- United States

- /

- Food

- /

- NasdaqCM:VFF

A Look at Village Farms International (NasdaqCM:VFF) Valuation Following Record Earnings and Share Buyback Announcement

Reviewed by Simply Wall St

Village Farms International (NasdaqCM:VFF) just delivered record third quarter earnings, shifting decisively to profitability with strong sales growth. The impressive results were fueled by strategic product moves and expansion efforts in Canada and the Netherlands.

See our latest analysis for Village Farms International.

Village Farms’ latest results arrive after a remarkable year for shareholders, with the company notching a 315% share price return year-to-date and a total shareholder return of 347% over the last twelve months. Recent momentum has been further supported by moves such as a $10 million share buyback, ongoing international expansion, and a profit turnaround. Meanwhile, a director trimmed their personal holdings last week, hinting at both confidence and evolving risk perception.

If this kind of rapid transformation has you wondering what else could be on the rise, now’s the perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares up over 300% in 2024 and record earnings just posted, the big question for investors is whether Village Farms International is still trading at a discount or if the market has already priced in its next chapter of growth.

Most Popular Narrative: 28% Undervalued

With Village Farms International closing at $3.52, the most popular narrative puts fair value at $4.92, highlighting considerable upside relative to current market pricing. This represents a notable disconnect between valuation models and where the shares currently trade, creating a pivotal moment for investors considering VFF's next move.

The company's ability to focus resources on cannabis, following the strategic privatization of produce operations and a robust cash position, allows it to pursue high-margin opportunities and self-fund growth projects. This can positively impact future net margins and earnings quality.

Want to know the real driver behind that premium price target? The heart of the narrative is in bold projections on future profitability, profit margins, and upside that may be achievable if expectations are met. Curious about the growth blueprint and the numbers that sparked this fair value? Dive deeper to uncover the assumptions that could influence how VFF is valued.

Result: Fair Value of $4.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition in global cannabis markets and potential delays in international regulatory changes could quickly challenge current bullish assumptions for Village Farms International.

Find out about the key risks to this Village Farms International narrative.

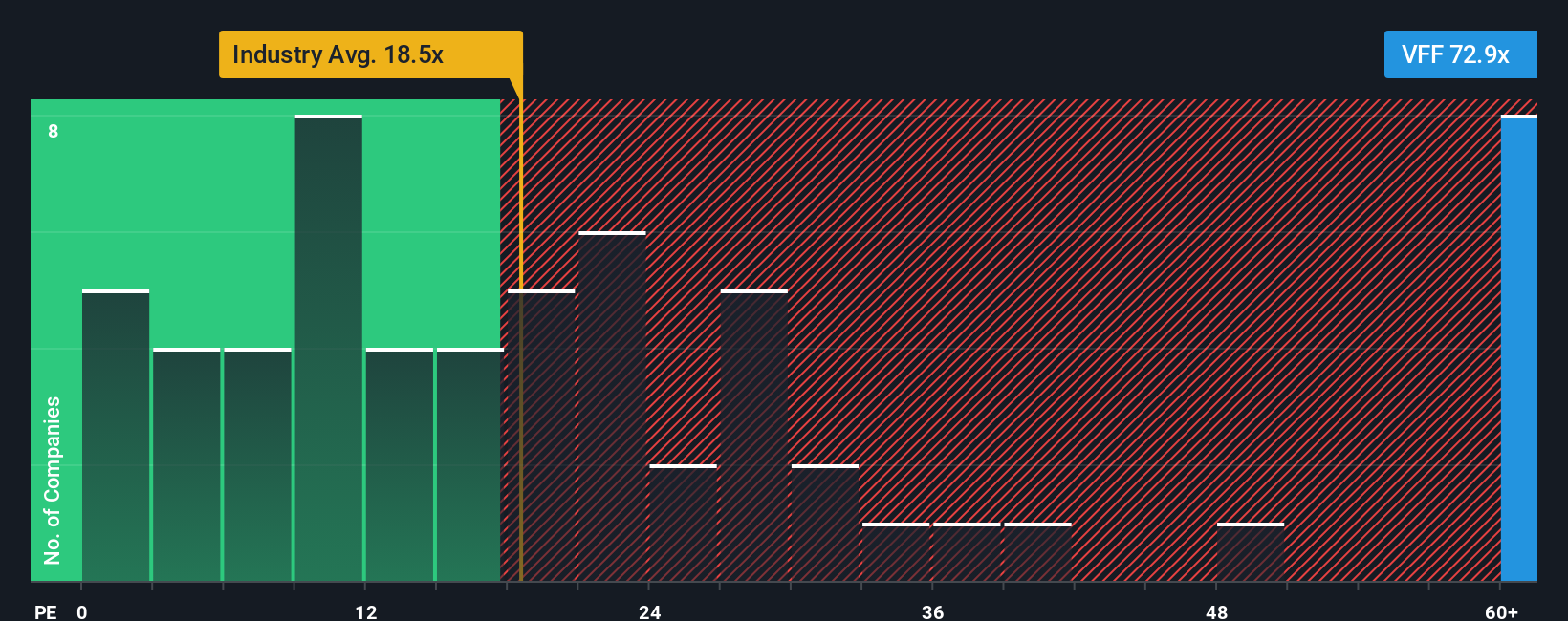

Another View: Market Multiples Paint a Cautious Picture

While fair value models suggest upside, there is a more cautious signal from standard market ratios. Village Farms trades at a price-to-earnings ratio of 72.5x, which is more expensive than both industry peers (averaging 23.4x) and the fair ratio of 50.6x. This premium indicates investors may be betting on further outperformance or rapid growth. However, what happens if future results fall short of these high hurdles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Village Farms International Narrative

If you see potential from a different angle or would rather chart your own course, you can analyze the latest data and build your personal view in under three minutes, then Do it your way.

A great starting point for your Village Farms International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Broaden your portfolio and unlock potential gains with investment opportunities you may have overlooked. If you want to spot tomorrow’s winners before the crowd, now is the moment to act.

- Uncover the most undervalued opportunities for significant upside by checking out these 921 undervalued stocks based on cash flows, which financial models say the market is missing.

- Tap into the AI revolution for high-growth potential with these 26 AI penny stocks, powering innovation across industries.

- Secure attractive yields and steady returns by browsing these 15 dividend stocks with yields > 3%, which offers robust dividend payments above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VFF

Village Farms International

Produces, markets, and distributes greenhouse grown tomatoes, bell peppers, cucumbers, and mini-cukes in North America.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives