- United States

- /

- Food

- /

- NYSE:MKC

A Look at McCormick’s (MKC) Valuation Following Its 40th Consecutive Dividend Increase

Reviewed by Simply Wall St

McCormick (MKC) is raising its quarterly dividend from $0.45 to $0.48 per share. This continues an impressive 40-year streak of dividend increases and highlights the company’s enduring focus on shareholder value and financial resilience.

See our latest analysis for McCormick.

Over the past year, McCormick’s share price has come under pressure even as the company launched inventive product collaborations such as the Frank’s RedHot Spicy Gummy Bears and expanded its holiday line with Milk Bar. Despite these bold moves, the latest share price of $68.16 represents a year-to-date share price return of -10.17%, and over the last year the total shareholder return stands at -9.95%. While the short-term momentum has perked up recently with a 4.33% gain over the past week, long-term investors have seen a steady decline in total returns. Momentum is still building off a low base but remains subdued overall.

If you’re looking to broaden your perspective beyond dividend growers, now’s the perfect moment to discover fast growing stocks with high insider ownership

With shares trading at a discount to analyst price targets and recent momentum still lagging, the big question now is whether McCormick’s earnings power and growth prospects remain undervalued, or if the market already reflects the road ahead.

Most Popular Narrative: 11.4% Undervalued

At $68.16, McCormick trades noticeably below the latest narrative fair value, revealing a gap that hinges on strong future earnings power and operational resilience.

Growth driven by health-focused innovation, premiumization, and expanded global distribution supports revenue gains, market share increases, and pricing power across key markets. Supply chain digitalization, cost-reduction initiatives, and strategic adaptation to regulatory shifts are expected to bolster margins and reinforce category leadership.

Want the full story on how fresh revenue growth and bold margin targets could transform the company’s financial future? One critical assumption underpins the entire valuation. Find out what it is by reading the full narrative.

Result: Fair Value of $76.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued cost pressures and unpredictable demand from key customer segments could quickly alter the outlook for McCormick’s earnings momentum.

Find out about the key risks to this McCormick narrative.

Another View: Looking at Price-to-Earnings

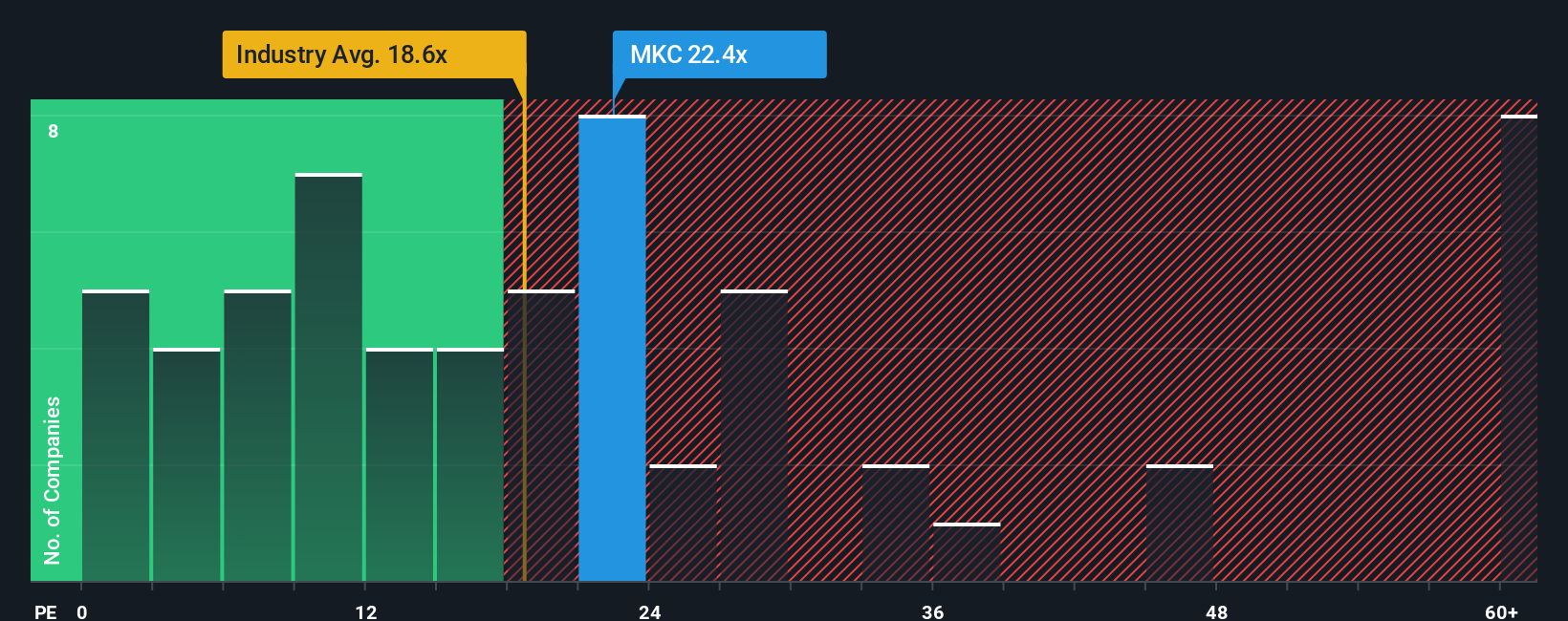

While some see McCormick as undervalued based on projected earnings, its current price-to-earnings ratio of 23.5x is notably higher than both the US Food industry average of 19.4x and its peer average of 18.2x. Compared to its fair ratio of 17.4x, the stock looks expensive. This valuation gap may suggest less room for upside unless estimates improve. Does the market know something the models do not, or is caution still warranted here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own McCormick Narrative

If you see the story differently or want to dive into the financials and forecasts yourself, you can craft your own take on McCormick in just minutes. Do it your way

A great starting point for your McCormick research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Open new pathways to financial growth by handpicking companies that align with your goals. Don’t miss strategies and stocks winning in today’s fast-changing market.

- Unlock growth stories early by tapping into these 3604 penny stocks with strong financials before they hit the mainstream. Watch emerging leaders gain momentum.

- Capture high potential in tomorrow’s technology landscape by checking out these 25 AI penny stocks at the forefront of artificial intelligence and automation.

- Secure attractive bargains and maximize upside with these 917 undervalued stocks based on cash flows with strong fundamentals, ready to reward patient investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MKC

McCormick

Manufactures, markets, and distributes spices, seasoning mixes, condiments, and other flavorful products to the food industry.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives