- United States

- /

- Food

- /

- NYSE:HSY

Evaluating Hershey (HSY): Is the Chocolate Maker Undervalued After Recent Share Price Pullback?

Reviewed by Simply Wall St

See our latest analysis for Hershey.

Looking beyond the past 30 days, where Hershey’s share price return was a notable -13%, the broader picture suggests momentum has weakened. Despite some recent positive moves earlier this year, the 1-year total shareholder return of -2.2% and a three-year total shareholder return of -19.9% highlight that long-term holders have endured a challenging stretch. Valuation concerns and changing consumer preferences continue to weigh on sentiment.

If this shift in momentum has you wondering about what else is taking shape, you might want to broaden your perspective and discover fast growing stocks with high insider ownership

With shares sitting well below recent highs and valuation metrics trending lower, is Hershey undervalued at these levels? Or is the market simply factoring in sluggish future growth and changing industry dynamics?

Most Popular Narrative: 11.6% Undervalued

According to the most widely followed narrative, Hershey's estimated fair value of $191.95 sits above its last closing price of $169.63, implying room to the upside if current projections materialize. The narrative framework draws together innovation plans, margin outlook, and sector backdrops to justify where the value could land next.

Hershey's expansion into sweets and better-for-you snacks categories alongside salty snacks with new acquisitions indicates strategic diversification beyond just chocolate. This approach is poised to capture additional market share and drive incremental revenue growth, potentially improving profitability in the long term.

What is the engine under the hood of this bullish story? The fair value rests on bold growth assumptions, with a playbook relying on new revenue streams and rising profitability. Want to see which profit levers this narrative is betting on, and how ambitious the long-term targets get? There is more behind the number; dig into the full narrative for the details.

Result: Fair Value of $191.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainties around tariffs and persistent high cocoa prices could quickly undermine these expectations if mitigation efforts fall short.

Find out about the key risks to this Hershey narrative.

Another View: Multiples Tell a Different Story

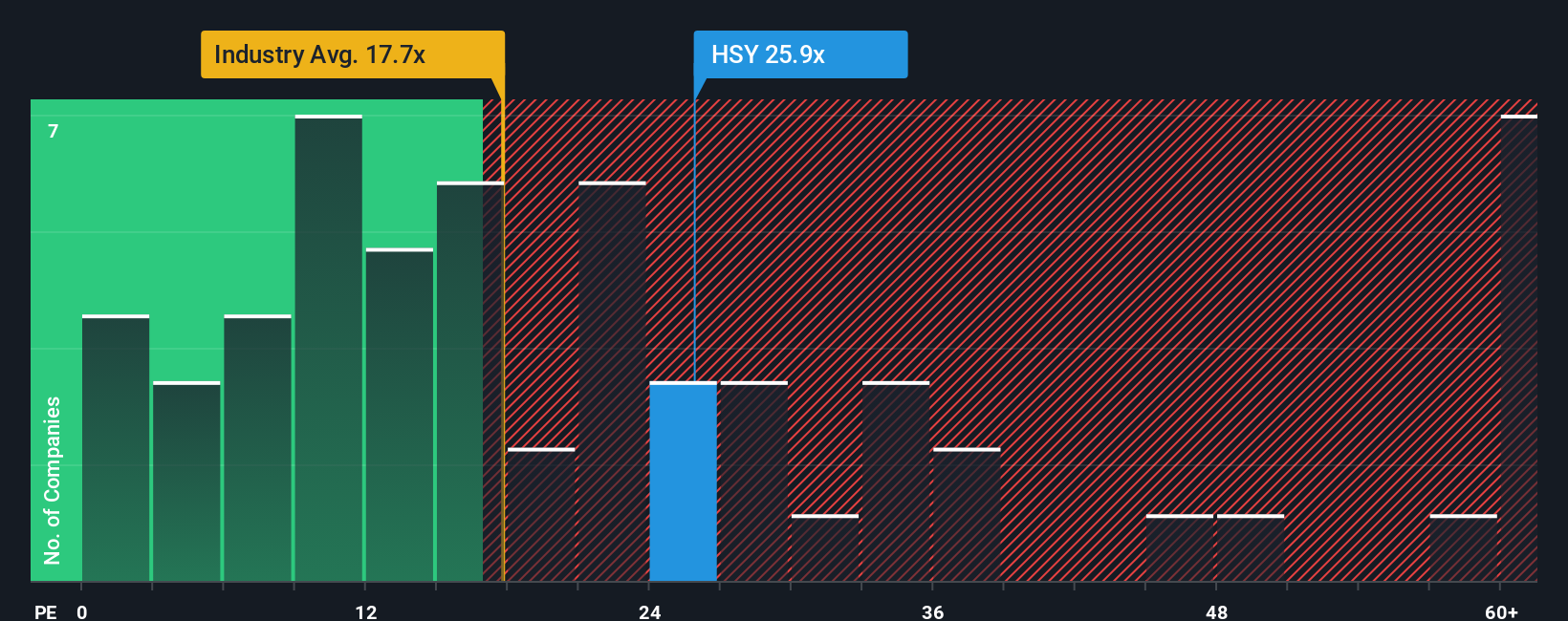

While the fair value estimate paints Hershey as undervalued, looking at its current price-to-earnings ratio offers a more cautious take. Hershey trades at 25.3x earnings, which is higher than both the industry average of 17.8x and the fair ratio of 22.3x that the market could revert to. This gap signals some valuation risk if the outlook does not improve. Will market confidence hold up, or could expectations reset?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hershey Narrative

If this analysis does not quite fit your view, or if you like getting hands-on with the numbers, you can dive in and construct your own perspective in just a few minutes. Do it your way

A great starting point for your Hershey research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't sit on the sidelines while new opportunities are taking off. Use the Simply Wall Street Screener for fresh strategies that match your goals.

- Capitalize on cutting-edge breakthroughs in next-gen technology. Check out these 28 quantum computing stocks sparking innovation across fast-moving industries.

- Secure consistent income even in unpredictable markets by evaluating these 22 dividend stocks with yields > 3% boasting yields above 3% and proven payout records.

- Ride the momentum of digital disruption by targeting these 27 AI penny stocks harnessing artificial intelligence for growth and competitive edge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hershey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HSY

Hershey

Engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives