- United States

- /

- Food

- /

- NYSE:ADM

A Fresh Look at Archer-Daniels-Midland (ADM) Valuation as US-China Trade Moves and New Partnerships Spark Interest

Reviewed by Kshitija Bhandaru

Archer-Daniels-Midland (ADM) stock is catching renewed attention as new US trade threats against Chinese cooking oil imports combine with strategic company moves. Investor sentiment is being shaped by these shifting dynamics.

See our latest analysis for Archer-Daniels-Midland.

ADM’s share price momentum is turning heads after surging to a new 52-week high, boosted by escalating US-China trade tensions and recent strategic moves such as its new animal feed partnership and expanded regenerative agriculture efforts. With a strong year-to-date share price return of 26% and a one-year total shareholder return of nearly 17%, ADM is regaining long-term appeal. However, some near-term signals remain mixed, which hints at building optimism around both its operational resilience and its growth strategy.

If this upswing in a major agricultural processor has you scanning for broader opportunities, now’s a smart time to explore fast growing stocks with high insider ownership.

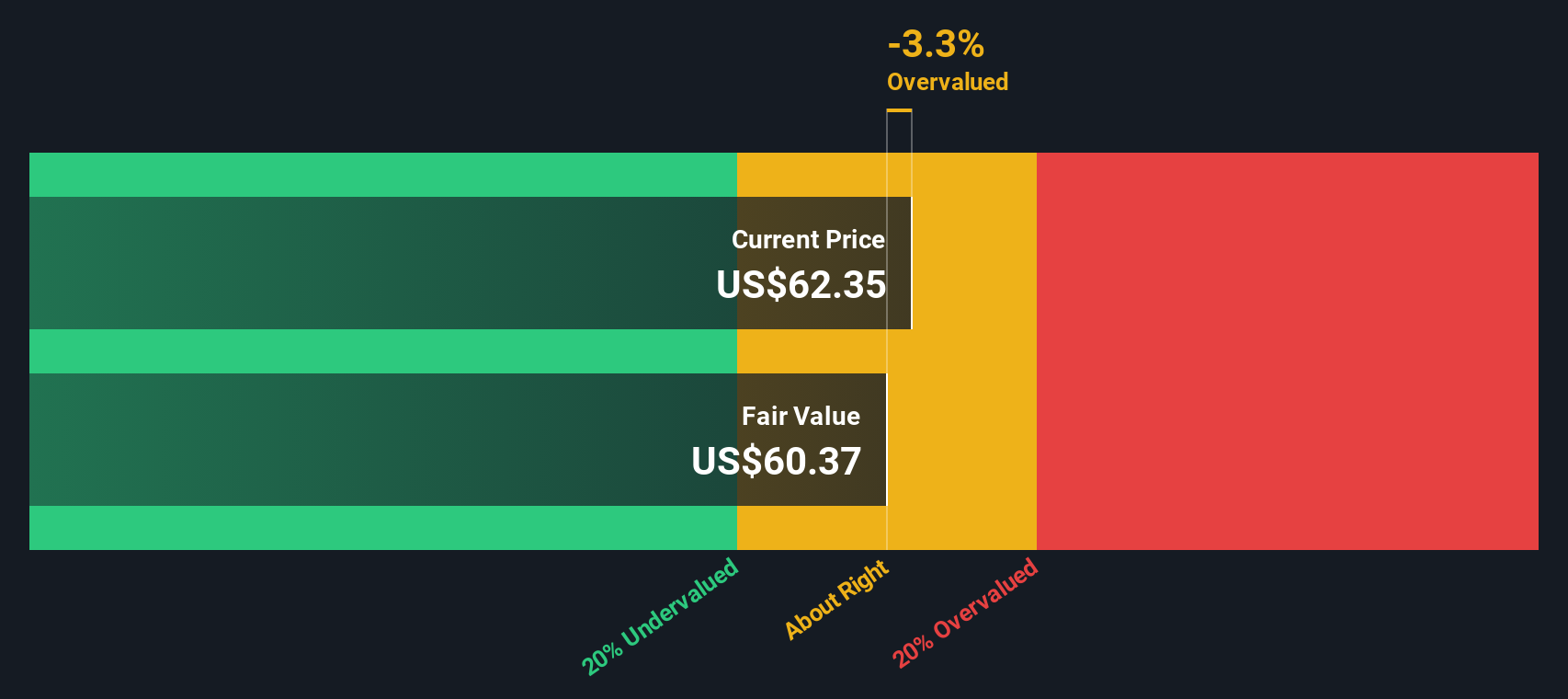

Given these robust gains and a stream of bullish headlines, the question now is whether ADM shares still offer undervalued potential or if the rally has already priced in all the growth ahead.

Most Popular Narrative: Fairly Valued

The top narrative compares Archer-Daniels-Midland's fair value to its recent close, finding the stock is trading right in line with consensus. This sets up a deeper look at the financial logic keeping ADM's fair price in check at current levels.

Policy clarity and ongoing government support for biofuels, including the extension of the 45Z tax credit, favorable RVOs, and domestic feedstock incentives, are expected to drive increased soybean oil demand and improved crush margins, directly supporting ADM's revenue and net margins from late 2025 into 2026.

Curious how much future growth and higher margins are really baked into this narrative? The calculations depend on some aggressive jumps in key operating metrics. Find out how bold forecasts for earnings power and a reset on ADM’s core multiples could drive the next move if the predictions hold.

Result: Fair Value of $58.3 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting global biofuel policy or a sharp drop in key segment margins could quickly undermine these current valuation assumptions.

Find out about the key risks to this Archer-Daniels-Midland narrative.

Another View: DCF Suggests Slight Undervaluation

Looking beyond analyst price targets, our SWS DCF model puts Archer-Daniels-Midland's fair value at $64.53, a touch above the recent share price of $63.33. While it points to a small margin of undervaluation, the difference is narrow. Could the model’s assumptions about future cash flows prove too optimistic, or not optimistic enough?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Archer-Daniels-Midland for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Archer-Daniels-Midland Narrative

If you want to challenge these assumptions or put your own perspective to the test, it’s quick and easy to shape your own analysis using the data. Do it your way

A great starting point for your Archer-Daniels-Midland research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for the obvious. If you want to get ahead of the crowd, make your next strategic move using these powerful, research-driven ideas from the Simply Wall St Screener.

- Grow your wealth with quality companies by seizing the chance to spot these 878 undervalued stocks based on cash flows trading at attractive prices relative to their fundamentals.

- Tap into unstoppable trends by backing innovation leaders found through these 24 AI penny stocks driving rapid advances in artificial intelligence and automation.

- Secure steady returns by targeting income opportunities. Check out these 18 dividend stocks with yields > 3% delivering yields above 3% and proven payout reliability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADM

Archer-Daniels-Midland

Engages in the procurement, transportation, storage, processing, and merchandising of agricultural commodities, ingredients, flavors, and solutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives