- United States

- /

- Beverage

- /

- NasdaqCM:WVVI

A Quick Analysis On Willamette Valley Vineyards' (NASDAQ:WVVI) CEO Compensation

Jim Bernau has been the CEO of Willamette Valley Vineyards, Inc. (NASDAQ:WVVI) since 1988, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Willamette Valley Vineyards

Comparing Willamette Valley Vineyards, Inc.'s CEO Compensation With the industry

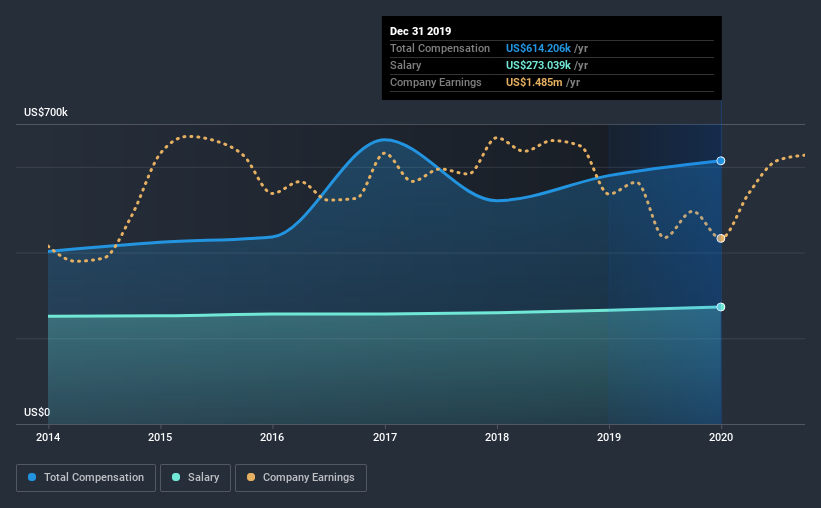

Our data indicates that Willamette Valley Vineyards, Inc. has a market capitalization of US$33m, and total annual CEO compensation was reported as US$614k for the year to December 2019. That's a modest increase of 6.0% on the prior year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$273k.

On comparing similar-sized companies in the industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$218k. Accordingly, our analysis reveals that Willamette Valley Vineyards, Inc. pays Jim Bernau north of the industry median. Moreover, Jim Bernau also holds US$2.8m worth of Willamette Valley Vineyards stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | US$273k | US$265k | 44% |

| Other | US$341k | US$314k | 56% |

| Total Compensation | US$614k | US$580k | 100% |

Speaking on an industry level, nearly 18% of total compensation represents salary, while the remainder of 82% is other remuneration. Willamette Valley Vineyards pays out 44% of remuneration in the form of a salary, significantly higher than the industry average. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Willamette Valley Vineyards, Inc.'s Growth Numbers

Over the past three years, Willamette Valley Vineyards, Inc. has seen its earnings per share (EPS) grow by 2.6% per year. Its revenue is up 5.6% over the last year.

We're not particularly impressed by the revenue growth, but the modest improvement in EPS is good. So there are some positives here, but not enough to earn high praise. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Willamette Valley Vineyards, Inc. Been A Good Investment?

Since shareholders would have lost about 21% over three years, some Willamette Valley Vineyards, Inc. investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As we noted earlier, Willamette Valley Vineyards pays its CEO higher than the norm for similar-sized companies belonging to the same industry. While we have not been overly impressed by the business performance, the shareholder returns have been utterly depressing, over the last three years. This doesn't look great when you consider Jim is taking home compensation north of the industry average. With such poor returns, we would understand if shareholders had concerns related to the CEO's pay.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 2 warning signs for Willamette Valley Vineyards (of which 1 makes us a bit uncomfortable!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Willamette Valley Vineyards, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Willamette Valley Vineyards might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqCM:WVVI

Willamette Valley Vineyards

Produces and sells wine in the United States and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives