- United States

- /

- Food

- /

- NYSE:K

Kellanova (K) Profit Margin Jumps to 10.6%, Marked Shift Challenges Slow-Growth Narrative

Reviewed by Simply Wall St

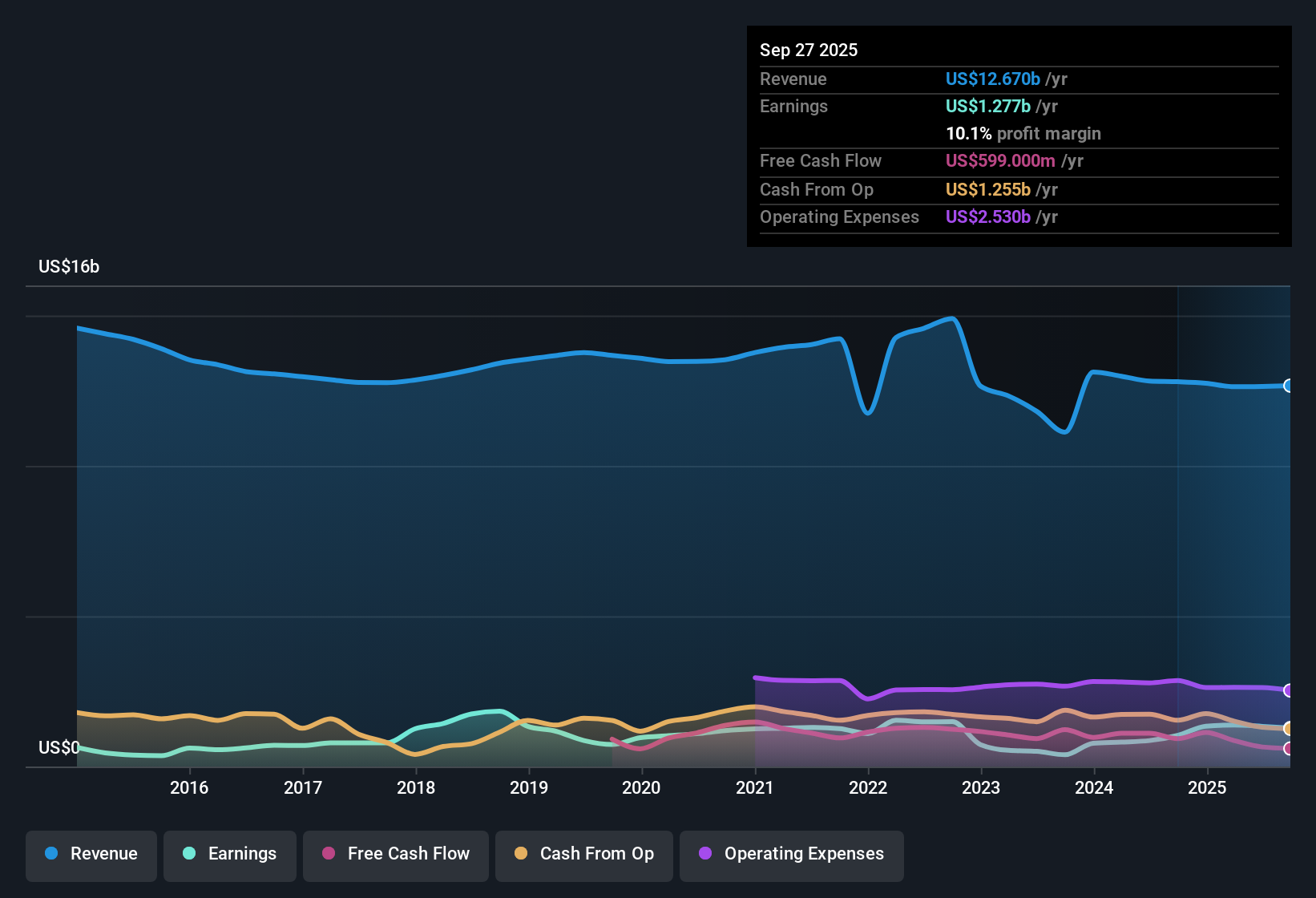

Kellanova (K) reported a dramatic turnaround in profitability, posting a net profit margin of 10.6% compared to 6.7% a year ago. Over the last year, EPS climbed an impressive 54.8%, a marked departure from the company’s five-year average annual decline of 5.1%. With three rewards highlighted: strong value indicators, persistent growth in profits and revenues, and a proven track record in both, investors see an earnings story that stands out, even as forward growth expectations remain moderate.

See our full analysis for Kellanova.The next section puts these headline numbers in context by weighing them against the widely followed market narratives and highlighting where consensus gets confirmed and where it might get a shake-up.

See what the community is saying about Kellanova

Innovation-Fueled Sales Outlook Meets Slower Industry Pace

- Analysts forecast Kellanova’s revenue to grow at 2.4% per year for the next three years, significantly lagging the broader US market expectation of 10.3% annualized growth.

- According to the analysts' consensus view, efforts such as the Pringles Mingles launch in North America and Cheez-It expansion into Europe are aimed at boosting sales volume. Revenue growth, however, is expected to rely heavily on price increases and international market expansion.

- Volume improvement and organic net sales growth are projected to come from increased innovation and strategic pricing. This combination faces headwinds from retailer pushback and macroeconomic risks.

- The consensus narrative highlights that despite a busy calendar of new products, Kellanova’s projected growth remains at about a quarter of the industry pace, making it important for these launches to deliver meaningful results.

Margin Expansion Drives EPS Recovery

- Profit margins are expected to increase modestly from 10.6% today to 11.0% over the next three years, providing a foundation for steady earnings gains even as top-line growth slows.

- The consensus narrative notes that Kellanova’s improved margins are supported by productivity gains and price mix management, which are helping deliver operating leverage in the face of currency devaluation and higher input costs.

- Strategic pricing actions, especially to offset rising costs in regions like Nigeria, are expected to sustain margin expansion but could come under pressure if volume declines accelerate or if retailer resistance intensifies.

- Kellanova’s pursuit of higher margins has been effective so far, but analysts are monitoring for signs that these gains could be eroded if innovation does not drive sufficient incremental sales.

Valuation Tension: Premium to Peers, Discount to DCF

- Kellanova’s current price-to-earnings ratio stands at 21.6x, above the US Food industry average of 17.3x and peer average of 19.2x. However, its $83.13 share price is about 6% below the estimated DCF fair value of $88.42.

- Analysts' consensus view emphasizes that the stock’s modest 4.7% upside to the $83.39 price target leaves little margin for error given rising peer valuations and slower expected profit growth.

- Investors weighing the merits of Kellanova must balance the company’s improving profit outlook and high-quality earnings against industry discounts and questions about future valuation upside.

- The minimal gap between Kellanova’s share price, the DCF fair value, and analyst target price suggests the market is already pricing in much of the anticipated earnings recovery, leaving limited room for positive surprises.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Kellanova on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Put your unique perspective into a personal narrative in just a few minutes with Do it your way.

A great starting point for your Kellanova research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Kellanova’s slower revenue growth and limited share price upside highlight concerns about whether its innovation and margin gains can offset an industry lag.

If you want to focus on businesses delivering reliable sales and earnings expansion, use our stable growth stocks screener (2113 results) to find companies with a proven track record of stability and consistency.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kellanova might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:K

Kellanova

Manufactures and markets snacks and convenience foods in North America, Europe, Latin America, the Asia Pacific, the Middle East, Australia, and Africa.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives