- United States

- /

- Food

- /

- NYSE:BRCC

Black Rifle Coffee (BRCC): Rapid 12.6% Revenue Growth Reinforces Bullish Value Narrative

Reviewed by Simply Wall St

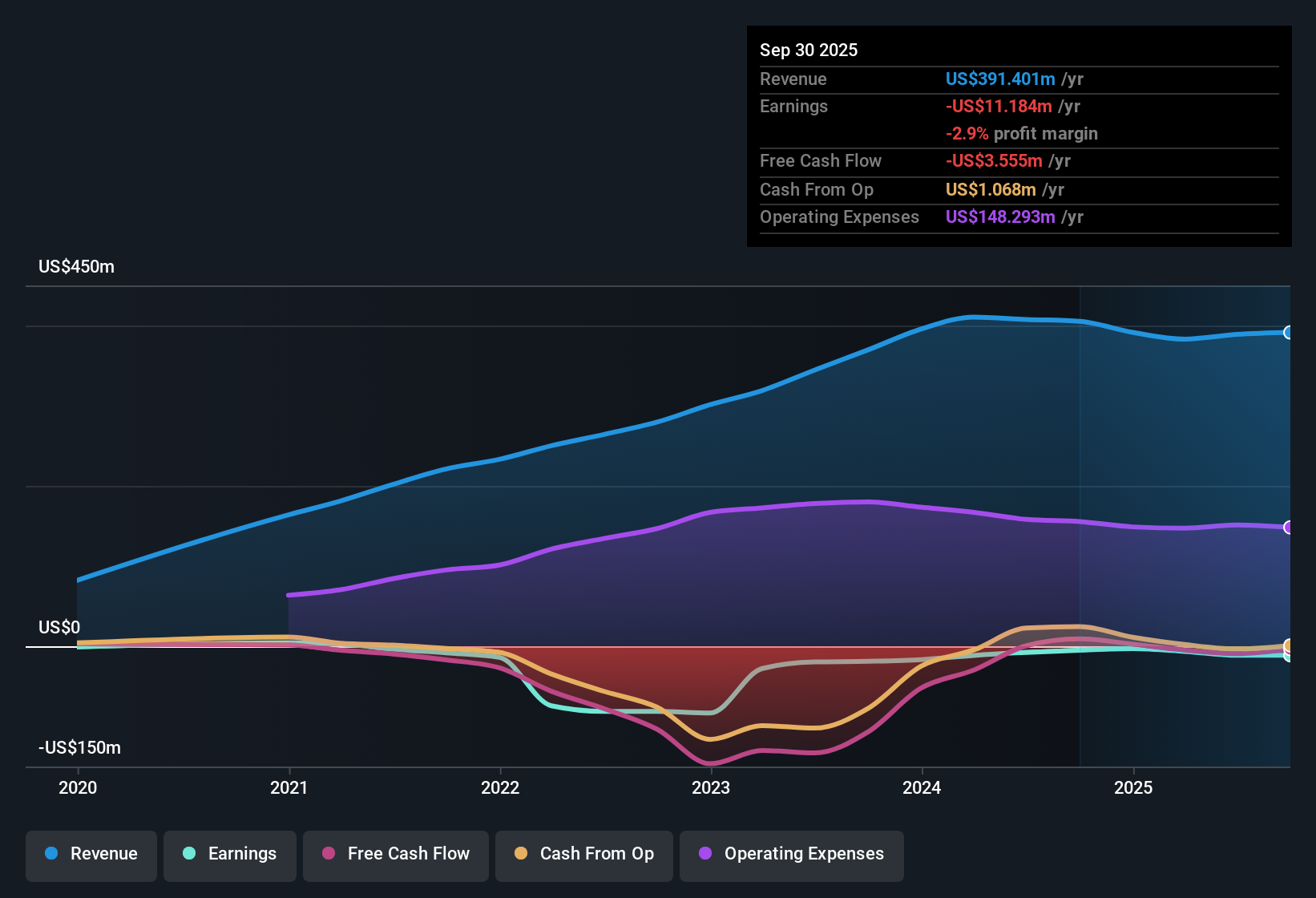

BRC (BRCC) booked revenue growth of 12.55% per year, outpacing the broader US market benchmark of 10.5% per year. While the company continues to operate at a loss and is projected to remain unprofitable over the next three years, it has made notable progress in reducing annual losses by 14.7% over the past five years. For investors, rapid revenue expansion, an undemanding 0.4x Price-to-Sales ratio, and a share price well below fair value present a mix of optimism and ongoing caution.

See our full analysis for BRC.Next up, we will see how these latest numbers compare with the current market narratives and whether the community consensus at Simply Wall St aligns or takes a different view.

See what the community is saying about BRC

Margins Expected to Rebound by 6 Percentage Points

- Analysts forecast profit margins to increase from -2.9% today to 3.1% in three years, shifting from unprofitability to the potential for positive earnings by 2028.

- According to analysts' consensus view, several factors could drive this improvement:

- Enhanced digital infrastructure and expansion in retail, e-commerce, and energy drink channels are anticipated to broaden the customer base and elevate recurring revenue.

- Greater scale and operational upgrades are seen supporting gross margin stabilization, even as pressure from green coffee costs and tariffs remains.

Peer-Beating Value: Price-to-Sales at 0.4x

- BRC trades at a 0.4x Price-to-Sales ratio, notably lower than both its peer group average of 4.7x and the broader US Food industry average of 0.9x.

- The consensus narrative highlights distinct value:

- BRC’s attractive multiple and a DCF fair value of $8.06 versus today’s $1.32 share price point to meaningful upside, assuming the company executes on its revenue and profitability road map.

- However, achieving the analyst price target of $2.17 would require convincing investors that future earnings justify a high, 46.2x PE ratio, which is well above the US Food sector average PE of 19.8x.

Share Growth Dilution and Risk Constraints

- The number of shares outstanding is expected to increase by 7% per year over the next three years, which could dilute per-share earnings even if total profits rise.

- From the analysts' consensus view, the overall risk profile is relatively restrained:

- No major risks have been flagged, though three minor risks have been identified in the latest review, mostly related to input costs and market penetration challenges.

- Competitive threats from established food brands and emerging rivals remain a watchpoint, but BRC’s growing distribution and brand loyalty may offset some of these pressures.

How do these themes fit into the bigger picture for BRC? See the arguments for and against the stock in the full Consensus Narrative.

📊 Read the full BRC Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for BRC on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? It only takes a few minutes to use your own insights and build a narrative that reflects your outlook. Do it your way

A great starting point for your BRC research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

BRC’s ongoing unprofitability, reliance on share issuance, and pressure to justify high earnings multiples create uncertainty in its financial performance trajectory.

If steady gains and dependable results matter to you, use stable growth stocks screener (2083 results) to quickly find companies that deliver consistent revenue and earnings expansion year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BRC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRCC

BRC

Through its subsidiaries, purchases, roasts, and sells coffee and coffee accessories in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives