- United States

- /

- Food

- /

- NYSE:ADM

Archer-Daniels-Midland (ADM): Is the Current Valuation Justified After Recent Share Price Gains?

Reviewed by Simply Wall St

Archer-Daniels-Midland (ADM) has been drawing attention lately, especially as investors weigh recent returns and monitor shifts in the broader food and agriculture sector. The company’s stock performance stands out over the past year, even though there have been mixed trends across the industry.

See our latest analysis for Archer-Daniels-Midland.

ADM’s share price has moved up over 20% year-to-date, and the 1-year total shareholder return clocks in at 15%, signaling gradual momentum after a challenging stretch. However, its three-year total return is still in the red. Recent volatility, including a soft patch over the past week, shows the market’s shifting view on the company’s growth potential and risk profile in a rapidly evolving sector.

If you’re curious what other names are capturing attention in this space, it’s worth exploring more opportunities using our fast growing stocks with high insider ownership.

But with strong recent gains and improving fundamentals, is ADM’s current share price an underappreciated bargain, or is the market already factoring in all future growth, leaving little room for investors to capitalize from here?

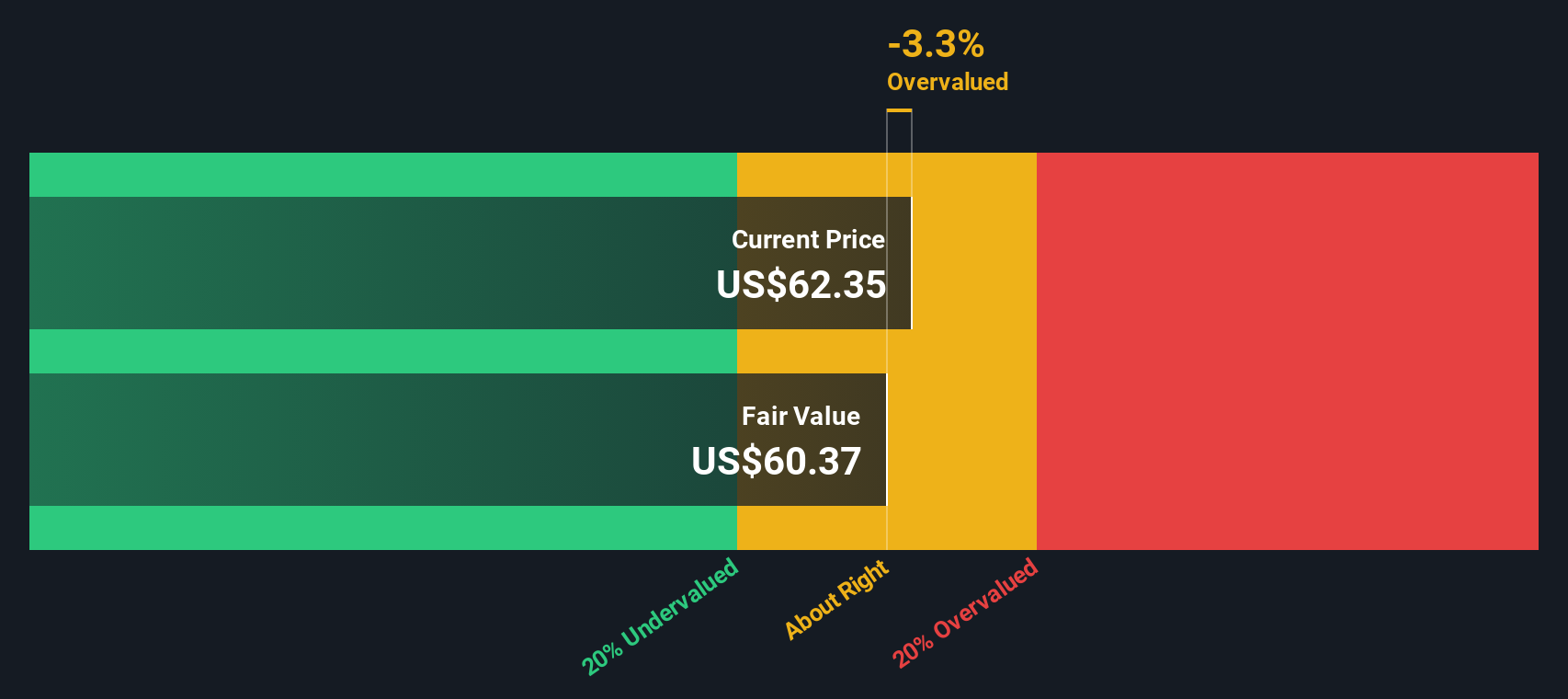

Most Popular Narrative: 3.8% Overvalued

With Archer-Daniels-Midland’s closing price above the consensus fair value, the latest narrative highlights a market that may be slightly ahead of fundamentals. This sets the stage for an examination of the underlying catalysts shaping that estimate.

Policy clarity and ongoing government support for biofuels, including the extension of the 45Z tax credit, favorable RVOs, and domestic feedstock incentives, are expected to drive increased soybean oil demand and improved crush margins, directly supporting ADM's revenue and net margins from late 2025 into 2026.

Want to know what’s powering that ambitious target? The narrative’s entire case for today’s price is built on a dramatic shift in policy and profit margins, but the real variables that validate it are surprising. Don’t miss the bold growth expectations hiding in the details. See what makes this scenario tick before you make your call.

Result: Fair Value of $58.3 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering regulatory uncertainty and softening demand in key markets could quickly challenge these growth projections and put pressure on ADM’s long-term earnings stability.

Find out about the key risks to this Archer-Daniels-Midland narrative.

Another View: DCF Model Highlights Undervalued Potential

While the consensus valuation signals that ADM's share price is a bit stretched, our SWS DCF model estimates that the stock is actually trading below its fair value, with a 4.1% discount. This offers a different perspective for investors who want to go beyond traditional market multiples. Could the market be missing some upside here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Archer-Daniels-Midland for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Archer-Daniels-Midland Narrative

If these conclusions leave you unconvinced or you'd rather dig into the numbers personally, you can quickly build your own thesis in just a few minutes. Simply Do it your way.

A great starting point for your Archer-Daniels-Midland research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t settle for just one opportunity when you could be tapping into strategies that uncover market movers, hidden gems, and unique sectors primed for growth. Check out these other ways to put your money to work:

- Capitalize on the next wave of technological disruption by scanning these 26 AI penny stocks with explosive AI-driven potential across industries.

- Supercharge your income strategy with these 22 dividend stocks with yields > 3% offering yields above 3% and a record of rewarding shareholders year after year.

- Catch early-stage innovators shaking up the market by targeting these 3590 penny stocks with strong financials that demonstrate proven financial strength and significant upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADM

Archer-Daniels-Midland

Engages in the procurement, transportation, storage, processing, and merchandising of agricultural commodities, ingredients, flavors, and solutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives