- United States

- /

- Food

- /

- NYSE:ADM

Archer-Daniels-Midland (NYSE:ADM) Declares Cash Dividend of US$0.51 Per Share

Reviewed by Simply Wall St

Archer-Daniels-Midland (NYSE:ADM) experienced a 14% increase in its share price over the last quarter. During this period, the company announced a cash dividend of $0.51 per share and confirmed its buyback program had repurchased 185 million shares since 2014. Despite a decrease in Q1 2025 earnings compared to a year ago, ADM's share price seemed resilient. Broader market trends showed volatility due to geopolitical tensions and fluctuating oil prices, yet ADM's strategic alliance with Mitsubishi Corporation could have reinforced investor confidence. The M&A rumors surrounding ADM also likely maintained interest amid the generally stable market conditions.

The recent 14% uptick in Archer-Daniels-Midland's share price amidst a tough Q1 2025 earnings environment, and in spite of broader market volatility, highlights investors' positive reception to the company's ongoing buyback program and dividend announcement. These factors may bolster shareholder confidence amidst the uncertainties surrounding geopolitical tensions and oil price fluctuations. The company's alliance with Mitsubishi Corporation could further underpin investor confidence, possibly stabilizing the market's response to potential M&A activities.

Over a longer period, Archer-Daniels-Midland has seen a total shareholder return of 55.40% over the past five years. Comparing this with the latest figures, it's clear the company has maintained resilience despite various challenges. However, in the recent one-year span, ADM underperformed the broader U.S. market, which returned 10.9%, and the U.S. Food industry, which experienced a 6.5% decline. This contrast paints a picture of relative stability over the long term, even if short-term performance lagged behind its peers.

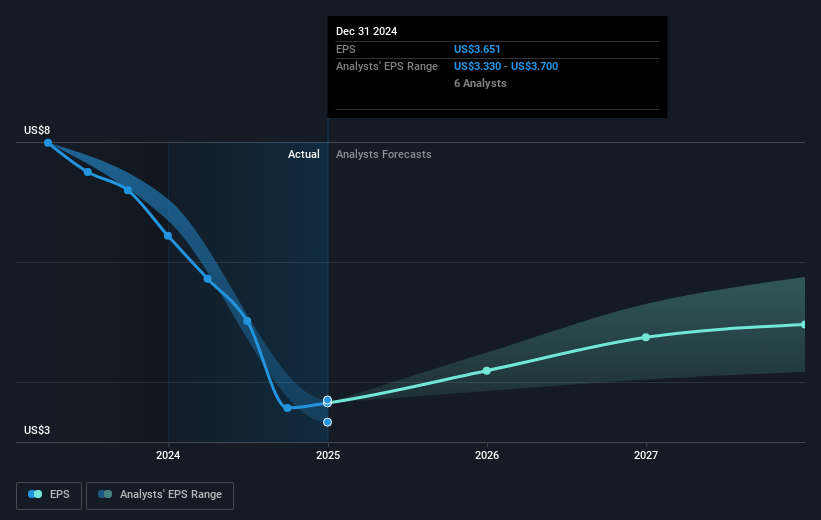

The narrative indicates that ADM's recommissioning projects and automation investments aim to improve efficiency and support revenue growth. Yet, the overall revenue is expected to grow at a slower 1.3% annually compared to broader U.S. market expectations. Meanwhile, earnings growth forecasts at 11% also trail behind market expectations. With the current share price at US$48.32, analysts' price target of US$49.73 suggests a limited upside of 2.8%. However, the ongoing cost-saving initiatives and automation advancements could potentially provide a more robust foundation for future growth should external conditions remain supportive. The company's focus on innovative partnerships and solutions reflects its commitment to overcoming competitive pressures and uncertainties in regulatory policies.

Evaluate Archer-Daniels-Midland's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADM

Archer-Daniels-Midland

Engages in the procurement, transportation, storage, processing, and merchandising of agricultural commodities, ingredients, flavors, and solutions in the United States, Switzerland, the Cayman Islands, Brazil, Mexico, Canada, the United Kingdom, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives