- United States

- /

- Food

- /

- NYSE:MKC

Does McCormick’s 40th Year of Dividend Growth Reveal MKC’s Long-Term Priorities?

Reviewed by Sasha Jovanovic

- On November 18, 2025, McCormick & Company announced its Board of Directors approved an increase in the quarterly dividend from US$0.45 to US$0.48 per share, payable January 12, 2026, to shareholders of record on December 29, 2025.

- This action marks McCormick's 102nd straight year of dividend payments and the 40th consecutive year of dividend growth, positioning the company as one of the longest-running dividend increasers in its sector.

- We'll explore how McCormick's record-setting dividend growth streak impacts its long-term investment narrative and financial strength.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

McCormick Investment Narrative Recap

To be comfortable as a McCormick shareholder right now, you need to believe in the long-term resilience of its brand, global market reach, and ability to adapt to shifting consumer flavor trends, while accepting that ongoing input cost pressures could still weigh on margins in the near term. The latest dividend increase underscores McCormick's commitment to shareholder returns, but does not materially affect the most important short-term catalyst, which remains volume-led growth in its Consumer segment, or mitigate the biggest risk of persistent cost inflation.

Of the recent announcements, McCormick's major redesign of the Gourmet Collection packaging stands out. While not directly linked to the dividend news, this initiative aligns with efforts to attract new customers and counter challenges from private label competitors, which ties back to McCormick's need to sustain volume growth amid changing consumer preferences and industry pricing pressures.

But, in contrast, investors should also be aware that continued cost pressure on raw materials and supply chains could ...

Read the full narrative on McCormick (it's free!)

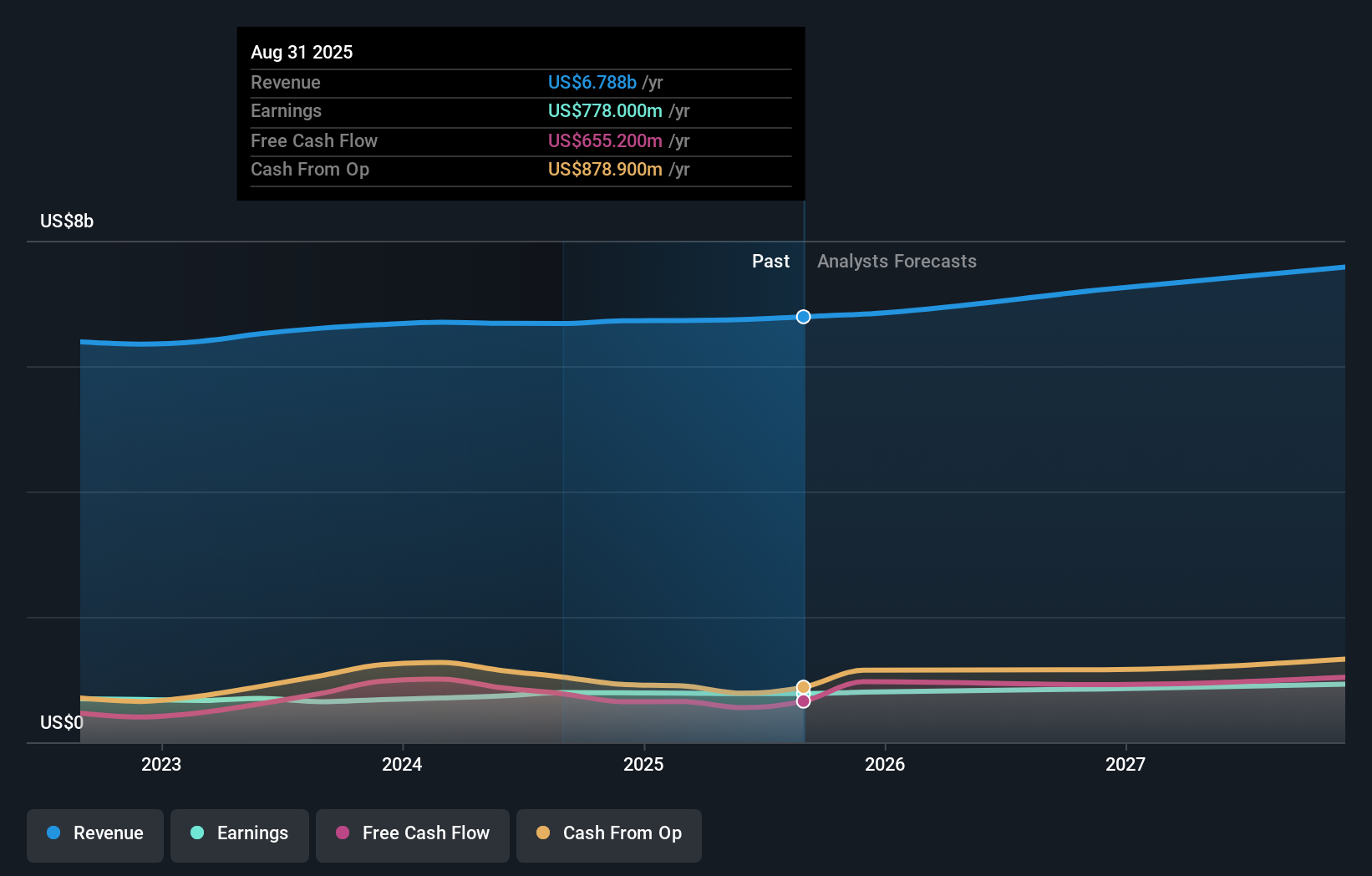

McCormick's outlook anticipates $7.7 billion in revenue and $1.0 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 4.7% and a $224 million increase in earnings from the current $775.6 million.

Uncover how McCormick's forecasts yield a $76.92 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community published US$74.09 to US$121.97 as their fair value estimates before the new dividend news. Yet with inflation-linked cost headwinds top of mind, you may want to consider why opinions among market participants can differ so widely.

Explore 4 other fair value estimates on McCormick - why the stock might be worth just $74.09!

Build Your Own McCormick Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your McCormick research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free McCormick research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate McCormick's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MKC

McCormick

Manufactures, markets, and distributes spices, seasoning mixes, condiments, and other flavorful products to the food industry.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives