- United States

- /

- Food

- /

- NYSE:JBS

Can JBS (JBS) Leverage Its Paraguay Expansion to Strengthen Global Poultry Market Position?

Reviewed by Sasha Jovanovic

- JBS announced it will invest US$70 million over the next two years to expand and modernize its recently acquired Campo 9 chicken processing plant in Paraguay.

- This move marks a significant expansion of the company’s protein diversification strategy and could boost Paraguay’s role in global poultry exports.

- We’ll explore how JBS’s major push into Paraguayan chicken production can influence its investment case and international market access.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is JBS' Investment Narrative?

For anyone considering JBS as a potential holding, the investment thesis has typically centered on its global protein platform, consistent shareholder returns through dividends and buybacks, and the board’s strong governance track record. The recent announcement to invest US$70 million in expanding the Campo 9 chicken plant in Paraguay speaks directly to JBS’s ongoing push for protein diversification and an increased role in international poultry markets. While this move broadens JBS’s export potential and helps balance exposure across geographies, it also comes as the company faces slowing forecasted earnings growth and relatively muted revenue outlook compared to broader markets. Short term, the Paraguay expansion doesn’t dramatically shift the immediate risks, which are still led by tight global meat margins, debt pressure, and foreign exchange swings. However, should the investment successfully ramp up export capacity and profitability, it could become a more meaningful catalyst for future growth and improved confidence. On the flip side, quick execution and regulatory risk around international meat trade remain critical to watch for prospective investors.

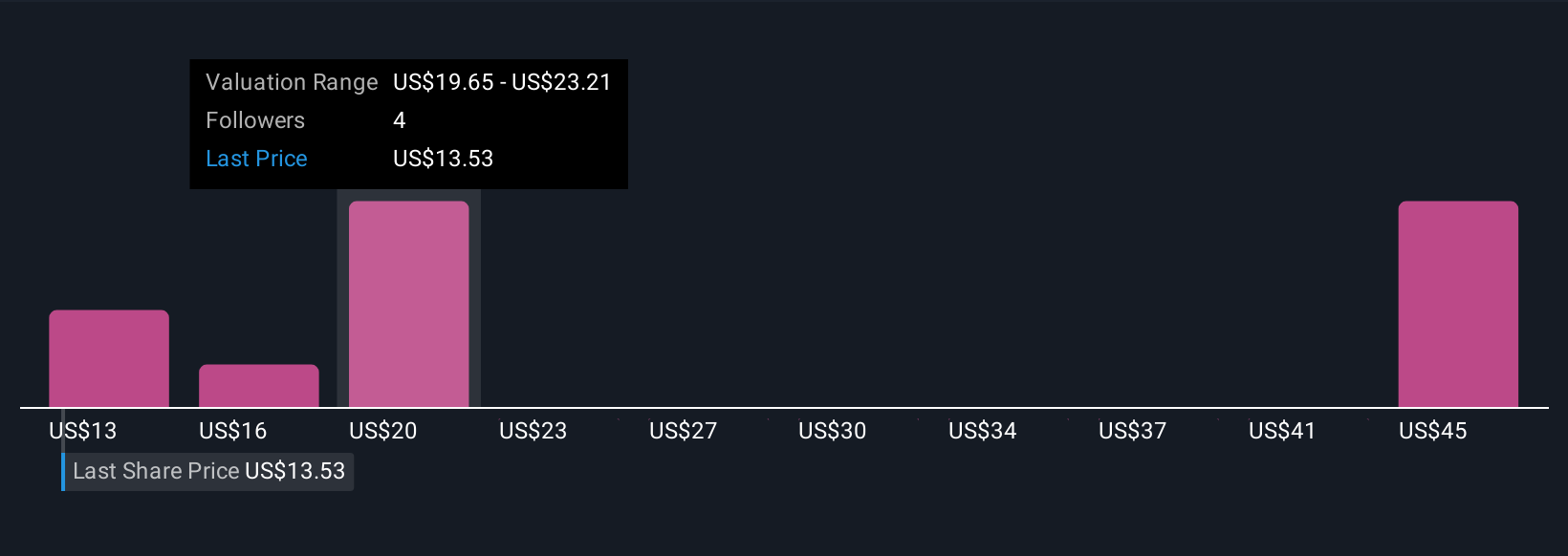

But with tight global margins and execution risks, investors should never overlook potential downside surprises. Despite retreating, JBS' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 6 other fair value estimates on JBS - why the stock might be worth over 3x more than the current price!

Build Your Own JBS Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JBS research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free JBS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JBS' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBS

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives