- United States

- /

- Food

- /

- NYSE:HRL

Hormel Foods (HRL): Assessing Valuation as Revenue Grows but Shareholder Returns Stall

Reviewed by Kshitija Bhandaru

Hormel Foods (HRL) shares have caught some attention this month as investors continue to weigh the company's performance against a choppy backdrop for food producers. Recent results highlight steady revenue and expanding net income, despite market pressures.

See our latest analysis for Hormel Foods.

Hormel Foods’ stock has seen its momentum wane, with a 1-year total shareholder return of -0.18% and a five-year total return of -0.43%, reflecting investor caution even as the company grows earnings. Despite steady fundamentals, recent price action suggests the market is waiting for a catalyst to reignite confidence in the shares.

If you’re looking for potential standouts beyond the usual picks, now is a great time to widen your search and discover fast growing stocks with high insider ownership

With Hormel Foods trading below its analyst price target and growing both revenue and net income, investors have to wonder: Is the market overlooking a bargain, or has it already priced in all the company’s potential?

Most Popular Narrative: 14.3% Undervalued

Hormel Foods’ most followed narrative places its fair value roughly $4 above the latest closing price, hinting at possible upside for patient investors. The supporting arguments go beyond consensus; there is a bold thesis at play worth a closer look.

Major supply chain automation, manufacturing footprint improvements, and the ongoing Transform and Modernize (T&M) initiatives are on track, expected to drive significant operational efficiencies and cost reductions. These steps support long-run margin expansion and ultimately higher future earnings.

Wondering what numbers drive this premium? It is not just about cutting costs; there is a broader vision for future growth. The key lies in ambitious financial targets, margin expansion, and analyst expectations that extend beyond simple year-on-year improvements. Ready to uncover which assumptions underpin that higher price?

Result: Fair Value of $28.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent commodity cost swings or slow demand recovery could undermine Hormel’s margin expansion and delay the operating improvements that analysts are counting on.

Find out about the key risks to this Hormel Foods narrative.

Another View: What Do the Numbers Say?

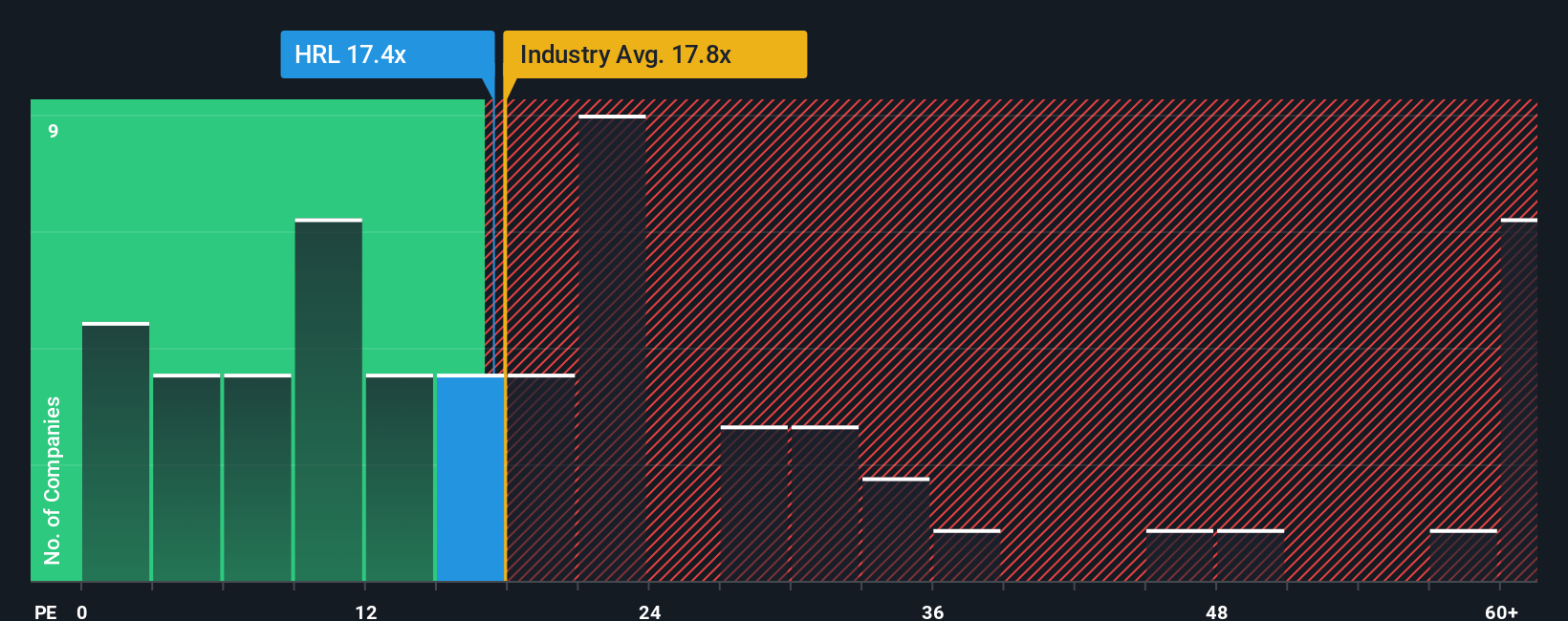

Looking at valuation through earnings multiples tells a slightly different story. At 18x earnings, Hormel is trading in line with the food industry average, yet it stands more expensive than its closest peers, which average 16.6x. The fair ratio sits at 18.1x, suggesting limited room for upside unless market sentiment shifts. Which valuation tells the real story: potential or risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hormel Foods Narrative

If these views don't match your own or you trust your own analysis more, take a fresh look and build your narrative in just a few minutes. Do it your way

A great starting point for your Hormel Foods research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye on hot sectors and undervalued gems. Don’t get left behind. The Screener is packed with fresh opportunities you won't want to miss.

- Uncover potential market leaders by checking out these 887 undervalued stocks based on cash flows that stand out for strong cash flows and attractive entry points.

- Tap into the rapid growth of artificial intelligence and start tracking these 24 AI penny stocks making waves with innovative technology and massive scaling power.

- Secure steady income and beat low-interest rates when you focus on these 19 dividend stocks with yields > 3% offering yields above 3% backed by reliable fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hormel Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HRL

Hormel Foods

Develops, processes, and distributes various meat, nuts, and other food products to foodservice, convenience store, and commercial customers in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives