- United States

- /

- Food

- /

- NYSE:DAR

Darling Ingredients (DAR): Evaluating Valuation After Q3 Revenue Growth But Falling Year-to-Date Net Income

Reviewed by Simply Wall St

Darling Ingredients (DAR) just released its third quarter earnings, showing year-over-year growth in quarterly sales and revenue. However, net income for the first nine months saw a steep decline compared to the previous year.

See our latest analysis for Darling Ingredients.

While Darling Ingredients posted higher quarterly sales, the market reaction has been cool, with a 1-year total shareholder return of -18.18%. After a tough start in 2024, recent share price momentum is modestly positive. However, the longer-term trend remains under pressure.

If you’re searching for new themes as momentum shifts, now is the perfect moment to discover fast growing stocks with high insider ownership.

With Darling Ingredients trading at a notable discount to analyst price targets despite improved sales, investors are left to wonder whether the market is overlooking its recovery potential or if future growth challenges are already priced in.

Most Popular Narrative: 30.2% Undervalued

Darling Ingredients closed at $32.22, while the most widely followed narrative assigns it a fair value of $46.17. This difference has fueled debate about whether the market is too pessimistic about Darling’s future. This sets the stage for a closer look at the drivers behind the valuation.

Policy changes favoring U.S.-sourced renewable diesel feedstocks (higher domestic fat prices, reduced foreign competition) and increasing U.S. biofuel mandates are expected to structurally expand demand and improve pricing power in Darling's Feed and Fuel segments. These changes could drive higher revenue and margin expansion through 2026 and beyond.

Curious what critical financial leap underpins this gap? The story rests on growth trends sweeping through revenue, margins, and a key future profit ratio. Find out which assumptions could reshape the price narrative and why each carries so much weight in this forecast.

Result: Fair Value of $46.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory uncertainty and volatile feedstock costs could threaten margin recovery and delay Darling’s expected earnings acceleration in the coming years.

Find out about the key risks to this Darling Ingredients narrative.

Another View: What Valuation Ratios Say

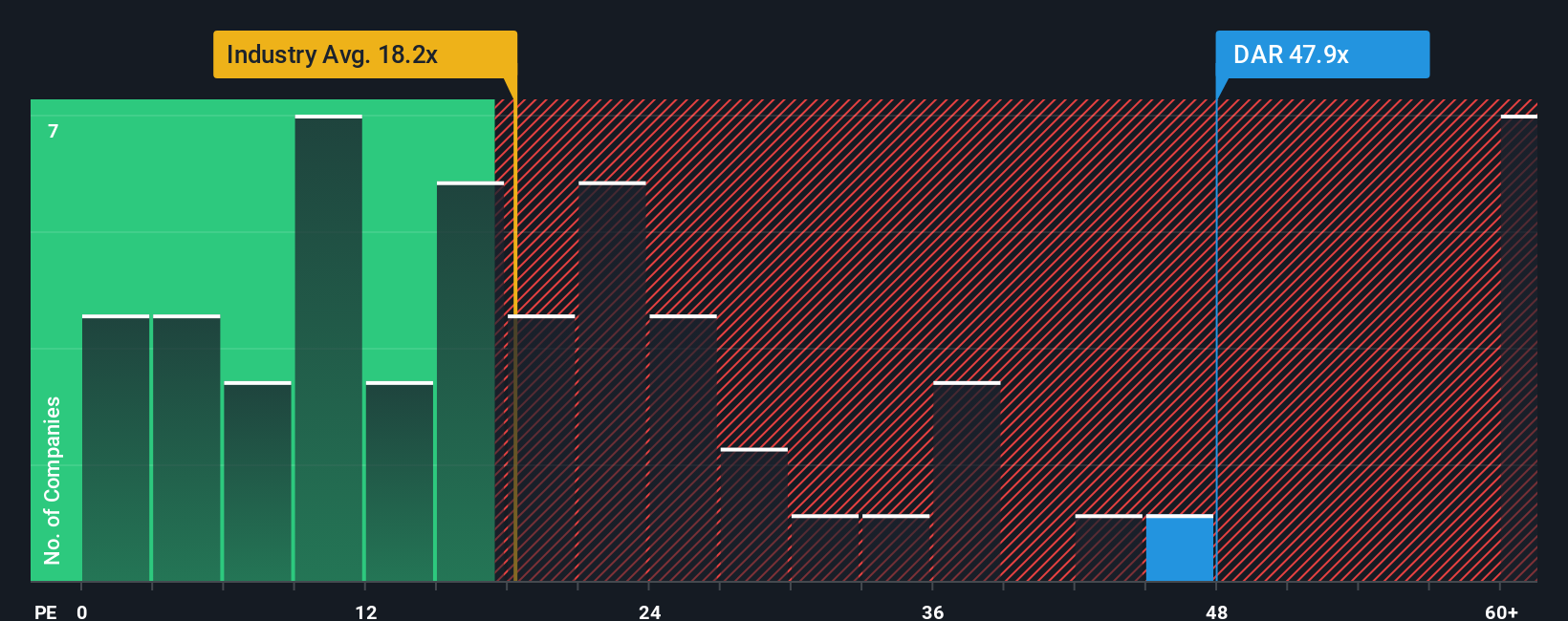

Turning to conventional valuation ratios, Darling Ingredients is trading at a price-to-earnings level of 47.3x, which is much higher than both peers (17.3x) and the US Food industry average (17.7x). Even compared to its fair ratio of 41.4x, the stock appears expensive. This gap signals heightened valuation risk in the near term. Is the market too optimistic or just pricing in future recovery?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Darling Ingredients Narrative

Not convinced by these scenarios or eager to run your own analysis? Uncover the fundamentals and shape your perspective in just a few minutes. Do it your way.

A great starting point for your Darling Ingredients research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Let your capital work smarter by finding overlooked opportunities before the crowd. Enhance your stock hunting skills with these hand-picked screens you simply shouldn’t miss:

- Accelerate your growth strategy by targeting future market leaders through these 25 AI penny stocks. These opportunities are fueled by artificial intelligence breakthroughs and rapid innovation.

- Lock in the power of compounding returns with these 20 dividend stocks with yields > 3%, which reward shareholders year after year with reliable, strong yields.

- Seize unique technological trends by tapping into these 81 cryptocurrency and blockchain stocks. This avenue is shaping tomorrow’s financial landscape with blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAR

Darling Ingredients

Develops, produces, and sells natural ingredients from edible and inedible bio-nutrients in North America, Europe, China, South America, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives