- United States

- /

- Food

- /

- NYSE:HRL

Did Securities Probe and Operational Setbacks Just Shift Hormel Foods' (HRL) Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier in November, Hormel Foods was named to Military Times' 2025 Best for Vets Employer list for the 13th consecutive year, while it also faced a securities investigation following operational setbacks including price pressures, bird flu, a production facility fire, and the departure of its CFO.

- These events have highlighted both Hormel's long-standing commitment to workforce support and the heightened scrutiny over the company's recent financial disclosures and business challenges.

- We’ll now examine how the recent securities investigation tied to operational disruptions may reshape Hormel’s investment narrative and outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Hormel Foods Investment Narrative Recap

To be a shareholder in Hormel Foods right now, you need confidence that its foundation in protein-focused brands and ongoing innovation can eventually offset stubborn pressures from commodity costs and input volatility. The recent securities investigation, triggered by a series of short-term disruptions and a weaker earnings update, has heightened focus on margin recovery, but it does not yet fundamentally alter the biggest near-term catalyst: Hormel’s cost-saving initiatives and pricing actions regaining traction. The main risk remains persistent input inflation challenging earnings consistency into 2026.

Among the recent announcements, Hormel’s corporate restructuring aimed at aligning resources with its strategic goals stands out in this context. As the company tightens operations and aims for efficiency, the effectiveness of these restructuring efforts could prove crucial to overcoming input cost pressures and restoring profitability, which sits at the heart of the current investment debate.

Yet while restructuring may help, investors should also consider the persistent margin risk that results when input cost inflation outpaces Hormel’s pricing power...

Read the full narrative on Hormel Foods (it's free!)

Hormel Foods' outlook anticipates $13.0 billion in revenue and $952.2 million in earnings by 2028. This scenario assumes 2.5% annual revenue growth and a $197.7 million increase in earnings from the current $754.5 million.

Uncover how Hormel Foods' forecasts yield a $27.06 fair value, a 21% upside to its current price.

Exploring Other Perspectives

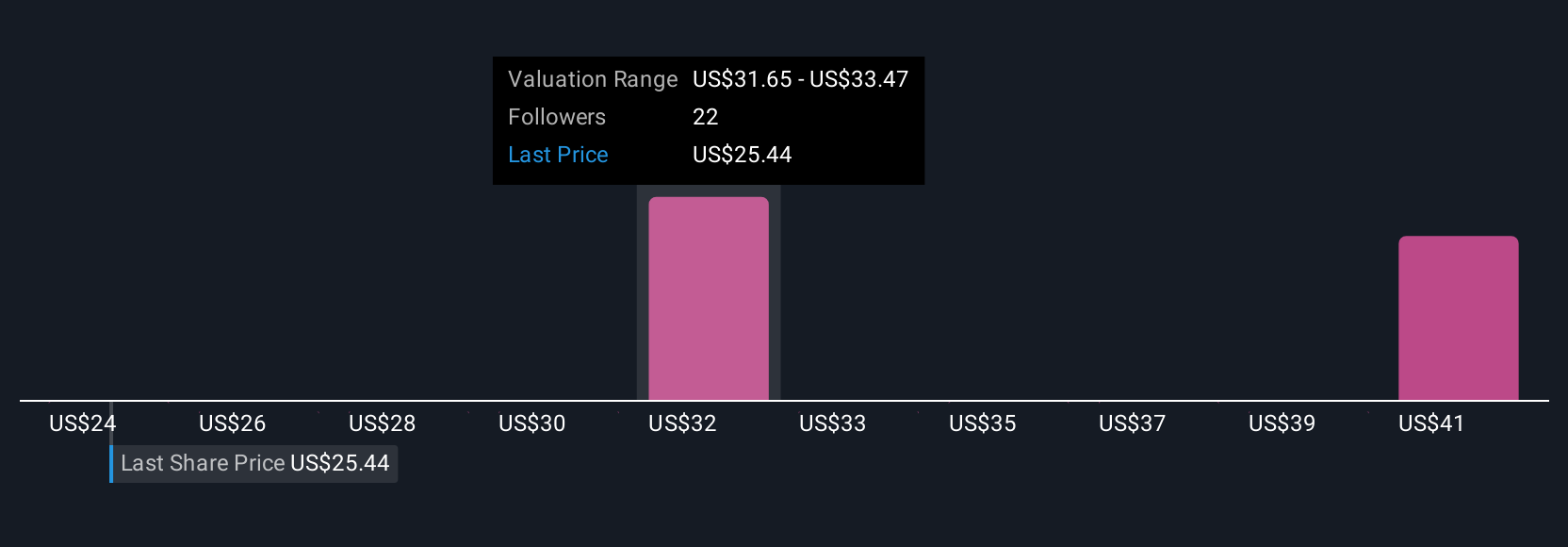

Five separate fair value estimates from the Simply Wall St Community span US$24.36 to US$42.40, showing a wide range of views. Given continuing input cost pressures highlighted by analysts, consider how these different perspectives might impact your outlook on Hormel’s future performance.

Explore 5 other fair value estimates on Hormel Foods - why the stock might be worth just $24.36!

Build Your Own Hormel Foods Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hormel Foods research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hormel Foods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hormel Foods' overall financial health at a glance.

No Opportunity In Hormel Foods?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hormel Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HRL

Hormel Foods

Develops, processes, and distributes various meat, nuts, and other food products to foodservice, convenience store, and commercial customers in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives