- United States

- /

- Food

- /

- NasdaqGS:PPC

Pilgrim's Pride (PPC) Profit Margin Improvement Reinforces Value Narrative, Despite Weak Growth Outlook

Reviewed by Simply Wall St

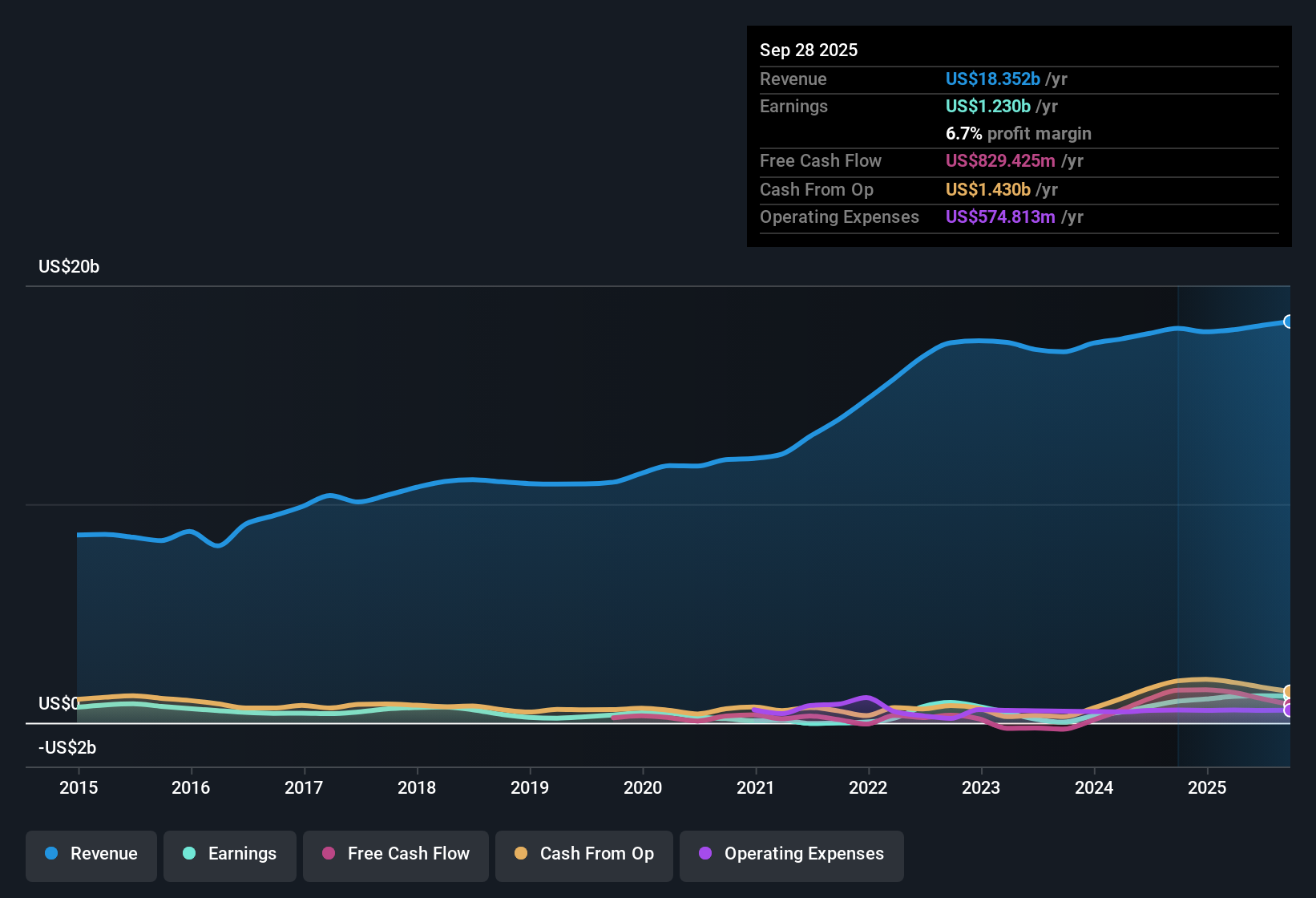

Pilgrim's Pride (PPC) delivered a net profit margin of 6.7%, up from 5.4% a year ago, demonstrating improved profitability. Over the last five years, earnings have surged at an average annual rate of 43.4%. However, more recent growth of 25.2% is below this long-term pace. With revenue growth forecast at just 1.3% annually and earnings projected to decline by 11.3% per year over the next three years, investors will be weighing these results against the company’s mixed growth outlook.

See our full analysis for Pilgrim's Pride.Next, we will see how these latest numbers stack up against the widely discussed market narratives. Some talking points will be reinforced, while others may face new questions.

See what the community is saying about Pilgrim's Pride

Price-to-Earnings Ratio Signals Discount

- Pilgrim's Pride is trading at a Price-To-Earnings Ratio of 7.4x, much lower than both the US Food industry average of 17.3x and a peer group average of 16.1x.

- Analysts' consensus view highlights the relative undervaluation compared to peers, suggesting the share price may already reflect a lot of caution. However, with earnings expected to shrink by 11.3% annually, some believe the low P/E is justified, while others see margin for a re-rating if the worst-case earnings declines do not materialize.

- The current share price of $38.08 is almost half the DCF fair value of $78.06, further deepening the value narrative for long-term buyers.

- Consensus price target is 44.86, implying a moderate 18% potential upside from current levels. This is much less than the discount to DCF fair value, reflecting lingering doubts around future growth and margin sustainability.

To see how analysts weigh these factors and what the broader market expects, check out the Consensus Narrative for the full range of perspectives. 📊 Read the full Pilgrim's Pride Consensus Narrative.

Profit Margins Face Downward Pressure

- Profit margins are forecast to slip from 6.8% today to just 4.6% within three years, according to the consensus narrative.

- Consensus narrative notes rising labor costs and volatile input expenses are widely expected to erode margins, even with investments in automation and efficiency.

- Margin compression is a major concern for future profit sustainability, given that input prices for commodities like corn and soy may not stay low and regulatory costs are steadily climbing.

- Past successes with prepared foods and branded product expansion are seen as potential buffers, but not strong enough to fully offset structural cost pressures highlighted by industry trends.

Revenue Growth Lags Industry Peers

- Pilgrim's Pride's anticipated revenue growth of 1.3% per year is well below the broader US market's forecasted growth rate of 10.3% annually.

- Consensus narrative emphasizes that global chicken demand offers a long-term growth theme, but cautions that forecasts assuming persistent outperformance may be too optimistic if consumer preferences or market conditions shift.

- Analysts are watching whether new facility investments and prepared foods expansion can lift sales meaningfully, especially as analysts are split between optimistic and more conservative cases for revenue trajectory.

- If demand for value-added products or exports stalls, top-line growth could disappoint, reinforcing the need to monitor these strategic bets closely.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Pilgrim's Pride on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the numbers? Shape your perspective and share your narrative in just a few minutes. Do it your way

A great starting point for your Pilgrim's Pride research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Pilgrim's Pride faces shrinking profit margins and slow revenue growth. This raises questions about its ability to deliver steady performance through changing cycles.

If consistent expansion is critical to your investment strategy, target companies offering reliability with stable growth stocks screener (2108 results) that continually demonstrate stable earnings and revenue growth across market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PPC

Pilgrim's Pride

Produces, processes, markets, and distributes fresh, frozen, and value-added chicken and pork products to retailers, distributors, and foodservice operators in the United States, Europe, and Mexico.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives