- United States

- /

- Food

- /

- NYSE:MKC

A Fresh Look at McCormick (MKC) Valuation Following Recent Share Price Shifts

Reviewed by Simply Wall St

See our latest analysis for McCormick.

Zooming out, McCormick’s share price has dipped around 12% year-to-date and its 1-year total shareholder return sits at -12.7%. This reflects some momentum loss following a string of resilient years. Recent news and continued pressure indicate that investors are still weighing McCormick’s growth prospects with caution.

If you’re watching shifts in established consumer names like McCormick, this could be the perfect moment to uncover opportunities through fast growing stocks with high insider ownership

With McCormick now trading at a notable discount to analyst price targets, investors are left to consider whether market pessimism has created a hidden value or if expectations for future growth are already fully reflected in the price.

Most Popular Narrative: 13.7% Undervalued

At $66.40, McCormick's shares are tracking well below the narrative's fair value of $76.92. This points to more upside than downside in the current market mood. This discount sets up a narrative built on resilient growth strategies and future margin recovery drivers.

Ongoing global expansion and success in winning new customers in high-growth, health-oriented categories, particularly in Asia-Pacific and through partnerships with innovative beverage and snack brands, are broadening McCormick's addressable market while diversifying revenue streams. This contributes to both top-line growth and future earnings stability.

Curious why this valuation is so ambitious? A handful of growth projections and optimistic profit margin moves could be tipping the scales. Wonder which future scenario underpins the narrative's bullish outlook? There is more beneath the surface. Unpack the key assumptions behind the number.

Result: Fair Value of $76.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent increases in commodity costs and uncertainty over future pricing power could quickly challenge the current bullish momentum for McCormick.

Find out about the key risks to this McCormick narrative.

Another View: Market Ratios Raise Caution

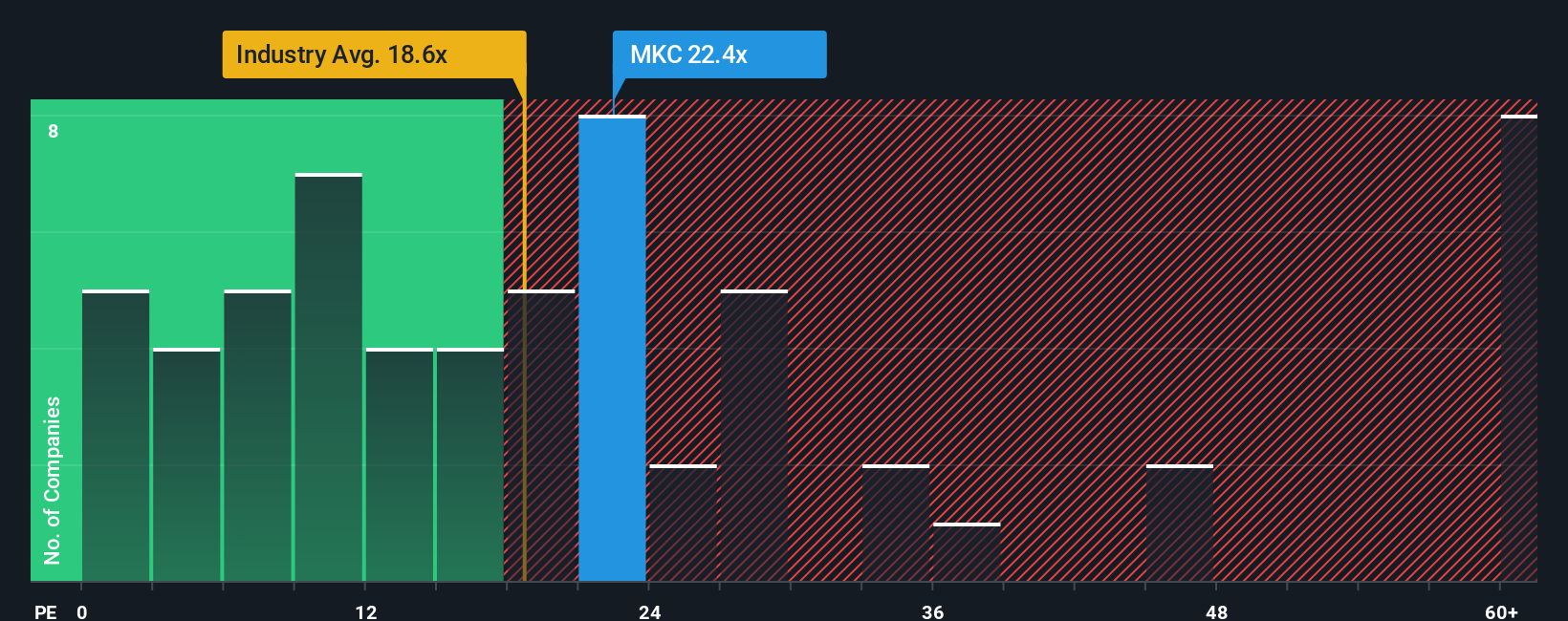

Looking at the numbers through market valuation ratios, McCormick trades at a price-to-earnings ratio of 22.9 times, which is higher than both its peer average (19.3x) and the US Food industry (20.6x). The fair ratio points lower, at just 18.1x. This gap signals that the current market price incorporates a lot of optimism, introducing more valuation risk if expectations shift suddenly. Is the premium justified, or could sentiment swing quickly?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own McCormick Narrative

If the current analysis does not align with your view, or you want to dig deeper into the data yourself, you can craft your own take in just a few minutes. Do it your way

A great starting point for your McCormick research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don't limit your gains to one stock when the market is filled with fresh possibilities. Maximize your portfolio by tapping into standout ideas waiting to be found:

- Discover steady potential for passive income as you browse these 14 dividend stocks with yields > 3% with yields surpassing 3% and strong fundamentals designed for long-term investors.

- Explore tomorrow’s breakthroughs by checking out these 25 AI penny stocks at the forefront of artificial intelligence, automation, and next-generation data solutions.

- Find compelling valuations and potential upside by selecting these 928 undervalued stocks based on cash flows that analysts believe are trading at attractive discounts based on their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MKC

McCormick

Manufactures, markets, and distributes spices, seasoning mixes, condiments, and other flavorful products to the food industry.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026