- United States

- /

- Food

- /

- NYSE:K

Kellanova (K): Exploring Valuation After Steady Share Performance and Recent Growth Trends

Reviewed by Simply Wall St

See our latest analysis for Kellanova.

After holding fairly stable through recent weeks, Kellanova’s stock is showing subtle momentum with a 4.3% three-month share price return and a 6.2% total shareholder return over the past year. This steady climb suggests that investors are beginning to reward consistent fundamentals and improved growth prospects.

If you’re interested in capturing emerging momentum and identifying new leaders, now is a great opportunity to discover fast growing stocks with high insider ownership.

But with shares trading just below analyst price targets despite solid growth figures, the question remains: Is Kellanova undervalued based on fundamentals, or is the market already factoring in all its upside?

Most Popular Narrative: Fairly Valued

Compared to the last close at $83.42, the narrative’s fair value estimate is almost identical, reflecting tight alignment between analysts and current market pricing.

Kellanova's return to full commercial activity and stepped-up innovation across regions are expected to drive improvements in volume growth and net sales. This includes launching Pringles Mingles in North America and Cheez-It in Europe, contributing to revenue growth.

Wondering what it takes to justify this closely matched valuation? The narrative hinges on new product launches, disciplined margin targets, and a future profit multiplier that rivals industry benchmarks. What-if scenarios on future growth and earnings power decide everything; find out which hard-hitting forecasts tip the scales.

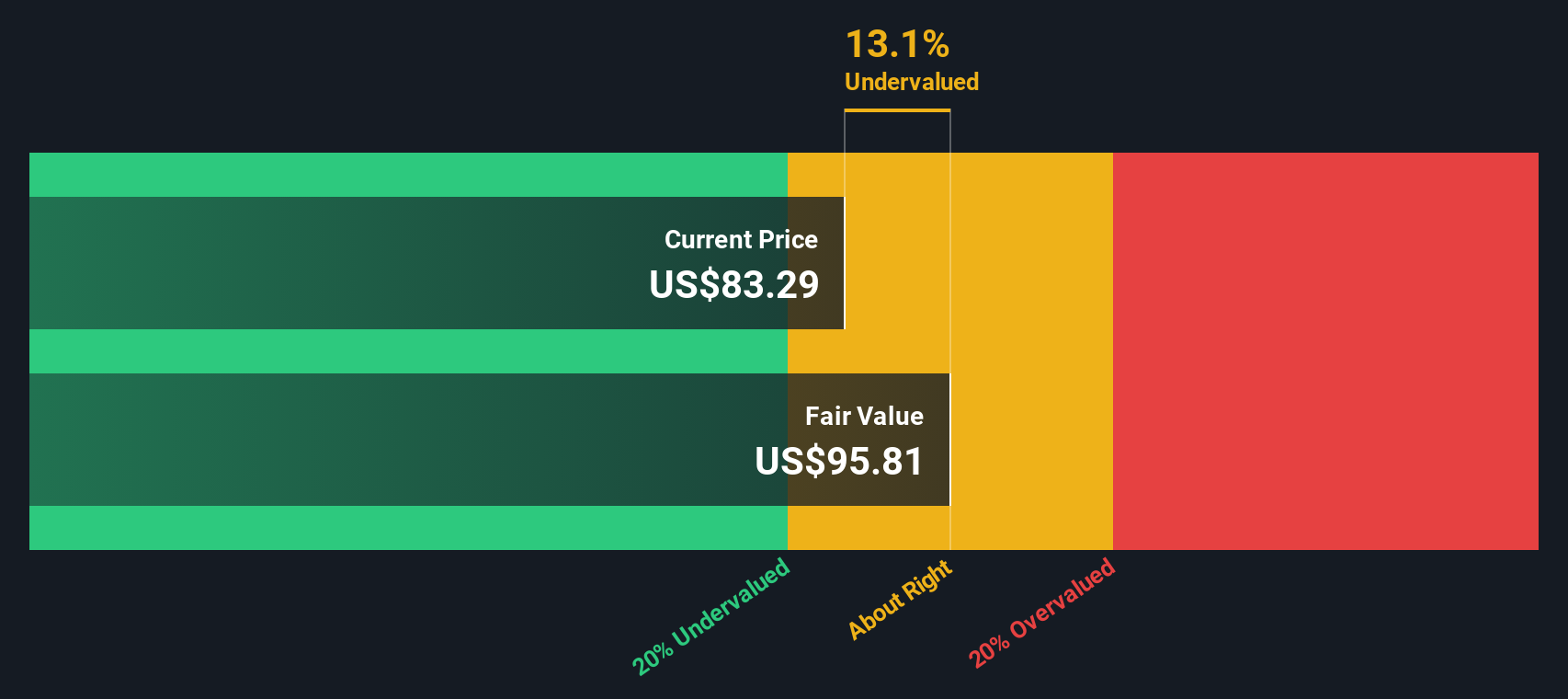

Result: Fair Value of $83.39 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if new product launches disappoint or consumer spending weakens in Europe, Kellanova's expected growth could fall short of analyst projections.

Find out about the key risks to this Kellanova narrative.

Another View: SWS DCF Model Highlights Opportunity

While analysts see Kellanova as fairly valued based on market consensus and future multiples, our SWS DCF model suggests a different story. According to this method, shares are trading about 12.9% below their calculated fair value. This points to potential undervaluation if assumptions about future cash flows hold up. Is the market missing something, or is the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kellanova for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kellanova Narrative

If you would rather dig into the numbers yourself or take a different approach, you can build and shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Kellanova research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next opportunity slip away. Expand your portfolio horizons with curated stock ideas you might wish you’d found sooner.

- Amplify your returns by tapping into these 897 undervalued stocks based on cash flows, featuring resilient companies trading below their fair value and poised for a turnaround.

- Capture future healthcare breakthroughs by checking out these 30 healthcare AI stocks, showcasing innovators transforming medicine with artificial intelligence.

- Strengthen your income stream when you review these 15 dividend stocks with yields > 3%, handpicked for robust dividend yields surpassing 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kellanova might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:K

Kellanova

Manufactures and markets snacks and convenience foods in North America, Europe, Latin America, the Asia Pacific, the Middle East, Australia, and Africa.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives