- United States

- /

- Food

- /

- NasdaqGS:SFD

Does Smithfield’s Plant-Based Expansion Signal Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Smithfield Foods is as undervalued as some claim? Let’s take a closer look at whether the current share price really offers a bargain for smart investors like you.

- The stock has nudged up by 3.0% over the past week. It has dipped 5.3% in the last 30 days, but still manages a robust 12.2% gain year-to-date. This hints at shifting sentiment and growth potential.

- Recent headlines have focused on Smithfield Foods' moves in expanding its plant-based protein product line and partnering with key retailers, which could set the stage for new revenue drivers. These developments have contributed to recent investor excitement and the share price swings we’ve seen.

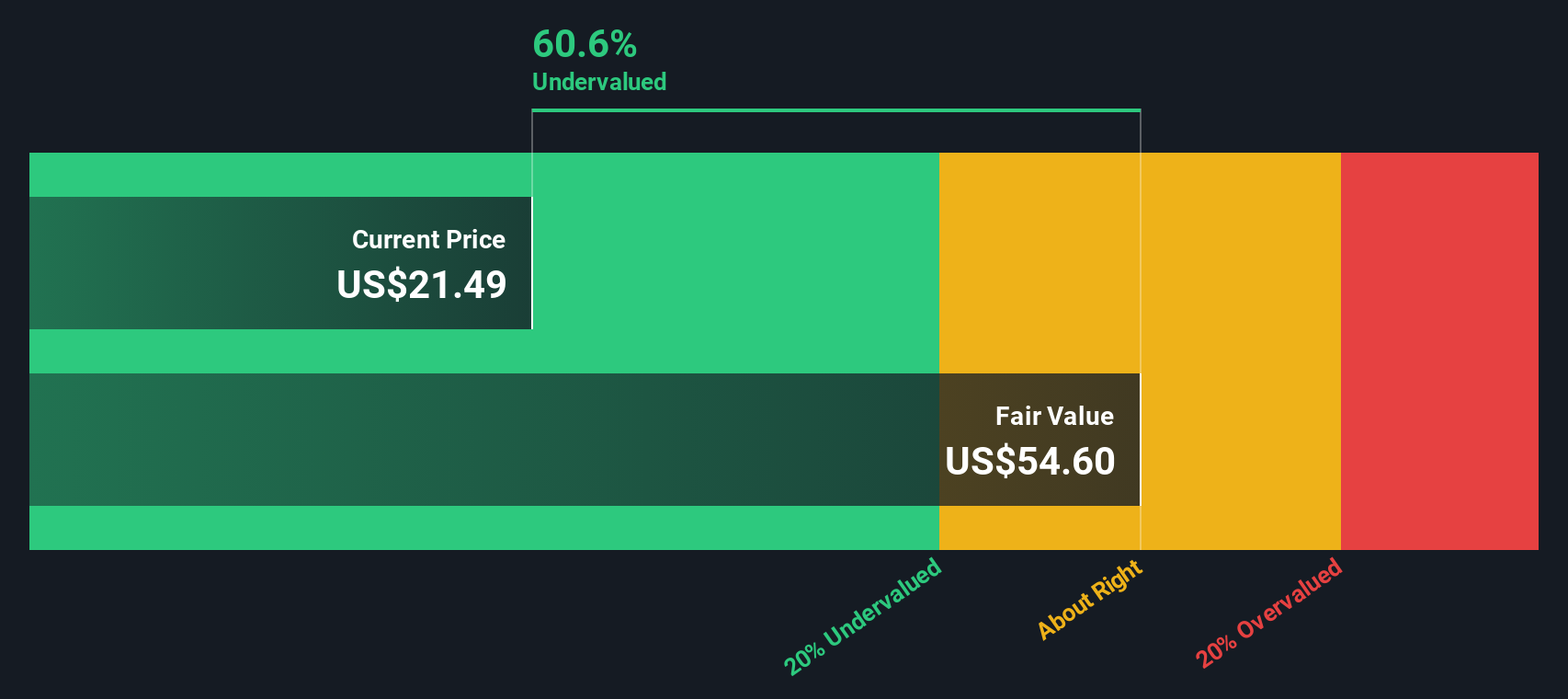

- When it comes to valuation, Smithfield Foods stands out with a solid 6 out of 6 score for being undervalued. This is an impressive result, which we’ll break down next, along with some traditional methods and, later, a smarter way to assess value.

Approach 1: Smithfield Foods Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting its future cash flows and discounting them back to their present value. For Smithfield Foods, analysts begin with the current Free Cash Flow (FCF) of $407 million. They then build a two-stage forecast: the first five years are based on analyst estimates, and additional years rely on growth extrapolations by Simply Wall St.

Looking at the next decade, projections suggest FCF could rise to over $1.48 billion by 2035. This growth path is drawn from estimates by both Wall Street analysts and industry-wide expectations. The company is expected to generate $735 million in FCF by 2027, reflecting a notable improvement from current levels.

After discounting these projected cash flows back to today, the intrinsic value produced by the model is $73.67 per share. The stock is currently trading at a market price that suggests a 69.9% discount to this DCF-calculated value, which indicates the model views Smithfield Foods as significantly undervalued considering its long-term cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Smithfield Foods is undervalued by 69.9%. Track this in your watchlist or portfolio, or discover 831 more undervalued stocks based on cash flows.

Approach 2: Smithfield Foods Price vs Earnings

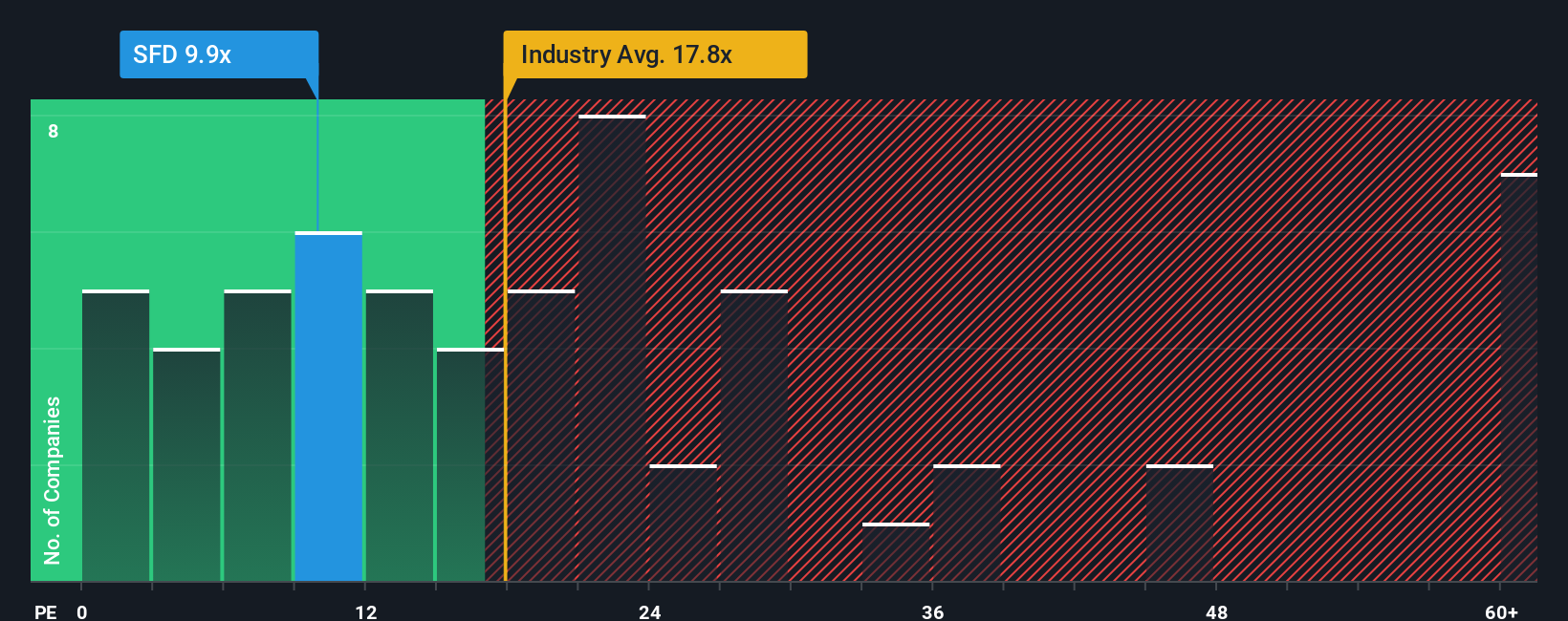

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Smithfield Foods because it reflects how much investors are willing to pay today for each dollar of future earnings. It serves as a quick snapshot of the market’s expectations for growth and profitability. When a company demonstrates steady profits, the PE ratio helps investors compare value across similar businesses.

A higher PE ratio usually implies stronger future growth expectations or lower perceived risk. In contrast, a lower PE ratio may suggest slower growth or more uncertainty. What is considered a "normal" or "fair" PE ratio can also vary with factors such as industry norms, the company’s growth prospects, and the risks it faces.

Currently, Smithfield Foods trades at a PE ratio of 10.0x. This figure is well below both the industry average PE of 17.8x and the peer group average of 15.3x. To provide a more nuanced benchmark, Simply Wall St calculates a proprietary "Fair Ratio" for Smithfield Foods, which in this case is 16.1x. The Fair Ratio goes beyond general industry or peer averages by considering unique company specifics such as growth outlook, profitability margins, risk factors, and market capitalization. This makes it a more tailored and insightful guide to valuation than simply relying on averages.

With Smithfield Foods’ actual PE of 10.0x compared to a Fair Ratio of 16.1x, the stock appears underpriced on this key metric. This suggests the market may be underestimating its earnings power and overall prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Smithfield Foods Narrative

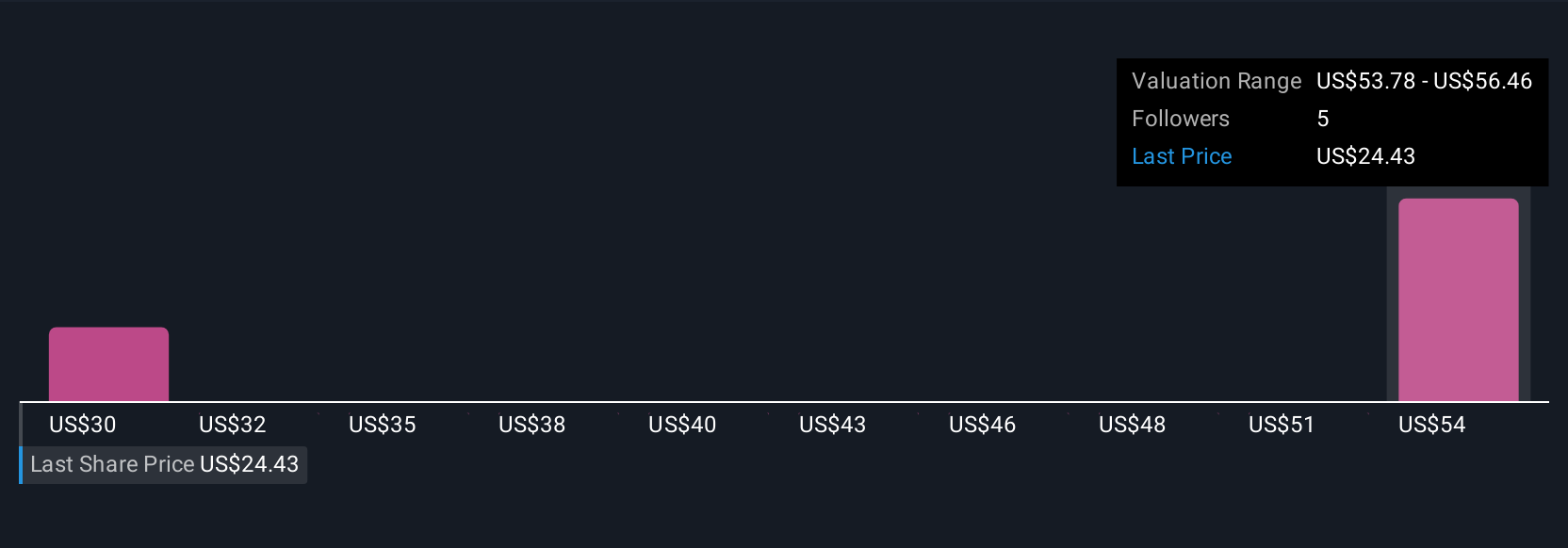

Earlier we mentioned that there's an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is simply the story behind the numbers, where you combine your perspective and expectations, such as assumed fair value, estimates for future revenues, and profit margins, into a clear, personal forecast for the company. Narratives link Smithfield Foods’ real-world story to your financial outlook and then calculate a fair value from those assumptions.

Narratives are designed to be easy and accessible, and millions of investors already use them on Simply Wall St's Community page. They help you make more informed decisions about when to buy or sell by showing you how your Fair Value compares to today's Price. As new news or earnings updates arrive, Narratives update instantly, keeping your outlook relevant and actionable.

For example, one investor’s Narrative might see Smithfield Foods thriving with strong plant-based trends, leading to the highest future value. Another user, concerned about market risks, might set much more conservative expectations and get a lower value. With Narratives, evolving your strategy is as simple as updating your view.

Do you think there's more to the story for Smithfield Foods? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SFD

Smithfield Foods

Produces packaged meats and fresh pork in the United States and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives