- United States

- /

- Food

- /

- NYSE:INGR

Ingredion (INGR) Valuation in Focus After Earnings Beat and Ongoing Production Challenges

Reviewed by Simply Wall St

Ingredion (NYSE:INGR) just posted quarterly earnings that beat expectations, even though revenue was slightly below estimates. The company has been managing some production setbacks at its Argo facility and experiencing softer demand in select markets.

See our latest analysis for Ingredion.

Ingredion's latest earnings beat was not enough to shift investor sentiment. The stock declined by 10.8% over the past month and is down more than 20% year-to-date in terms of share price return. While the company has rolled out an expanded buyback plan and its core healthful ingredients business is holding up well, operational disruptions and muted demand have weighed on performance. Long-term holders, however, have still seen strong total shareholder returns of nearly 27% over three years and close to 70% over five years. This underscores the company’s track record even amid current headwinds.

If you’re interested in broadening your search for opportunity beyond Ingredion, see what else stands out among fast growing stocks with high insider ownership.

With shares trading at a discount to analyst targets and long-term gains still evident, the key question for investors is whether Ingredion is now undervalued or if the market has already factored in its future growth potential.

Most Popular Narrative: 23.5% Undervalued

Ingredion’s most widely followed narrative places its fair value well above the last close, painting a much brighter picture than recent stock performance suggests. What’s driving this optimistic outlook? The narrative centers on specialty portfolio gains and operational efficiency, setting the scene for a potential rerating.

Enhanced operational efficiencies, supply chain digitalization, and cost optimization initiatives have resulted in a structural step change in segment margins (notably in Texture & Healthful Solutions). Management expects these higher levels of profitability and operating leverage to persist, improving overall net margins and earnings.

Curious what’s powering this bullish stance? The real story lies in a blend of specialty segment momentum, margin upgrades, and aggressive long-term profit assumptions. You’ll want a front-row seat to discover which projections made the valuation leap so far ahead of share price.

Result: Fair Value of $141.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent currency volatility in key Latin American markets and ongoing pricing headwinds could quickly challenge this optimistic valuation narrative if conditions become more difficult.

Find out about the key risks to this Ingredion narrative.

Another View: Our SWS DCF Model

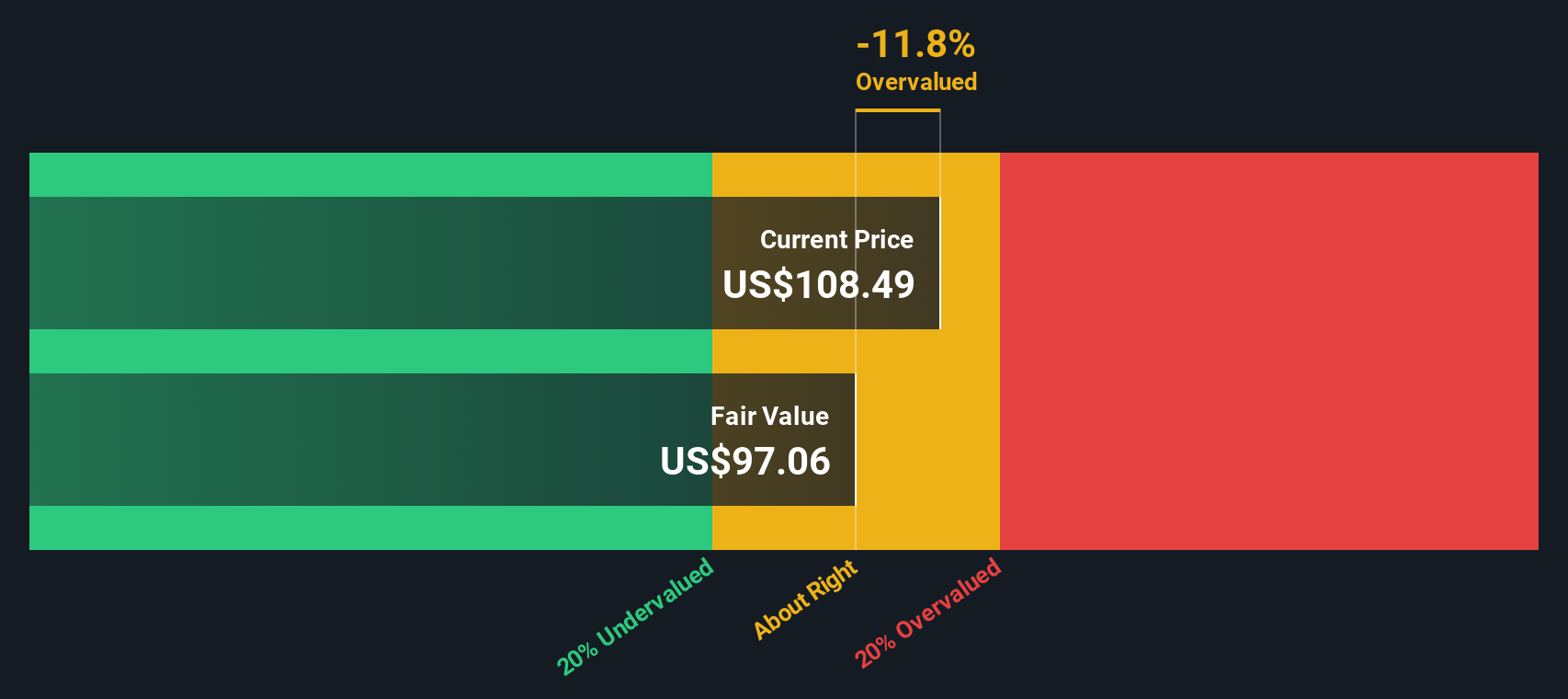

Looking at Ingredion through the lens of our SWS DCF model brings a different perspective. While earlier analysis suggests undervaluation based on multiples, the DCF calculation puts fair value at $96.80, which is below today's price. Does this signal market optimism, or is it a sign of increased valuation risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ingredion for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ingredion Narrative

If you see the numbers differently or want to dig into the details yourself, you can build your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ingredion.

Ready for More Smart Investment Ideas?

Take your investing momentum to the next level. Simply Wall Street’s screener surfaces incredible stocks you might overlook on your own, keeping you steps ahead.

- Unlock unique value by checking out these 870 undervalued stocks based on cash flows. This screener is perfect for spotting companies trading under their true worth based on cash flow fundamentals.

- Spot tomorrow’s healthcare leaders and transform your portfolio with these 32 healthcare AI stocks. This is a handpicked group harnessing artificial intelligence to change patient outcomes and industry standards.

- Boost your returns with reliable income by browsing these 16 dividend stocks with yields > 3%. This screener features businesses paying dividends above 3% and building long-term wealth for shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INGR

Ingredion

Manufactures and sells sweeteners, starches, nutrition ingredients, and biomaterial solutions derived from wet milling and processing corn, and other starch-based materials to a range of industries worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives