- United States

- /

- Beverage

- /

- NasdaqGS:MNST

What Monster Beverage (MNST)'s Record-Breaking Q2 Sales and Global Expansion Mean for Shareholders

Reviewed by Sasha Jovanovic

- Monster Beverage Corporation recently reported record-breaking Q2 fiscal 2025 net sales of US$2.11 billion, surpassing US$2 billion for the first time and exceeding analyst expectations, with growth driven by the Monster Energy Drinks segment and strong international performance.

- With over 40% of sales now coming from international markets, the company’s launch of affordable brands like Predator and Fury aligns with its strategy to expand globally and maintain momentum in a competitive sector.

- We’ll explore how Monster Beverage’s successful international expansion and new product launches are influencing its investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Monster Beverage Investment Narrative Recap

To be a shareholder in Monster Beverage today, you need to believe the company's global expansion and product innovation can keep driving growth, even as international sales introduce fresh margin pressures. While record Q2 fiscal 2025 sales signal strong category momentum, the critical catalyst remains whether Monster can sustain earnings growth by balancing new market share with profitability; the biggest short-term risk is that increased exposure to lower-margin regions might erode overall margins. The recent sales milestone itself doesn’t materially change the near-term risk profile.

Among Monster's latest announcements, the strong international performance and launch of affordable brands like Predator and Fury are particularly relevant. These initiatives align with Monster's ambition to grow market share in emerging regions, supporting the catalyst of global expansion while also adding complexity to margin management and market dynamics.

However, investors should be mindful that, despite these growth opportunities, mounting margin pressures from lower-priced products could present a major headwind if...

Read the full narrative on Monster Beverage (it's free!)

Monster Beverage's outlook anticipates $9.8 billion in revenue and $2.5 billion in earnings by 2028. This scenario depends on annual revenue growth of 8.5% and a $0.9 billion increase in earnings from the current $1.6 billion.

Uncover how Monster Beverage's forecasts yield a $66.91 fair value, in line with its current price.

Exploring Other Perspectives

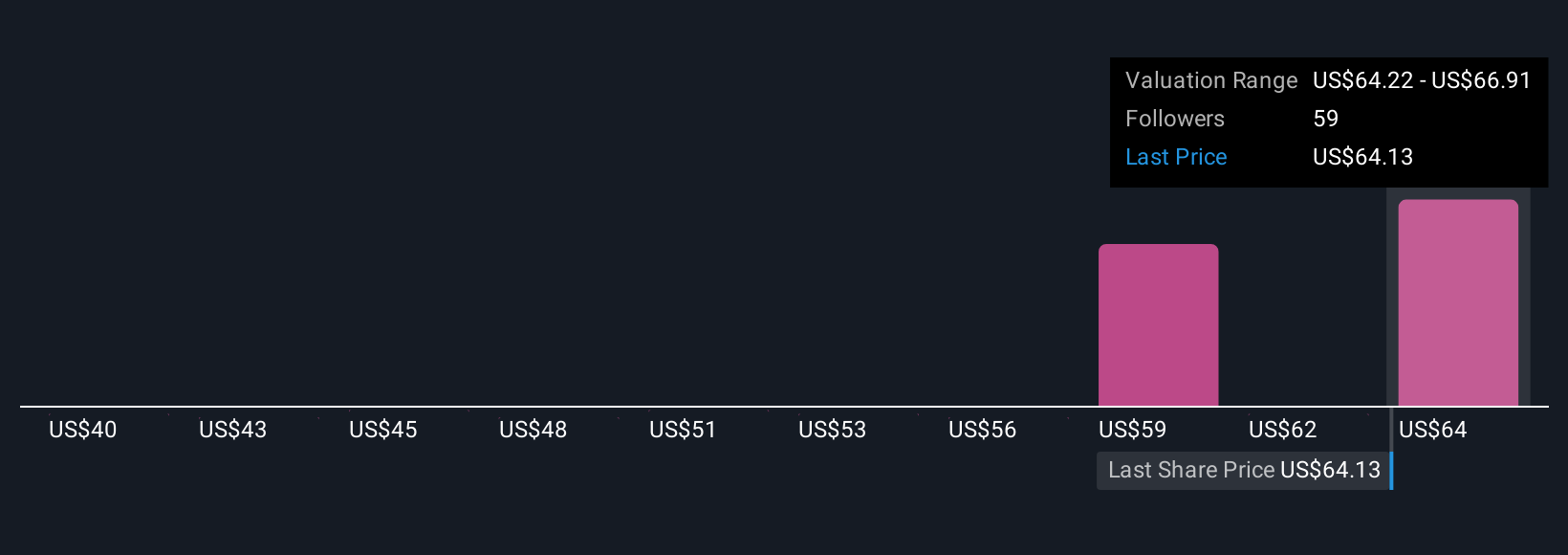

Simply Wall St Community members have produced nine fair value estimates for Monster Beverage, spanning US$40 to US$66.91 per share. Against this backdrop of varied outlooks, keep in mind that many participants are weighing the impact of international growth on both revenue and margin trends, differences that could shape the future narrative for Monster.

Explore 9 other fair value estimates on Monster Beverage - why the stock might be worth 41% less than the current price!

Build Your Own Monster Beverage Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Monster Beverage research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Monster Beverage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Monster Beverage's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNST

Monster Beverage

Through its subsidiaries, engages in development, marketing, sale, and distribution of energy drink beverages and concentrates in the United States and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success