- United States

- /

- Food

- /

- NasdaqCM:SMPL

Should Investors Reevaluate Simply Good Foods After Recent 38% Drop in 2025?

Reviewed by Bailey Pemberton

If you are weighing what to do with your Simply Good Foods shares, you are definitely not alone. Lately, this stock has been on quite a ride, and that has left a lot of investors watching closely and wondering if now is the moment to make a move. Over just the past week, the price slipped 3.1%. Stretch that out over a month, and you are looking at a 14.7% drop. The year-to-date story is even rougher, with shares down a notable 38.3%. It is not a new trend either—the past year has seen a 27.8% dip, and even the usually steady multi-year view has been lackluster, returning -28% in three years. Still, zoom out to the last five years and you will spot a glimmer of long-term growth at 9.4%.

What is behind these swings? Many industry watchers have pointed to shifting consumer habits, macroeconomic crosswinds, and some market skepticism around food stocks as a whole. While those worries echoed around the sector, some analysts now see Simply Good Foods as a possible value play, especially after factoring in how the stock has pulled back. The company currently lands a healthy 5 out of 6 on the valuation scorecard, meaning it is considered undervalued by most of the major criteria. That seems compelling, but what does it actually mean for your investment decision?

Let us break down how Simply Good Foods stacks up by different valuation methods, and then go a step further to explore a new angle that might give us an even clearer read on the stock.

Why Simply Good Foods is lagging behind its peers

Approach 1: Simply Good Foods Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. For Simply Good Foods, this process helps gauge what the business is truly worth based on its ability to generate future cash.

Currently, Simply Good Foods produces an annual Free Cash Flow of $173 million. Analyst estimates see this figure rising steadily, reaching around $253 million by 2030. The first five years of these projections are driven by direct analyst forecasts, while longer-term estimates are extrapolated based on expected growth trends. Over the next decade, figures suggest Free Cash Flow will maintain a positive growth trajectory, with incremental annual increases each year.

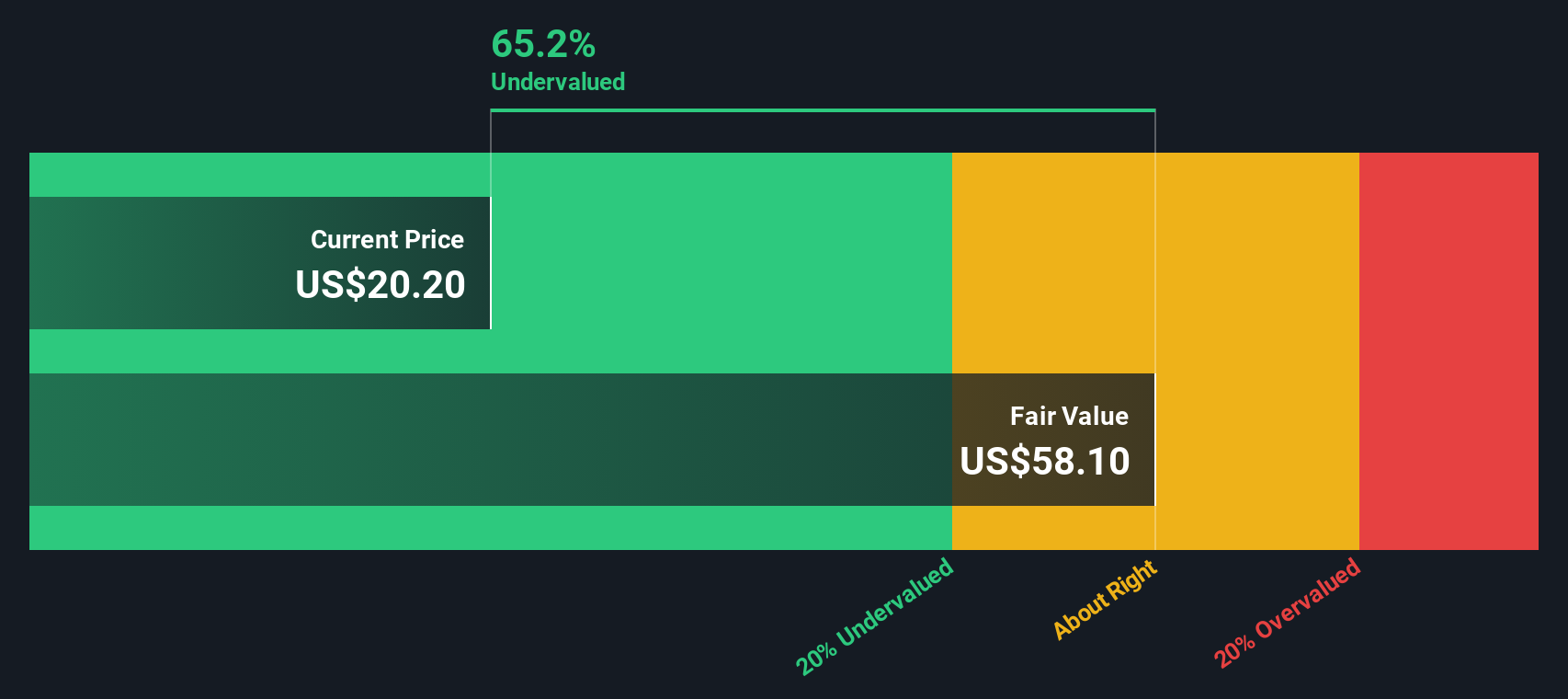

Based on these cash flow projections, the DCF analysis estimates an intrinsic fair value of $62.43 per share. Compared to today’s price, this implies the stock is trading at a 61.5% discount to what the model considers fair value. In other words, the market appears to be undervaluing Simply Good Foods significantly, even after accounting for the usual uncertainties that come with forecasts.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Simply Good Foods is undervalued by 61.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Simply Good Foods Price vs Earnings (PE)

Another popular way to value a profitable company like Simply Good Foods is by looking at its Price-to-Earnings (PE) ratio. The PE ratio remains a useful tool for investors because it connects the stock price directly to how much the company earns, making it easy to see how the market values each dollar of profit. Generally, higher growth prospects or lower risks will justify a higher “normal” PE ratio, while companies with uncertain outlooks or more risk typically trade at lower multiples.

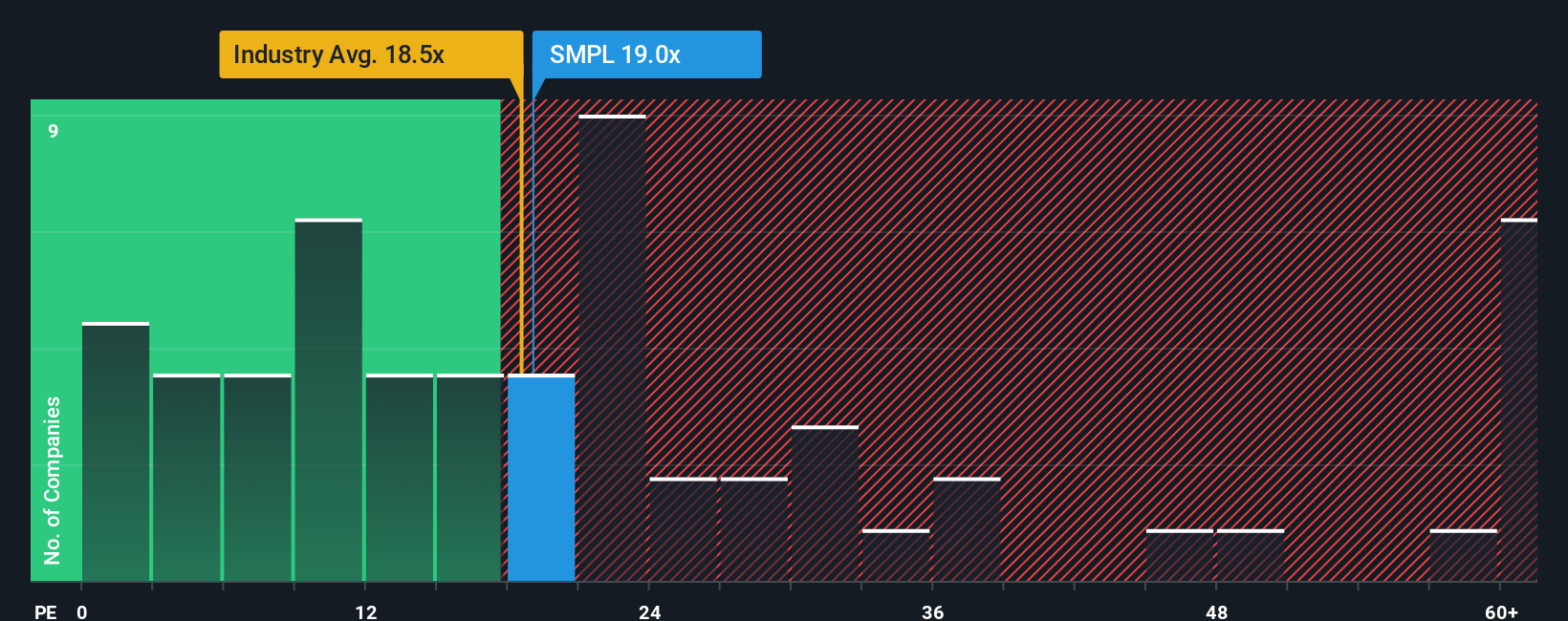

Currently, Simply Good Foods trades at a PE ratio of 16.6x. To put this in perspective, the average PE for the broader food industry is 17.7x, while its group of peers sits higher still at 19.2x. On the surface, this suggests Simply Good Foods is valued a bit below both the industry and peer averages, offering investors a potentially appealing entry point.

However, instead of simply comparing against industry averages or peers, it is important to look at the Fair Ratio. This is a proprietary multiple tailored by Simply Wall St to reflect the company’s own fundamentals, such as earnings growth, profit margins, risk profile, industry effects, and market cap. Because the Fair Ratio (15.4x) accounts for these core company-specific factors, it paints a more precise picture than broad averages can offer.

In this case, Simply Good Foods’ current PE ratio of 16.6x is just above its Fair Ratio of 15.4x. While this indicates the stock may be priced a bit higher than its intrinsic fundamentals would suggest, the difference is not significant. Overall, investors can expect that the stock price is about in line with what its earnings and fundamentals justify at this moment.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Simply Good Foods Narrative

Earlier, we mentioned that there is an even better way to make investment decisions, so let us introduce you to Narratives. A Narrative is your personalized story about a company; it captures the perspective that shapes your view on fair value, future revenues, earnings, and margins, making the numbers meaningful by linking them to real business drivers.

Unlike traditional methods that focus only on the financials, Narratives connect a company's current situation and outlook to a forecast and a fair value, allowing you to see the business through your lens. Using Narratives is straightforward on Simply Wall St’s Community page, where millions of investors share, compare, and refine their stories in real time. These Narratives update automatically when things change, whether that is new earnings, big news, or shifts in the industry, so your investment view always stays relevant.

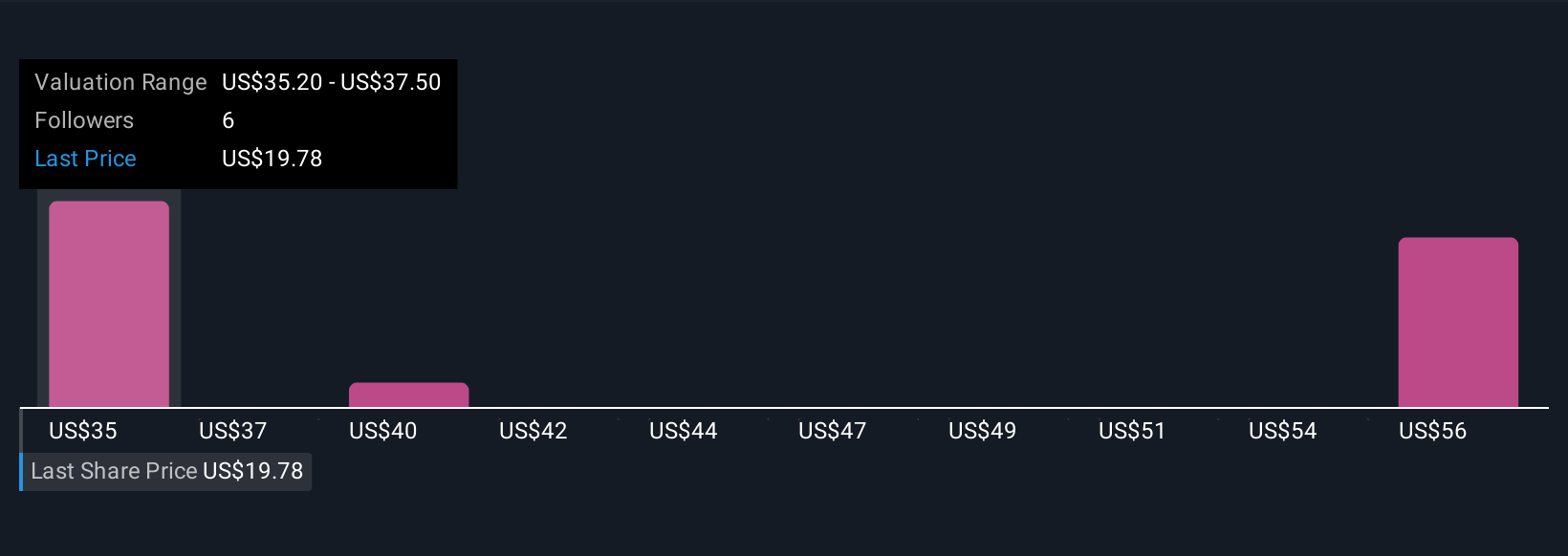

For example, some investors believe Simply Good Foods will accelerate growth by focusing on Quest and OWYN products, expecting the stock to reach $43.00 per share, while others remain cautious due to margin pressures and believe a fair value is closer to $32.00. With Narratives, you can quickly see how your expectations compare to others and decide for yourself if Simply Good Foods is a buy, hold, or sell at today’s prices.

Do you think there's more to the story for Simply Good Foods? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SMPL

Simply Good Foods

A consumer-packaged food and beverage company, engages in the development, marketing, and sale of snacks and meal replacements, and other products in North America and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives