- United States

- /

- Food

- /

- NYSE:HRL

Does the Latest Protein Acquisition Signal a Turning Point for Hormel Foods Stock?

Reviewed by Bailey Pemberton

- Wondering whether Hormel Foods is a hidden value play or a stock to watch cautiously? If you have your eye on finding great investments at the right price, you are in the right place.

- Hormel Foods’ share price has slipped lately, dropping 7.1% over the last month and down 29.2% year-to-date, catching the attention of investors weighing its growth outlook versus risks.

- Recent headlines have swirled around Hormel’s shifting product strategy and updates to its international supply chain, which could impact future profitability. News of strategic acquisitions in the protein space has also sparked debate about whether these moves will support a turnaround or add more pressure in a competitive sector.

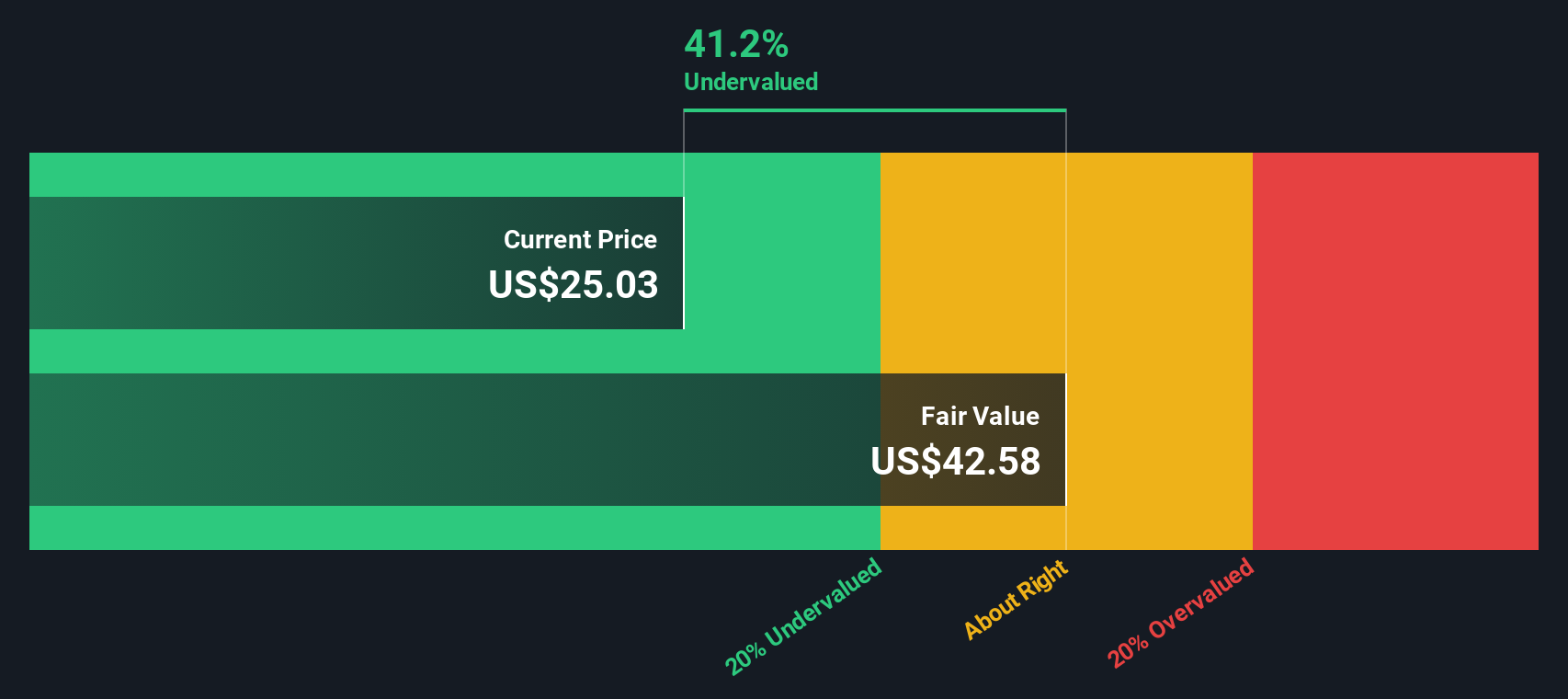

- When it comes to valuation, Hormel Foods scores a 5 out of 6 on our value checks, suggesting the company is undervalued in most key areas. Let’s break down what these different metrics reveal and stick around for an even sharper perspective on valuation at the end of this article.

Find out why Hormel Foods's -21.8% return over the last year is lagging behind its peers.

Approach 1: Hormel Foods Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This method helps investors determine what a company is worth based on its expected ability to generate cash over time.

Hormel Foods currently delivers annual free cash flow of $653 million. Analysts forecast this will rise steadily, with projections reaching $857.5 million by 2027. Beyond the next few years, further growth estimates are extrapolated, suggesting free cash flow could approach $1.16 billion by 2035, with intermediate milestones such as $809.5 million in 2026 and $935.9 million in 2029.

Based on these cash flow forecasts using the 2 Stage Free Cash Flow to Equity method, the DCF model estimates Hormel Foods’ fair value at $42.40 per share. With shares trading at a significant discount, the model implies the stock is 47.4 percent undervalued relative to its intrinsic value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hormel Foods is undervalued by 47.4%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: Hormel Foods Price vs Earnings

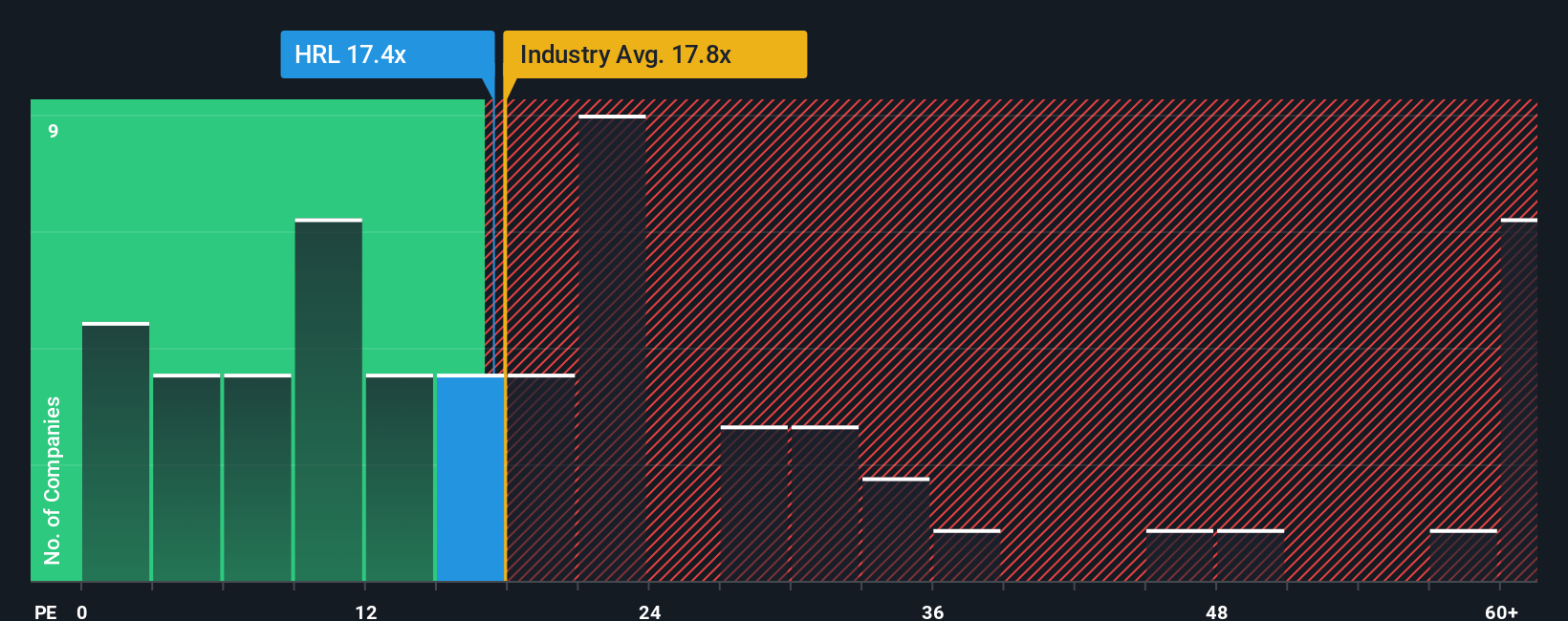

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Hormel Foods, since it directly links the company's share price to its earnings. For established businesses that reliably generate profits, the PE ratio can help investors gauge whether they are paying a reasonable amount for each dollar of earnings.

While a high PE ratio might reflect strong growth prospects or lower perceived risks, a lower PE can suggest slower growth or increased uncertainties. The “right” PE is always relative. It should take into account not only current earnings power, but also expectations for future growth, risks tied to the business or sector, and how similar companies are valued.

As of now, Hormel Foods trades at a PE of 16.3x. For context, this is comfortably below the broader Food industry average of 19.0x, and also higher than the average of its close peers at 8.5x. However, instead of just stopping at these benchmarks, Simply Wall St calculates a proprietary "Fair Ratio" that tailors the ideal PE for each company. In Hormel Foods’ case, the Fair Ratio is 16.7x. This Fair Ratio captures not only typical comparative metrics but also factors in Hormel’s growth outlook, profit margins, sector dynamics, and market size, providing a more meaningful assessment of value.

With Hormel’s current PE ratio of 16.3x nearly matching the Fair Ratio of 16.7x, the market appears to be valuing the stock just about right based on its financial performance and prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1420 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hormel Foods Narrative

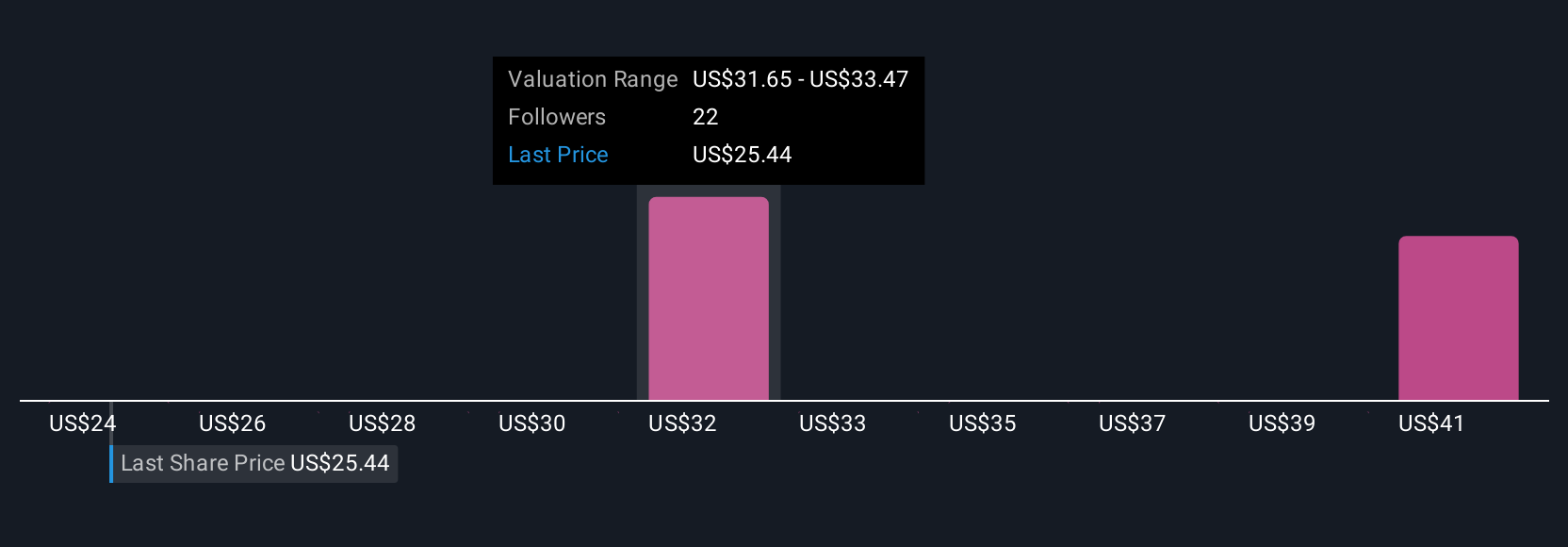

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a powerful, accessible way to combine the “story” behind a company—your perspective on its business, catalysts, and challenges—with your outlook for its financial future, including estimates for revenue, earnings, and profit margins. Narratives bridge the gap between what is happening in the real world and what you see in the numbers, linking a company’s journey directly to a dynamic fair value calculation.

On Simply Wall St’s Community page, investors of all experience levels create and follow Narratives to share their unique views and forecasts, and to see how fresh information, such as company news or earnings reports, instantly updates the data and valuation. Using Narratives, you can compare a company’s Fair Value to its current share price, helping you decide whether it is the right time to buy, hold, or sell based on your own beliefs and assumptions rather than just analyst estimates.

For example, looking at Hormel Foods, one investor’s optimistic Narrative might result in a fair value of $34.00, expecting health-driven innovations to drive growth, while another’s more cautious Narrative could yield a $25.00 fair value, reflecting concern about ongoing input cost pressures and shifting consumer tastes.

Do you think there's more to the story for Hormel Foods? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hormel Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HRL

Hormel Foods

Develops, processes, and distributes various meat, nuts, and other food products to foodservice, convenience store, and commercial customers in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives