- United States

- /

- Beverage

- /

- NasdaqGS:PEP

Is PepsiCo’s Valuation Justified After Elliott’s Strategic Reset Push?

Reviewed by Bailey Pemberton

Thinking about what to do with PepsiCo shares right now? You are definitely not alone. With a stock price that has recently rebounded 7.6% in just the last week and climbed 5.6% over the past month, the market is showing renewed interest. This comes after a rough patch, with shares still down 10.5% over the past year. So, what is shifting to spark short-term optimism, and could this be a signal for longer-term opportunity?

The buzz largely circles around activist investor Elliott Management. Their $4B stake in PepsiCo has the market talking about possible change, and their calls for a strategic reset are spotlighting everything from streamlining brands to shaking up the company’s core business model. Add in headlines about PepsiCo’s moves to boost its partnership with Celsius Holdings and increase soft drink prices to offset rising costs, and it is no wonder investors are recalibrating their expectations.

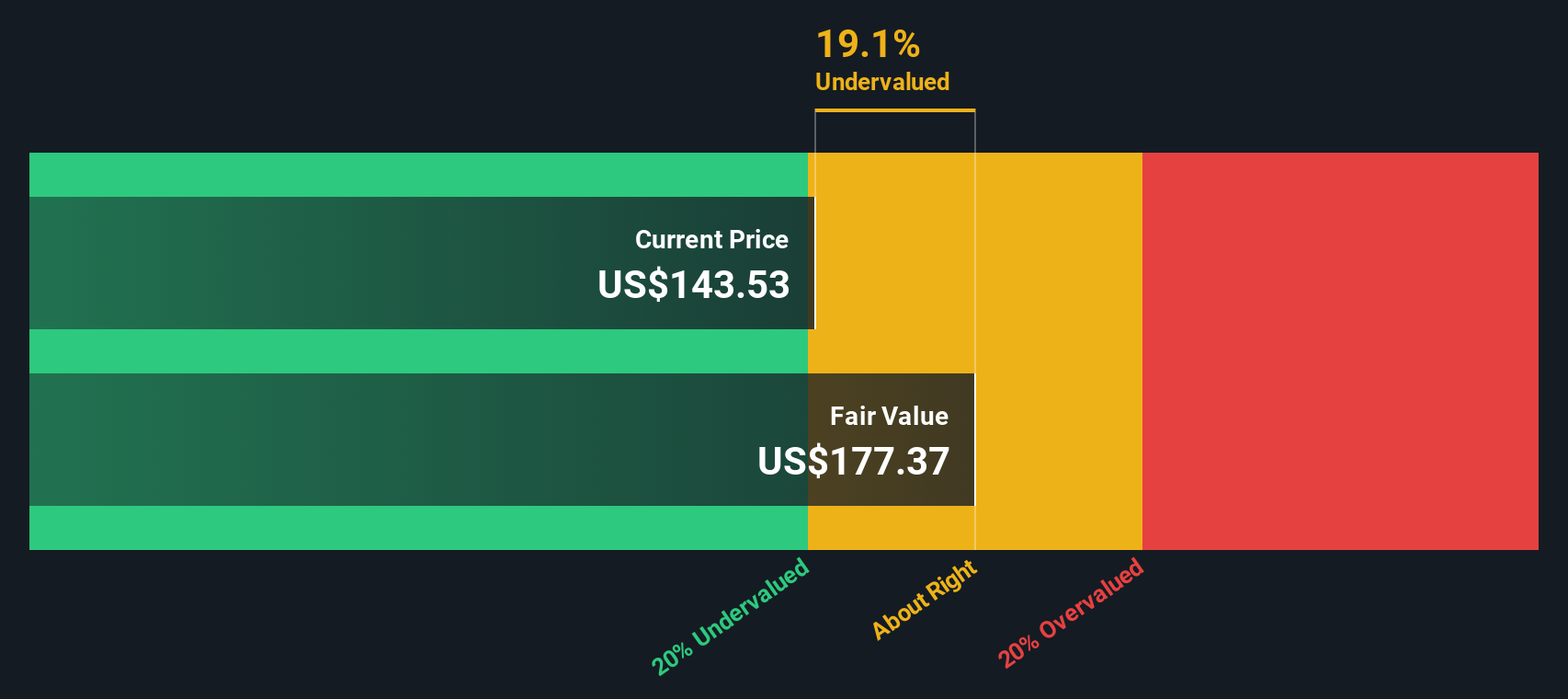

Yet, price action is only one piece of the puzzle. Is PepsiCo’s underlying value compelling at this point? A quick check of established valuation metrics gives the company a score of 3 out of 6, suggesting that it is undervalued in half of the metrics we typically watch. That is neither screamingly cheap nor wildly expensive. This is something you could interpret in several ways as a buyer or holder.

But before forming any conclusions, let’s dig into the actual numbers and valuation frameworks that analysts use, so you can see for yourself how PepsiCo’s fundamentals stack up. And stay with me, because I will wrap up with a perspective on how to interpret all this data even more effectively than the traditional playbook allows.

Why PepsiCo is lagging behind its peers

Approach 1: PepsiCo Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common valuation approach that estimates a company's intrinsic worth by projecting its future cash flows and discounting them back to today. In other words, it tries to answer what all of PepsiCo's expected future free cash, adjusted for the time value of money, is worth right now.

For PepsiCo, the latest reported Free Cash Flow (FCF) is $6.81 Billion. According to analyst projections, FCF is expected to grow over the coming years, reaching over $11.39 Billion by the end of 2027. Extrapolated forecasts by Simply Wall St push this figure even higher in subsequent years, topping $14.95 Billion by 2035. These projections illustrate steady annual growth in PepsiCo’s underlying FCF, a key ingredient for a higher intrinsic valuation.

Based on this two-stage approach using Free Cash Flow to Equity, the DCF model arrives at an intrinsic value of $223.98 per share. This suggests a 32.3% discount to the current stock price, meaning the shares are considered significantly undervalued by this framework.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests PepsiCo is undervalued by 32.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: PepsiCo Price vs Earnings (P/E)

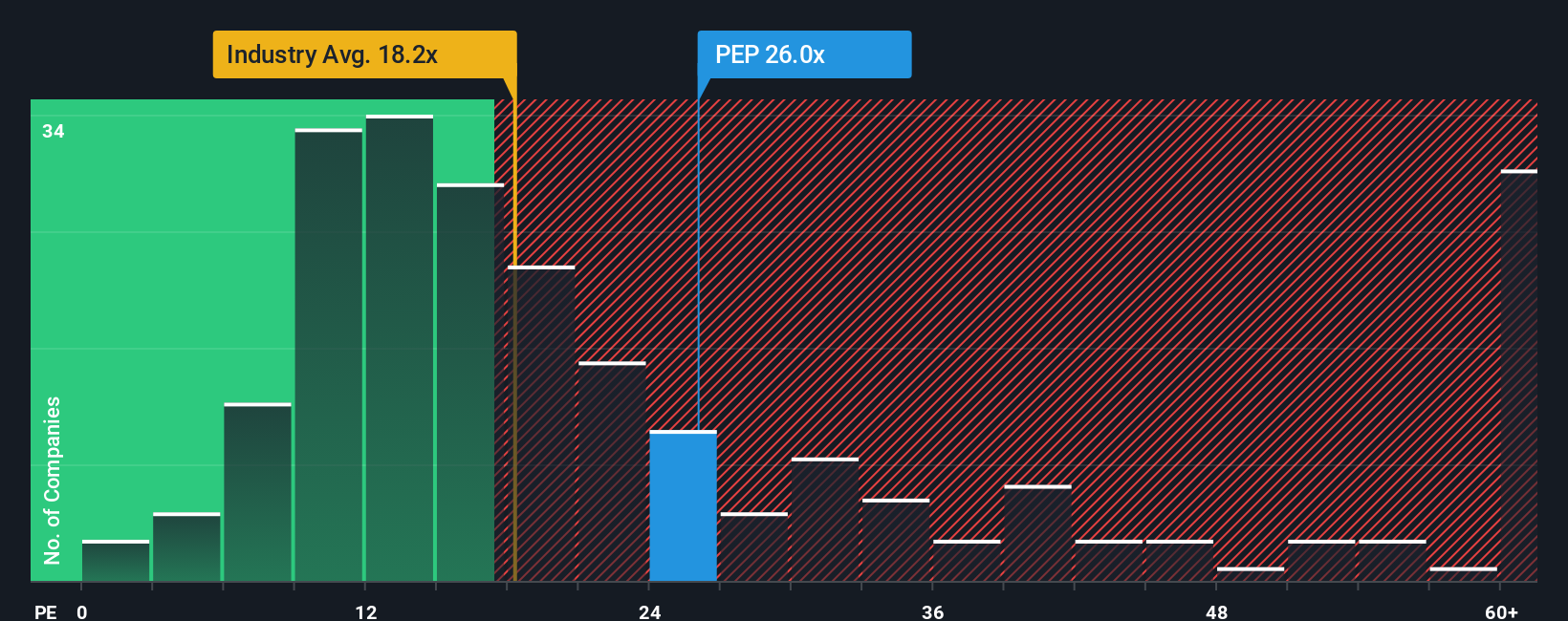

The Price-to-Earnings (P/E) ratio is a preferred valuation tool for mature, profitable companies like PepsiCo. It links a company’s market price to its earnings power, making it a widely used quick reference for investors evaluating value and growth potential. Generally, higher growth prospects or lower risk justify higher P/E ratios. Companies facing slower growth or more uncertainty tend to trade on lower P/E multiples.

Currently, PepsiCo’s P/E ratio stands at 27.5x. For context, the global peer average is 25.8x, while the beverage industry average is notably lower at 17.4x. This may suggest PepsiCo trades at a premium, perhaps reflecting its global brand strength, scale, and a defensive business model with consistent profits.

However, relying solely on industry or peer averages can overlook factors such as unique growth rates, risk, and profit margin. For this reason, Simply Wall St applies its Fair Ratio. PepsiCo’s Fair P/E Ratio, calculated using proprietary analytics that account for growth, profitability, industry trends, and company-specific risks, is 28.3x. This method offers a more tailored yardstick for what the market should pay.

With PepsiCo’s current P/E at 27.5x, just below its Fair Ratio of 28.3x, the stock appears to be valued about right by this metric. Investors may find that market expectations are broadly in line with the company’s underlying fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PepsiCo Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story you believe about a company’s future, written in plain language and backed by your own assumptions about fundamentals like future revenue, profits, risk, and fair value.

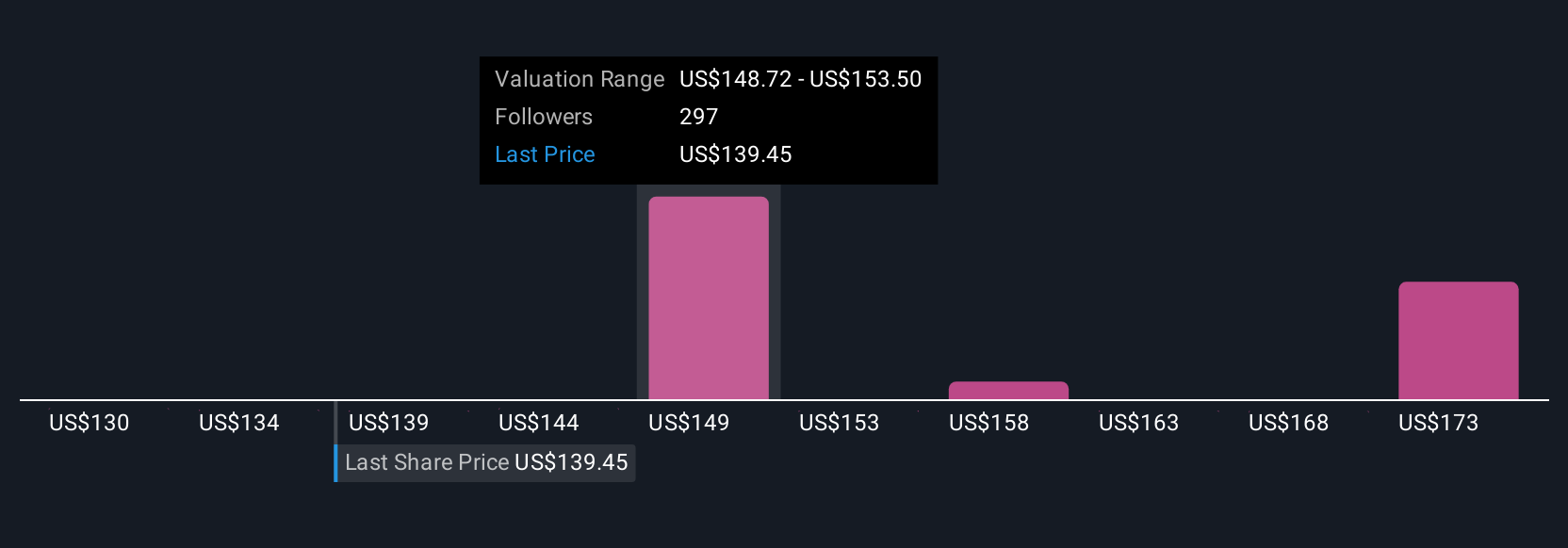

Narratives connect the dots between what you think will drive a company’s future and the numbers behind your forecast, helping you translate your views into an actionable fair value. On Simply Wall St’s platform, Narratives are easy to create and available to everyone on the Community page, making it simple to compare your thinking to millions of other investors worldwide.

By sharing and updating your Narrative whenever new news or earnings drop, you always have a dynamic, real-world sense of whether PepsiCo’s current share price aligns with your outlook or if it is time to act. For example, some investors see PepsiCo’s fair value as high as $160.43 with steady, global expansion and digital transformation. Others take a more cautious view around $115, citing legacy risks and margin pressures. This offers a real-time consensus to guide your investment decisions in a way that feels both personal and smart.

Do you think there's more to the story for PepsiCo? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEP

PepsiCo

Engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives