria’s recent $1 billion expansion of its share repurchase program brings the total buyback authorization to $2 billion through 2026, directly responding to share price weakness and aiming to support shareholder value. This move underscores management’s commitment to capital returns, but it also highlights the importance of maintaining enough financial flexibility to address ongoing business pressures. Yet, while buybacks may offer near-term support, the longer-term headwinds tied to regulatory risk and market share losses in e-vapor are issues investors should be aware of...

Read the full narrative on Altria Group (it's free!)

Altria Group is projected to generate $20.3 billion in revenue and $9.1 billion in earnings by 2028. This outlook is based on an annual revenue decline rate of 0.1% and a decrease in earnings of $1.1 billion from the current $10.2 billion level.

Uncover how Altria Group's forecasts yield a $63.83 fair value, a 9% upside to its current price.

Exploring Other Perspectives

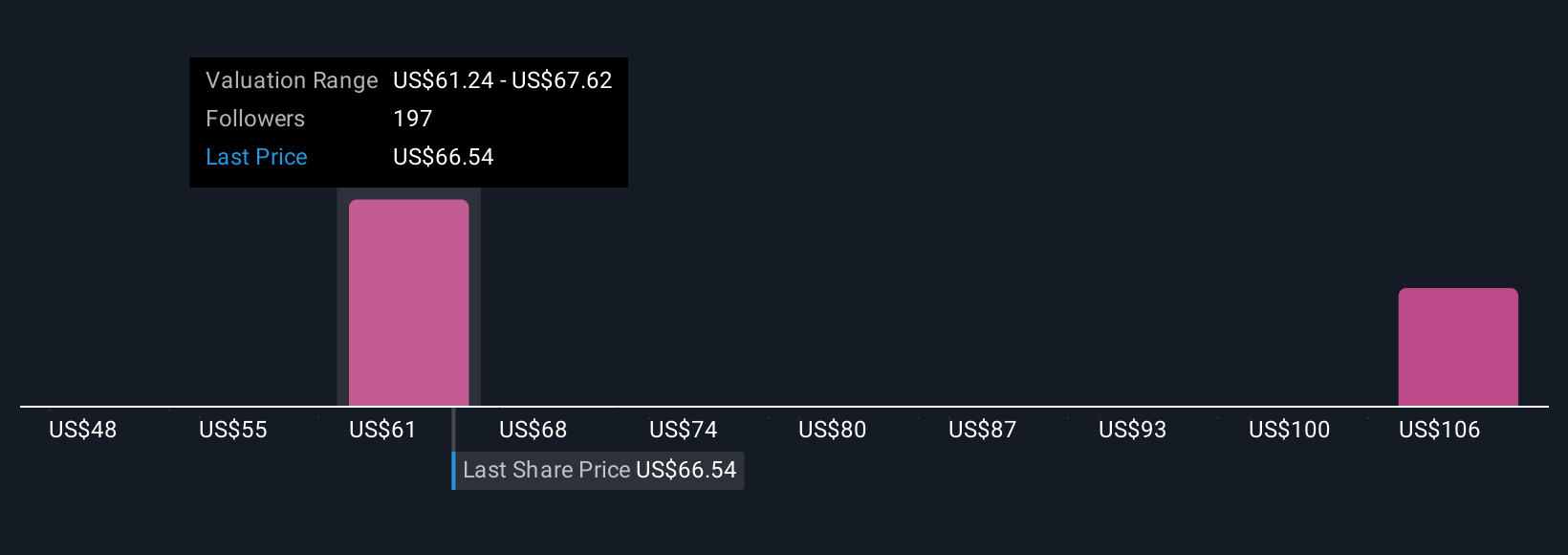

Nine members of the Simply Wall St Community see Altria’s fair value in a wide span from US$50 to US$103.41 per share. While many expect strong shareholder returns, ongoing declines in the core tobacco segment suggest you should weigh both risks and opportunities as you compare these diverse opinions.

Explore 9 other fair value estimates on Altria Group - why the stock might be worth as much as 77% more than the current price!

Build Your Own Altria Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Altria Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Altria Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Altria Group's overall financial health at a glance.

No Opportunity In Altria Group?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MO

Altria Group

Through its subsidiaries, manufactures and sells smokeable and oral tobacco products in the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success