- United States

- /

- Food

- /

- NasdaqCM:SMPL

How Investors Are Reacting To Simply Good Foods (SMPL) Weak Sales, Net Loss and Soft 2026 Outlook

Reviewed by Sasha Jovanovic

- The Simply Good Foods Company recently reported earnings for the fourth quarter and full year ended August 30, 2025, revealing a quarterly year-over-year sales decline to US$369.04 million and a swing to a net loss of US$12.36 million, while offering a 2026 outlook of flat to slightly lower revenue and reduced gross margins.

- A key insight is that the company is facing ongoing inflationary pressures in ingredients and tariffs, with operational challenges in its Atkins brand affecting profitability, even as it invests in new product innovation and share repurchases.

- We'll explore how the softer 2026 guidance and Atkins brand headwinds could shape Simply Good Foods' investment thesis going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Simply Good Foods Investment Narrative Recap

Owning shares of Simply Good Foods means believing in the company’s ability to revitalize its Atkins brand while leveraging innovation and new products to spark consistent growth, even as cost pressures mount. The latest results, with a swing to quarterly loss and a forecast for flat or declining revenue in 2026, place the spotlight firmly on the Atkins turnaround as the key short-term catalyst, while persistent ingredient inflation and margin pressures now represent the biggest risk; these developments are material and impact the near-term narrative. Among recent company updates, the expansion of the share buyback program stands out, signaling the company’s commitment to returning capital to shareholders even as profits face headwinds; however, this move does not address underlying operational challenges, particularly within Atkins, that could shape the trajectory of any potential recovery. Yet, it’s important for investors to watch closely as ongoing weakness in Atkins sales could ...

Read the full narrative on Simply Good Foods (it's free!)

Simply Good Foods is expected to reach $1.6 billion in revenue and $204.1 million in earnings by 2028. This projection requires 4.1% annual revenue growth and a $58.8 million increase in earnings from the current $145.3 million.

Uncover how Simply Good Foods' forecasts yield a $35.20 fair value, a 80% upside to its current price.

Exploring Other Perspectives

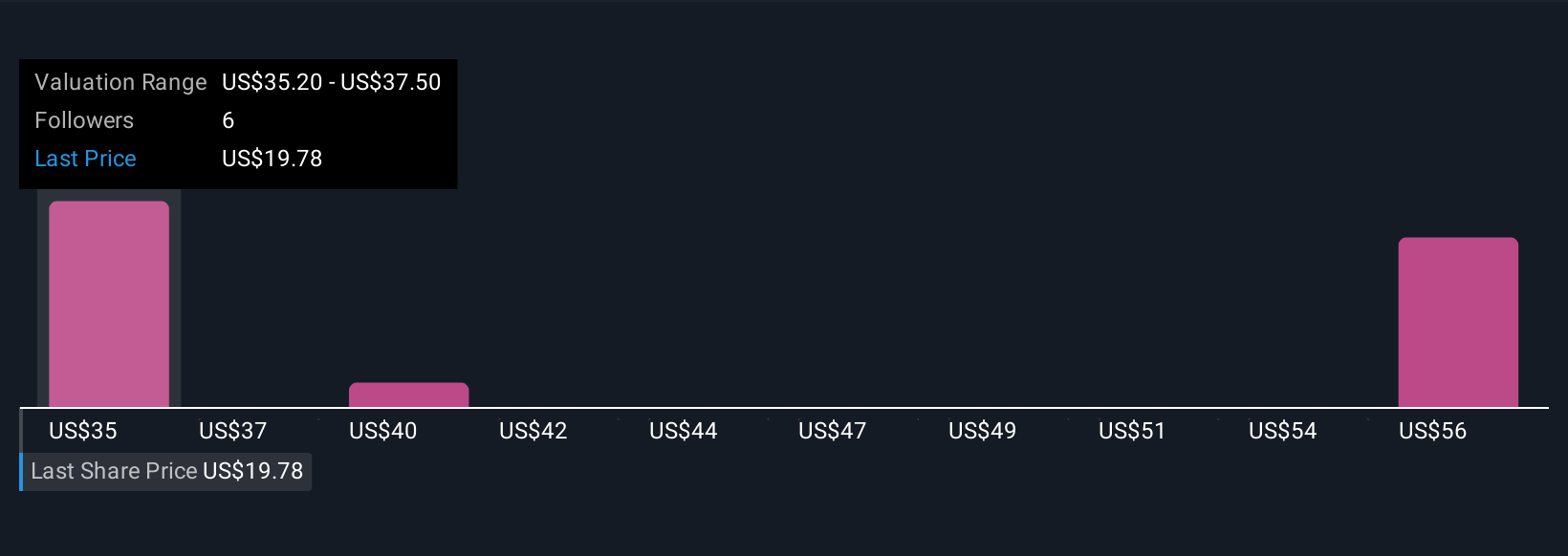

Three members of the Simply Wall St Community estimate fair value for Simply Good Foods between US$35.20 and US$58.10, highlighting the wide spread of opinions. Amid these differing views, ongoing Atkins brand challenges and margin pressures continue to influence the company’s outlook and long-term potential for improvement.

Explore 3 other fair value estimates on Simply Good Foods - why the stock might be worth over 2x more than the current price!

Build Your Own Simply Good Foods Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Simply Good Foods research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Simply Good Foods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Simply Good Foods' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SMPL

Simply Good Foods

A consumer-packaged food and beverage company, engages in the development, marketing, and sale of snacks and meal replacements, and other products in North America and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives