- United States

- /

- Beverage

- /

- NYSE:KO

Is Coca-Cola’s Valuation Justified After 15% Rally and New Health Beverage Launches?

Reviewed by Bailey Pemberton

- Wondering if Coca-Cola’s stock is still a refreshing value or if the fizz has gone flat? Let’s dive into what the numbers are saying right now.

- The stock has been bubbling up, gaining 3.8% over the past week and rising 14.7% over the last year. This could signal a sense of renewed optimism or shifts in investor sentiment.

- Recent headlines have spotlighted Coca-Cola’s continued expansion into healthier beverage categories and strategic partnerships, which has fueled speculation around its ability to adapt and grow. Ongoing buzz about sustainability commitments and a flurry of product launches have also kept the spotlight on the brand and may have influenced recent price changes.

- When it comes to value, Coca-Cola scores a 3 out of 6 on our valuation checks, showing a mixed but intriguing story. In the next section, we will unpack how classic and alternative valuation approaches stack up for Coca-Cola, and later reveal a method that goes beyond the usual numbers.

Approach 1: Coca-Cola Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This helps investors gauge whether a stock is trading at a fair price compared to its fundamental worth.

Coca-Cola’s most recent Free Cash Flow stands at approximately $5.60 Billion. Analyst projections look five years ahead. For Coca-Cola, Simply Wall St extrapolates further from those estimates to cover ten years. According to these forecasts, annual Free Cash Flow is expected to rise to $19.40 Billion by 2035. Both the initial analyst estimates and the longer-range projections show steady growth, which supports a robust cash generation outlook for the soft drink giant.

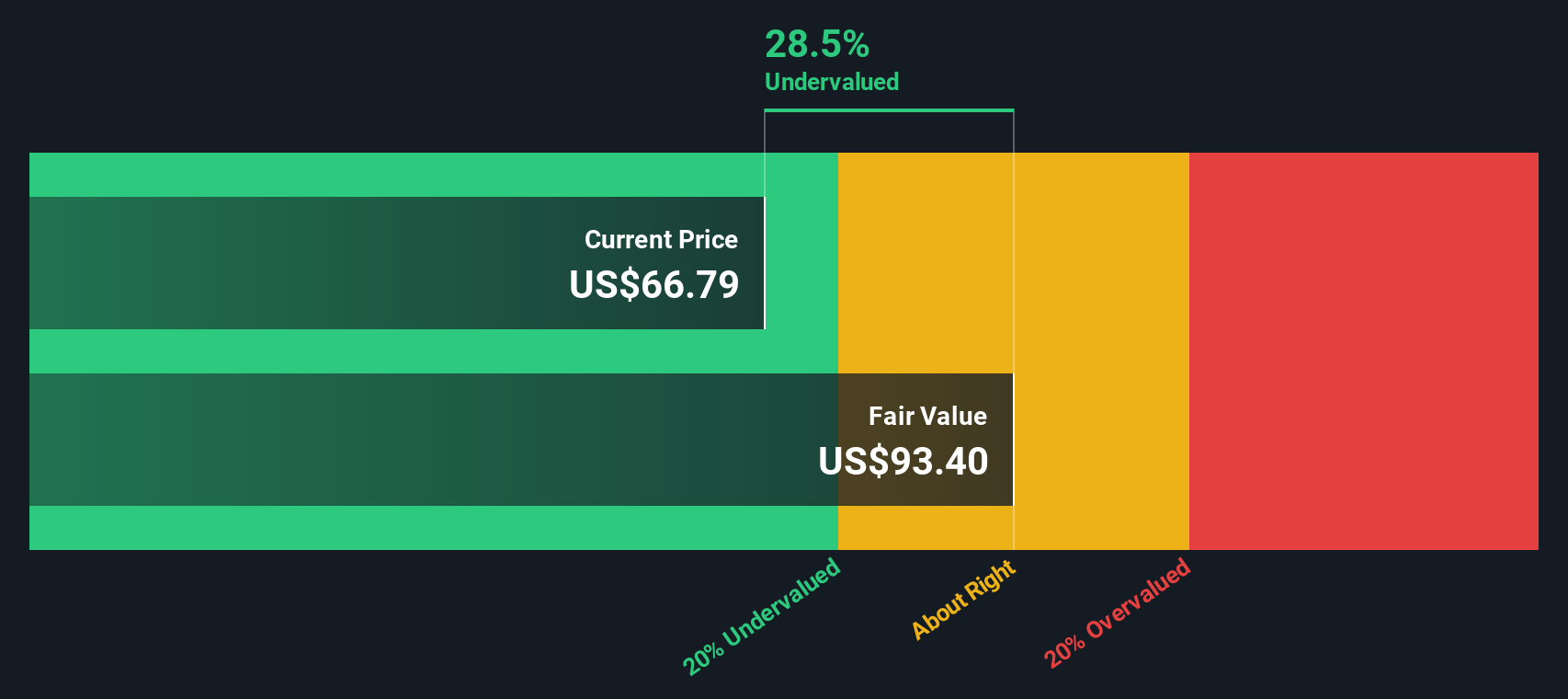

Based on the DCF model, the calculated fair value for Coca-Cola is $89.90 per share. This is roughly 21.5% higher than the current share price, implying that the stock is undervalued by a significant margin according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Coca-Cola is undervalued by 21.5%. Track this in your watchlist or portfolio, or discover 878 more undervalued stocks based on cash flows.

Approach 2: Coca-Cola Price vs Earnings

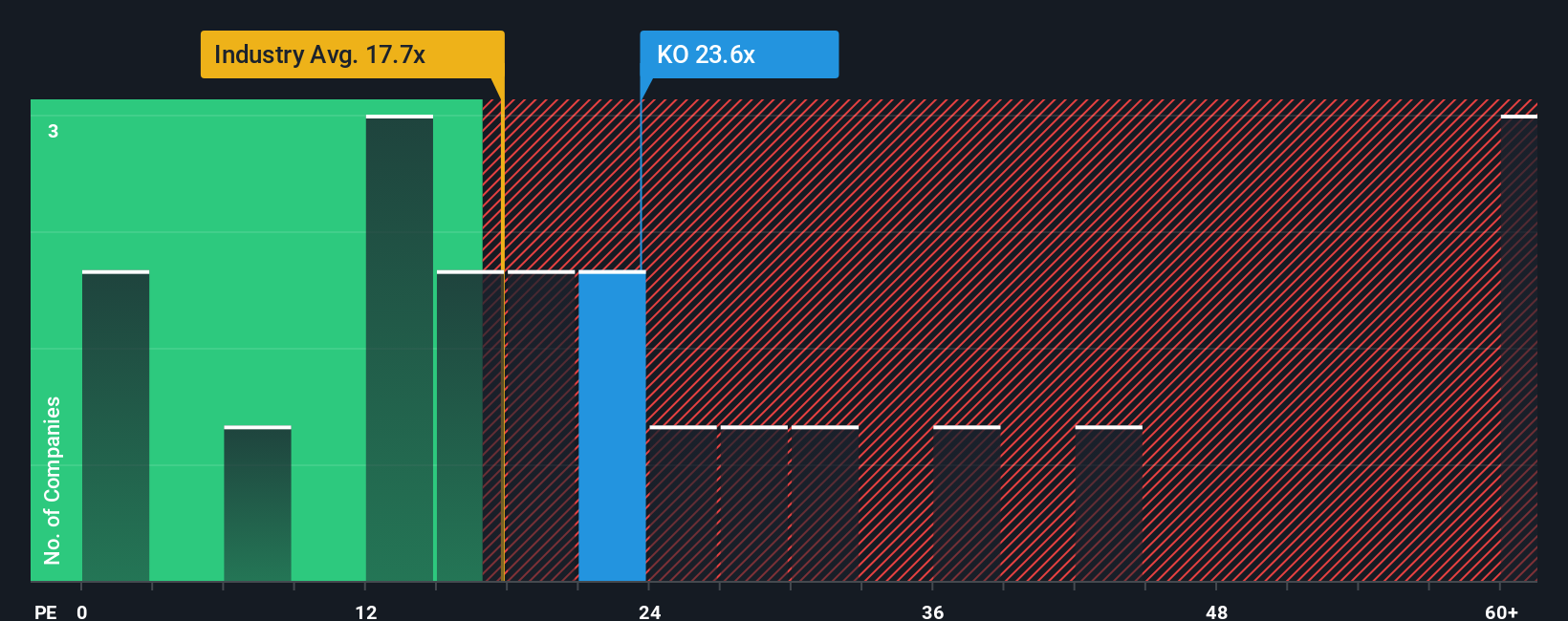

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Coca-Cola. It gives investors a quick sense of how much they are paying for each dollar of earnings, making it easy to compare companies across the same sector. For businesses with steady profits, the PE ratio is a robust standard for valuation.

What counts as a "normal" or "fair" PE ratio depends on market expectations for growth and risk. Companies with faster projected earnings growth or lower perceived risk generally trade at higher multiples. Slower-growing or riskier firms command lower valuations.

Coca-Cola is currently trading at a PE ratio of 23x. This is above the broader Beverage industry average of 17x but slightly below the peer average of 26x. To provide a more tailored benchmark, Simply Wall St calculates a proprietary “Fair Ratio” for Coca-Cola, which accounts for factors such as its profit margins, growth outlook, size, industry, and market risks. Coca-Cola’s Fair Ratio is 22.7x, indicating what a neutral valuation should look like for this specific company.

Unlike simple peer or industry comparisons, the Fair Ratio delivers a nuanced view by combining company-specific fundamentals and broader market conditions. This makes it especially useful when judging companies with unique strengths or risks that are not reflected in generic benchmarks.

Comparing the Fair Ratio of 22.7x to Coca-Cola’s actual PE of 23x, the difference is minimal. This suggests the stock is trading almost precisely where you would expect, given its current outlook and attributes.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coca-Cola Narrative

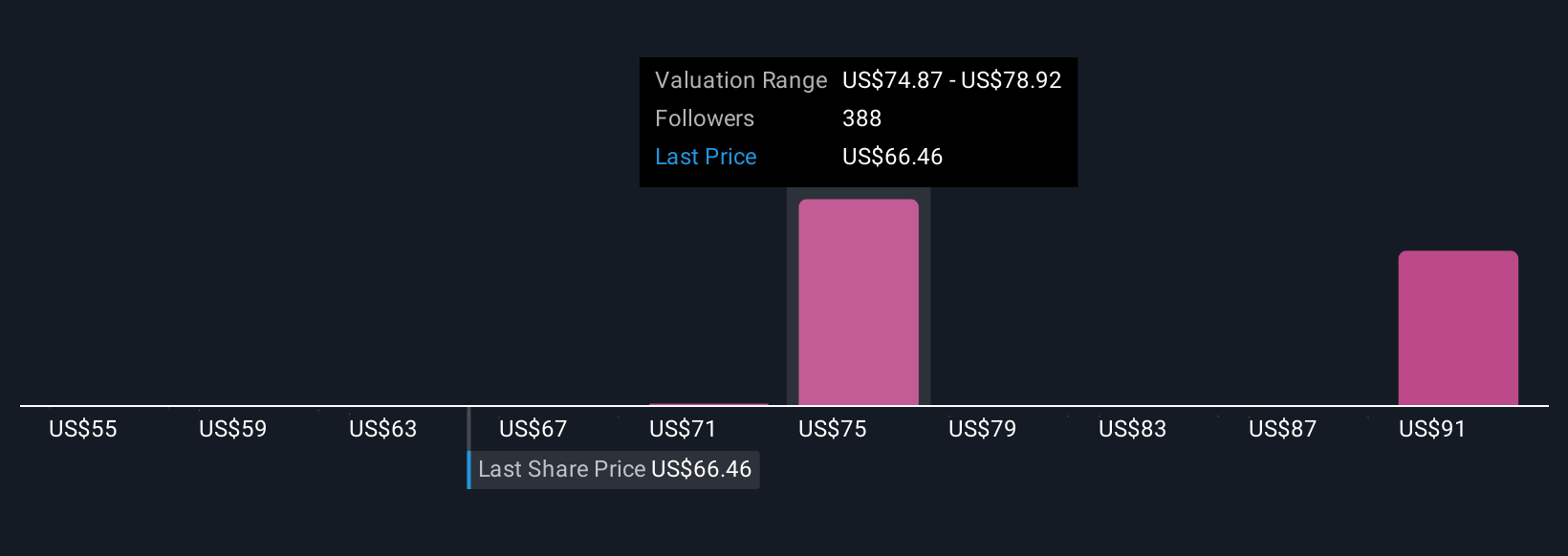

Earlier we mentioned there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is your personalized story or perspective about a company's future, combining your assumptions about Coca-Cola’s fair value, future growth, and margins with the story you believe fits best. Narratives link a company's business outlook to tangible financial forecasts and ultimately to what you think the stock is actually worth.

Narratives are user-friendly and accessible investment tools available on Simply Wall St’s Community page, used by millions of investors to clarify their thinking and make more confident decisions. When you write a Narrative, you can compare your estimated fair value to the current price and decide whether Coca-Cola is a buy or sell based on your beliefs, not just someone else’s spreadsheet. These Narratives stay relevant by dynamically updating whenever major news or earnings are released, meaning your numbers and thesis always reflect the latest information.

For example, looking at recent Coca-Cola Narratives, the most optimistic investor sees a fair value as high as $85 per share due to resilient organic sales growth and margin expansion, while the most cautious believes it is only worth $67.50 because of headwinds like regulatory risks and cost pressures.

For Coca-Cola, we'll make it really easy for you with previews of two leading Coca-Cola Narratives:

- 🐂 Coca-Cola Bull Case

Fair Value: $71.00

Undervalued by approximately 0.6%

Forecast Revenue Growth: 6.64%

- Coca-Cola is a globally dominant brand with a resilient, recession-tested business model and six decades of dividend increases. This has particular appeal to long-term, income-focused investors.

- The company is adapting to health-conscious trends, expanding in emerging markets, and investing in digital transformation. These new growth areas bring unique risks and require careful execution.

- Risks to the outlook include currency volatility, rising input costs (such as tariffs on aluminum), regulatory challenges, and increasing scrutiny over sustainability and environmental impact.

- 🐻 Coca-Cola Bear Case

Fair Value: $67.50

Currently trading about 4.5% above this fair value

Forecast Revenue Growth: 5.23%

- Even small changes in discount rates significantly affect Coca-Cola’s valuation. The stock’s “bond proxy” appeal becomes stronger as interest rates fall, supporting its premium pricing.

- Steady free cash flows, high margins, and dividend consistency justify a valuation premium. However, expected long-term revenue growth is slowing and future P/E ratios are projected to decline.

- This narrative expects Coca-Cola to remain a global leader in beverages, but with moderation in growth, rising regulatory and consumer headwinds, and an eventual transition toward being valued primarily for income rather than growth.

Do you think there's more to the story for Coca-Cola? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KO

Coca-Cola

A beverage company, manufactures and sells various nonalcoholic beverages in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives